PACCAR (PCAR) Q1 Earnings Miss Estimates, Sales Top, Down Y/Y

PACCAR Inc. PCAR has reported earnings of $1.03 per share for first-quarter 2020, missing the Zacks Consensus Estimate of $1.21, mainly due to lower income and revenues from the company’s trucks, parts and others unit. The reported figure also came in lower than the prior-year quarter’s $1.81.

Consolidated revenues (including trucks and financial services) came in at $5.16 billion, outpacing the Zacks Consensus Estimate of $5.04 billion. The top-line figure, however, came in lower than the year-ago quarter’s $6.49 billion.

During the reported quarter, the company recorded total pre-tax income of $462.2 million, reflecting a decline from the prior-year quarter’s $819.4 million. The company’s net income fell to $359.4 million from the $629 million reported in first-quarter 2019.

SG&A expenses during first-quarter 2020 fell 3.2% to $164 million from the $169.4 million incurred in first-quarter 2019. R&D expenses declined 9.3% to $71 million during the March-end quarter from the first-quarter 2019 number of $78.3 million.

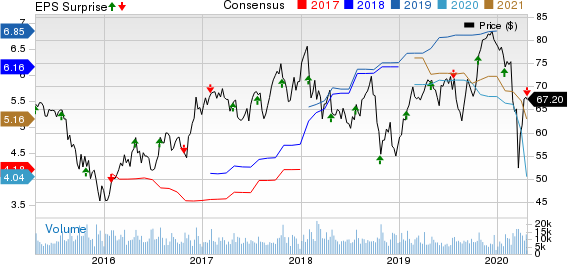

PACCAR Inc. Price, Consensus and EPS Surprise

PACCAR Inc. price-consensus-eps-surprise-chart | PACCAR Inc. Quote

Segmental Performance

Revenues from trucks, parts and others totaled $4.78 billion in the first quarter, down from the prior-year quarter’s $6.14 billion. The segment’s pre-tax income decreased to $399.1 million from the $716.1 million recorded in the year-ago period.

Revenues in the financial services segment increased to $383.7 million from the year-earlier quarter’s $349.5 million. Pre-tax income declined to $48.3 million from the $874 million reported in the year-ago quarter.

Dividends & Cash Position

During first-quarter 2020, PACCAR announced a regular quarterly cash dividend of 32 cents per share, payable on Jun 2, to stockholders of record as of May 12, 2020.

PACCAR’s cash and marketable debt securities amounted to $4.3 billion as of Mar 31, 2020, compared with $5.2 billion as of Mar 31, 2019.

Outlook

For the ongoing year, the company has lowered its capex and R&D expenses forecast amid the coronavirus crisis. Capex is now projected at $525-575 million, and R&D expenses are estimated in the $265-$295 million band.

Zacks Rank & Stocks to Consider

PACCAR currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same sector are AB Volvo VLVLY, Veoneer, Inc. VNE and Modine Manufacturing Company MOD, each carrying a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

AB Volvo (VLVLY) : Free Stock Analysis Report

Veoneer, Inc. (VNE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance