Palo Alto Networks's (NASDAQ:PANW) Q1 Sales Beat Estimates But Stock Drops

Cybersecurity provider Palo Alto Networks (NASDAQ:PANW) reported Q1 CY2024 results topping analysts' expectations , with revenue up 15.3% year on year to $1.98 billion. The company expects next quarter's revenue to be around $2.16 billion, in line with analysts' estimates. It made a non-GAAP profit of $1.32 per share, improving from its profit of $1.10 per share in the same quarter last year.

Is now the time to buy Palo Alto Networks? Find out in our full research report.

Palo Alto Networks (PANW) Q1 CY2024 Highlights:

Revenue: $1.98 billion vs analyst estimates of $1.97 billion (small beat)

EPS (non-GAAP): $1.32 vs analyst estimates of $1.25 (5.6% beat)

Revenue Guidance for Q2 CY2024 is $2.16 billion at the midpoint, roughly in line with what analysts were expecting

Revenue Guidance for CY2024 was slightly raised to $8.00 billion at the midpoint, roughly in line with expectations of $7.99 billion

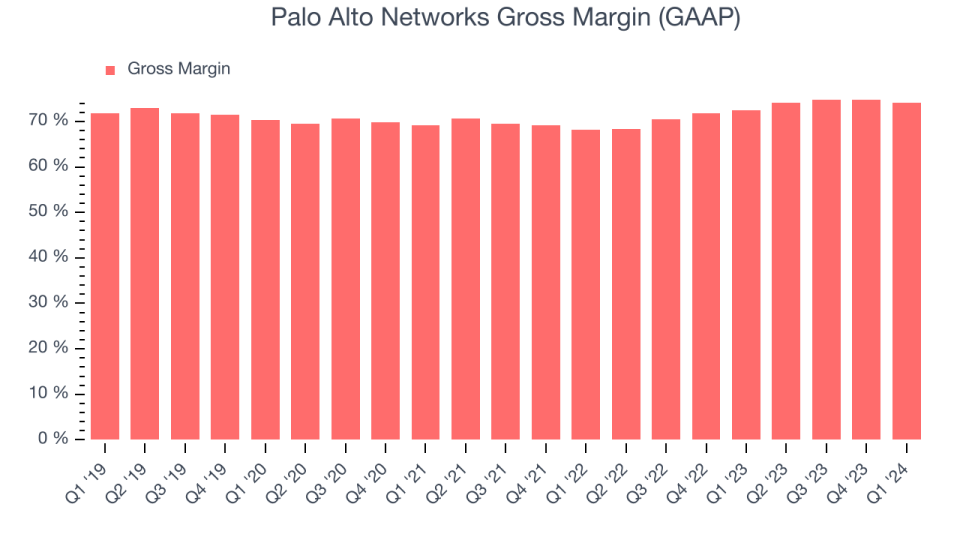

Gross Margin (GAAP): 74.1%, up from 72.4% in the same quarter last year

Market Capitalization: $102.6 billion

"We are pleased with the enthusiastic response to platformization from our customers in Q3. Platformization is a long-term strategy that addresses the increasing sophistication and volume of threats, and the need for AI-infused security outcomes," said Nikesh Arora, chairman and CEO of Palo Alto Networks.

Founded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ:PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats.

Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

Sales Growth

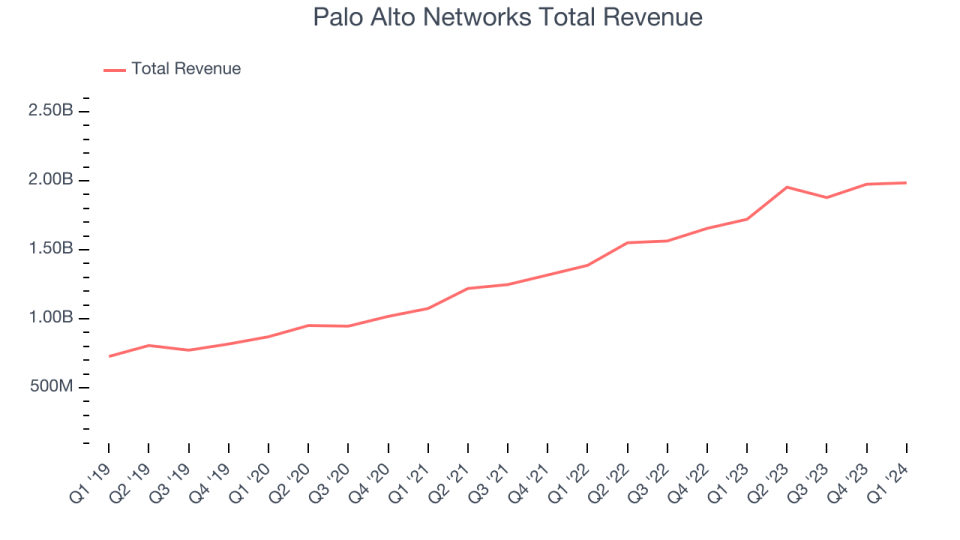

As you can see below, Palo Alto Networks's revenue growth has been strong over the last three years, growing from $1.07 billion in Q3 2021 to $1.98 billion this quarter.

This quarter, Palo Alto Networks's quarterly revenue was once again up 15.3% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $9.7 million in Q1 compared to $97 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Palo Alto Networks is expecting revenue to grow 10.6% year on year to $2.16 billion, slowing down from the 26% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 12.3% over the next 12 months before the earnings results announcement.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Palo Alto Networks's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 74.1% in Q1.

That means that for every $1 in revenue the company had $0.74 left to spend on developing new products, sales and marketing, and general administrative overhead. Palo Alto Networks's gross margin is around the average of a typical SaaS businesses. It's encouraging to see its gross margin remain stable, indicating that Palo Alto Networks is controlling its costs and not under pressure from its competitors to lower prices.

Key Takeaways from Palo Alto Networks's Q1 Results

Revenue beat by a small amount and operating profit as well as EPS beat by more convincing amounts. Billings and revenue guidance for next quarter was roughly in line. Full year billings and revenue guidance were also roughly in line. After last quarter's poor results and cautious commentary, the market was likely hoping for better results. The stock is down 6.7% after reporting, trading at $302.32 per share.

So should you invest in Palo Alto Networks right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance