Palo Alto (PANW) Beats Q3 Earnings and Revenue Estimates

Continuing its earnings streak, Palo Alto Networks Inc. PANW reported stellar results, once again, for the third quarter of fiscal 2018. The company’s earnings and revenues surpassed the Zacks Consensus Estimate as well as management’s guided ranges. Also, it marked year-over-year improvement on both the counts.

The impressive quarterly results were mainly driven by a healthy demand environment, product launches and increasing adoption of the company’s next-generation security platforms. Buoyed by a marvellous fiscal third-quarter performance, the company provided an encouraging guidance for the next quarter and also raised the fiscal 2018 outlook.

Let’s discuss the quarter in detail.

Revenues

Palo Alto’s revenues of $567.1 million jumped 31% year over year, outpacing the Zacks Consensus Estimate of $546 million. In fact, the top line came above the guided range of $538-$548 million.

The year-over-year increase was primarily driven by customer additions, along with product launches. Additionally, the company stated that the successful sales execution helped it acquire new clients. Palo Alto also managed to increase its existing customers’ expenditures, which contributed to overall growth. In the reported quarter, the company added nearly 3,000 customers, bringing the total count to 51,000.

Product revenues increased approximately 31% to $215.2 million and surpassed its projected range of $193-$196 million. The company witnessed a 32% surge in subscription and support revenues ($351.9 million). SaaS-based subscription revenues also climbed 38% from the year-ago period. Support revenues increased 25% year over year.

Billings improved 33% year over year to $721 million and came ahead of the company’s guided range of $665-$680 million.

Geographically, revenues from the Americas climbed 29% on a year-over-year basis. The figures from Europe, the Middle East and Africa were up 35%, while the same from Asia Pacific rose 37%.

Operating Results

Palo Alto’s non-GAAP gross margin shrunk 20 basis points (bps) on a year-over-year basis to 76.2%. Non-GAAP operating expenses in the fiscal third quarter came in at $316.6 million, or 55.9% of revenues. This marks a year-over-year improvement of 210 bps backed by the increasing leverage in sales and marketing.

Non-GAAP operating margin expanded 190 bps to 20.3% as loss from reduced gross margin was more than offset by benefit from lower operating expenses (as a percentage of revenues).

The company’s non-GAAP net income for the reported quarter was $95.1 million or 99 cents per share compared with $57.1 million or 61 cents reported in the year-ago quarter. On a per-share basis, the company’s non-GAAP earnings marked year-over-year growth of 62.2%. Moreover, quarterly earnings surpassed the Zacks Consensus Estimate of 96 cents, as well as the company’s projected range of 94-96 cents.

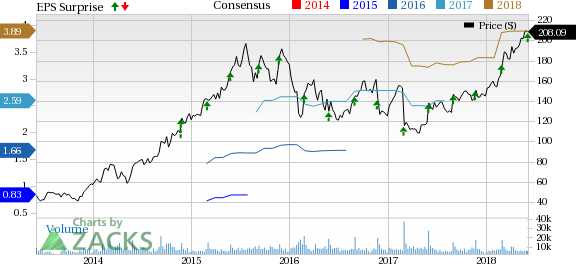

Palo Alto Networks, Inc. Price, Consensus and EPS Surprise

Palo Alto Networks, Inc. Price, Consensus and EPS Surprise | Palo Alto Networks, Inc. Quote

Balance Sheet

Palo Alto exited the quarter under review with cash, cash equivalents and short-term investments of approximately $1.62 billion compared with $1.64 billion at the end of the fiscal second quarter.

Receivables were $361.8 million compared with $365.1 million recorded in the previous quarter. Furthermore, the company’s balance sheet does not have any long-term debt. It generated cash flow from operations of $759.1 million in the first three quarters of fiscal 2018. Free cash flow during the first nine months of the fiscal came in at $672.5 million.

In addition, the company repurchased 1.724 million shares worth $259.1 million. At quarter end, the company had approximately $330 million available under its ongoing share-repurchase authorization.

Guidance

Palo Alto raised its revenue and billings outlook for fiscal 2018. The company now expects revenues in the band of $2.24-$2.25 billion, an improvement of 27-28%, year over year, compared with $2.190-$2.220 billion, projected earlier. The Zacks Consensus Estimate is pegged at $2.21 billion.

Product revenues are anticipated in the range of $850-$853 million, reflecting year-over-year growth of nearly 20% and higher than the previous guided range of $810-$820 million. Billings are now expected to lie between $2.807 billion and $2.822 billion, indicating growth of 22-23% from the year-ago quarter. The new guidance range is higher than the earlier guidance of $2.715-$2.770 billion.

The company narrowed its earnings guidance for fiscal 2018. Palo Alto now anticipates non-GAAP earnings in the range of $3.86-$3.89 per share compared with the earlier range of $3.84-$3.91 band. The Zacks Consensus Estimate is pegged at $3.89.

Non-GAAP effective tax rate for the fiscal is still anticipated to be around 24%. Including a cash expenditure of $30 million related with acquisitions, free cash flow margin will likely be in the band of 39-40% in fiscal 2018. Excluding the same, it should come in the range of 40-41%.

For the fiscal fourth quarter, Palo Alto anticipates revenues of $625-$635 million, up 23-25% year over year. The Zacks Consensus Estimate is pegged at $619.1 million. Product revenues are forecast in the $246-$249 million band, up 16-17%. Billings are projected to lie between $815 million and $830 million, depicting an increase of 22-24%.

Non-GAAP effective tax rate for the current quarter is projected to be approximately 22%. Non-GAAP earnings per share are expected in the range of $1.15-$1.17. The Zacks Consensus Estimate is pegged at $1.20.

Zacks Rank & Key Picks

Palo Alto currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are NVIDIA NVDA, Micron Technology MU and Texas Instruments TXN, all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term expected EPS growth rates for NVIDIA, Micron and Texas Instruments are pegged at 10.3%, 10% and 9.6%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance