Palo Alto (PANW) & Deloitte to Offer Managed Security Services

Palo Alto Networks PANW recently announced an expansion of its strategic alliance with Deloitte to offer managed security services to their shared U.S.-based clients. The latest announcement came within a year after the two companies entered into an agreement in July 2021 to deliver integrated security solutions to their mutual clients.

With the latest agreement, Palo Alto Networks’ cybersecurity technology portfolio will now be available in outcome-based, managed offerings from the global consulting giant – Deloitte. The managed security services offerings will help customers in threat detection, enable zero trust for U.S. organizations and enhance 5G security.

With the latest expanded strategic alliance, PANW and Deloitte will help companies augment their in-house security team capabilities and offer these teams instant access to managed third-party support.

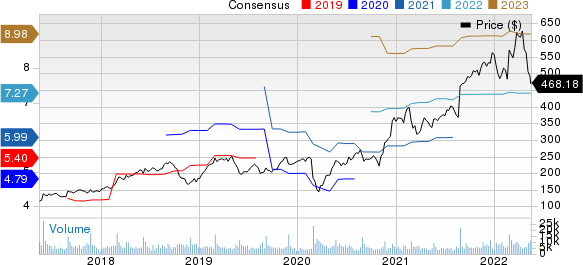

Palo Alto Networks, Inc. Price and Consensus

Palo Alto Networks, Inc. price-consensus-chart | Palo Alto Networks, Inc. Quote

Of late, cybersecurity has gained immense importance among organizations. On one hand, the pandemic accelerated the digital transformation and cloud migration process. Meanwhile, it created security and risk issues for companies. This has been driving demand for managed security services globally.

According to a latest report by Allied Market Research, the global managed security services market is likely to reach $77.01 billion by 2030 from $22.45 billion in 2020, reflecting a CAGR of 12.8% during the 2021-2030 period.

With the growing need for enhanced security measures, given the rising security threats in interconnected systems laden with software, the demand for Palo Alto’s solutions is shooting up. The latest partnership extension with Deloitte showcases the credibility of Palo Alto Networks’ cybersecurity solutions and its deep commitment toward transforming network capabilities in the U.S. market.

Palo Alto Networks has been benefiting from continuous deal wins and the increasing adoption of the company’s next-generation security platforms, attributable to the rise in the remote working environment and the need for stronger security. The growing traction in the Prisma and Cortex offerings also acted as a tailwind. The company also continued to acquire new customers and increase the wallet share with the existing customers.

However, PANW’s higher sales incentives related to Next-Generation Security products are likely to continue negatively impacting its bottom line. Additionally, forex headwinds and higher marketing and sales expenses are likely to continue hurting its profitability. Moreover, high acquisition-related expenses are denting margins. Additionally, the competition from the likes of Fortinet and Cisco is a perpetual concern for this Zacks Rank #4 (Sell) cybersecurity company.

Stocks to Consider

Some better-ranked stocks from the broader technology sector are Semtech SMTC, MaxLinear MXL and Analog Devices ADI. Semtech sports a Zacks Rank #1 (Strong Buy), while MaxLinear and Analog Devices each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Semtech's first-quarter fiscal 2023 earnings has been revised to 76 cents per share from 70 cents over the past 60 days. For fiscal 2023, earnings estimates have moved north by 8% to $3.38 per share in the past 60 days.

Semtech's earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 2.8%. Shares of SMTC have declined 1.8% in the past year.

The Zacks Consensus Estimate for MaxLinear's second-quarter 2022 earnings has been revised upward by 10 cents to $1.02 per share over the past 30 days. For 2022, MaxLinear's earnings estimates have moved north by 36 cents to $4.07 per share in the past 30 days.

MaxLinear's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 7.1%. Shares of MXL have soared 21.9% in the past year.

The Zacks Consensus Estimate for Analog Devices' second-quarter fiscal 2022 earnings has been revised upward by 4 cents to $2.12 per share over the past 60 days. For fiscal 2022, earnings estimates have moved north by 11 cents to $8.43 per share in the past 60 days.

Analog Devices' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6%. Shares of ADI have increased 7.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Semtech Corporation (SMTC) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

MaxLinear, Inc (MXL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance