Pan American Silver (PAAS) Project Uncertain as Mining Law Repealed

The future of Pan American Silver Corp.’s PAAS Navidad silver project is uncertain again as of Dec 20, after the executive of the Province of Chubut in Argentina repealed the mining law approved earlier this month. The law had triggered expectations that the company would be able to start the project — one of the world’s largest undeveloped silver deposits after an 18-year long wait.

The Province of Chubut had passed a law in 2003 (“Law 5001”) that banned open-pit mining and the use of cyanide in mineral processing in the entire province. This effectively prevented the development of Pan American’s 100% owned Navidad silver project. However, the company remained committed to the development of Navidad. It contributed toward the positive economic and social development of the province of Chubut, while awaiting the adoption of a favorable legislative framework.

On Dec 15, 2021, the legislature of the Province of Chubut in Argentina approved a legislative bill that would modify the mining law to allow open-pit mining in certain zones in the Departments of Gastre and Telsen. This new law was subsequently promulgated on Dec 16, 2021 by the governor of Chubut, Mariano Arcioni. This had indicated that the company might be able to start the Navidad Silver Project. However, due to violent protests by local communities, the provincial government decided to repeal the mining law. This dealt a blow to the mining sector as the law would have removed a bottleneck for the companies operating in the region whose operations have remained stalled so far due to the restrictions.

Pan American Silver had acquired the Navidad silver project in 2010 following the buyout of Aquiline Resources Inc. The Navidad properties are located in north-central Chubut Province in Argentina. It is within the designated zone that would potentially allow open-pit mining. Per the law, any mining project, including Navidad, would be required to undergo relevant review processes and apply for permission under provincial laws. Pan American Silver owns and operates silver and gold mines located in Mexico, Peru, Canada, Argentina and Bolivia. It owns the Escobal mine in Guatemala, which is currently not operating.

Pan American recently reported third-quarter 2021 adjusted earnings per share of 18 cents that missed the Zacks Consensus Estimate of 35 cents. The company had reported an adjusted EPS of 28 cents in the year-ago quarter.

Pan American Silver’s revenues increased 53.2% year over year to a record $460 million in the quarter under review but missed the Zacks Consensus Estimate of $462 million. Average realized silver price, during the quarter, declined 2.5% year over year to $24.16 per ounce. Average realized gold price also declined 6.9% year over year to $1,782 per ounce. Revenues in the reported quarter benefited from the sale of dore and concentrate inventories built-up in prior periods. This was partly offset by the increase of on-pad inventories at Dolores and Shahuindo.

Pan American Silver expects current year silver production between 19 million ounces and 20 million ounces. Annual gold production is projected to be 560,000-588,000 ounces.

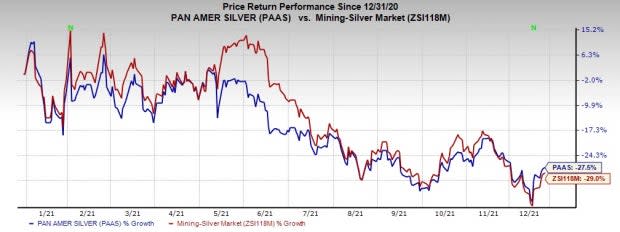

Price Performance

Image Source: Zacks Investment Research

Shares of the company have fallen 27.5% so far this year compared with the industry’s decline of 29%.

Zacks Rank & Stocks to Consider

Pan American Silver currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Nutrien Ltd. NTR, The Chemours Company CC and AdvanSix Inc. ASIX. All of these stocks currently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nutrien has an expected earnings growth rate of 233.3% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised upward by 16.3% in the past 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 73.5%, on average. NTR stock has rallied 55.7% year-to-date.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for CC’s earnings for the current year has been revised upward by 10% in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in each of the last four quarters, the average surprise being 34.2%.. It has rallied 27.9% so far this year.

AdvanSix has a projected earnings growth rate of 194.5% for the current year. The Zacks Consensus Estimate for ASIX’s earnings for the current year has been revised upward by 5.9% in the last 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 46.9%. So far this year, ASIX has soared 126%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pan American Silver Corp. (PAAS) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance