Pan American Silver (PASS) Q3 Earnings Lag Estimates, Revenues Up

Pan American Silver Corp. PAAS reported third-quarter 2021 adjusted earnings per share (EPS) of 18 cents, missing the Zacks Consensus Estimate of 35 cents. The company had reported an adjusted EPS of 28 cents in the year-ago quarter.

Including one-time items, the company reported EPS of 10 cents in the third quarter compared with the year-ago quarter’s 31 cents.

Pan American Silver’s revenues increased 53.2% year over year to a record $460 million in the quarter under review. The top line missed the Zacks Consensus Estimate of $462 million. Average realized silver price, during the quarter, declined 2.5% year over year to $24.16 per ounce. Average realized gold price also down 6.9% year over year to $1,782 per ounce. Revenues in the reported quarter benefited from the sale of dore and concentrate inventories built-up in prior periods. This was partly offset by the increase of on-pad inventories at Dolores and Shahuindo.

Operational Update

Consolidated silver production for the quarter was 4.8 million ounces, up 18% year over year. Consolidated gold production of 142.6 thousand ounces in the reported quarter reflects year-over-year growth of 22%.

Silver segment’s cash costs were $11.92 per ounce in the third quarter, up 67% from the year-ago period’s levels. The segment’s all-in sustaining costs (AISC) surged 171% year over year to $16.30 per ounce in the quarter. Gold segment’s cash costs were $922 per ounce, up 16.3% from the year-ago quarter’s tally. The segment AISC costs amounted to $1,176 per ounce in the July-September period, reflecting a year-over-year increase of 11.3%.

Pan American Silver reported mine-operating earnings of $99 million for the quarter, indicating a year-over-year decline of 20.6%.

Pan Amerian Silver Corp. Price, Consensus and EPS Surprise

Pan American Silver Corp. price-consensus-eps-surprise-chart | Pan American Silver Corp. Quote

Financial Position

At the end of the third quarter, Pan American Silver had cash and short-term investment balances of $315.4 millionand $500.0 million available in its revolving credit facility. It has an equity investment in Maverix Metals Inc. with a market value of $116.1 million. Total debt was at $45 million. Net cash generated from operations was $157 million in the reported quarter.

Guidance

Pan American Silver now expects current year silver production in between 19 million ounces and 20 million ounces. Silver segment cash costs are expected to be $11.60-$12.50 per ounce. AISC is estimated between $15.75 per ounce and $16.75 per ounce for the ongoing year.

It expects 2021 annual gold production between 560,000 ounces and 588,000 ounces. Gold segment cash costs are projected in the range of $825-$925 per ounce. AISC is forecast between $1,135 per ounce and $1,250 per ounce. Capital expenditures for 2021 are anticipated in the range of $261-$271 million.

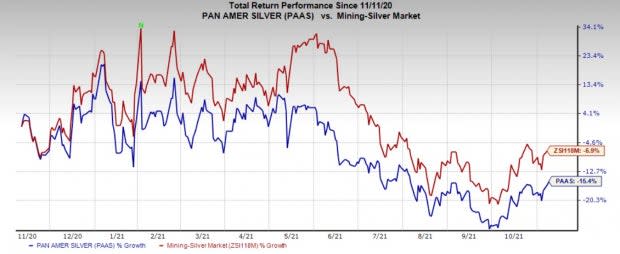

Price Performance

Shares of the company have fallen 15.4% in the past year compared with the industry’s decline of 6.9%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Pan American Silver currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Olin Corporation OLN, Nucor Corporation NUE and Bunge Limited BG. All of these stocks currently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olin has an expected earnings growth rate of around 740% for the current fiscal year. The company’s shares have surged 229% in the past year.

Nucor has a projected earnings growth rate of around 583% for 2021. The company’s shares have soared 128% in a year’s time.

Bunge has an estimated earnings growth rate of around 26% for the current year. The company’s shares have appreciated 60% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Bunge Limited (BG) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

Pan American Silver Corp. (PAAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance