PARKEN Sport & Entertainment (CPH:PARKEN) Shareholders Have Enjoyed A 66% Share Price Gain

The simplest way to invest in stocks is to buy exchange traded funds. But you can do a lot better than that by buying good quality businesses for attractive prices. For example, the PARKEN Sport & Entertainment A/S (CPH:PARKEN) share price is 66% higher than it was five years ago, which is more than the market average. It's fair to say the stock has continued its long term trend in the last year, over which it has risen 32%.

See our latest analysis for PARKEN Sport & Entertainment

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

PARKEN Sport & Entertainment's earnings per share are down 13% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

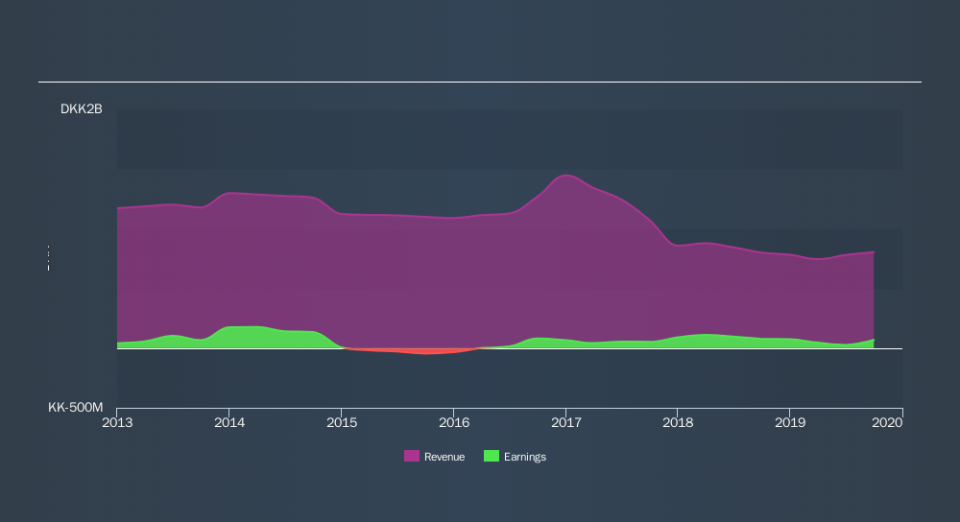

It is not great to see that revenue has dropped by 9.1% per year over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on PARKEN Sport & Entertainment's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for PARKEN Sport & Entertainment the TSR over the last 5 years was 95%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that PARKEN Sport & Entertainment has rewarded shareholders with a total shareholder return of 35% in the last twelve months. And that does include the dividend. That gain is better than the annual TSR over five years, which is 14%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is PARKEN Sport & Entertainment cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance