Parker-Hannifin's (PH) Q1 Earnings Top Estimates, Down Y/Y

Parker-Hannifin Corporation PH reported better-than-expected results for first-quarter fiscal 2020 (ended September 2019), wherein both earnings and revenues beat estimates.

Earnings/Revenues

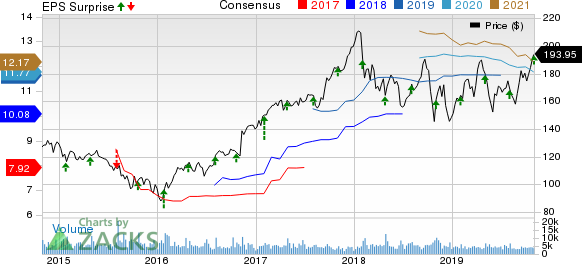

Parker-Hannifin Corporation Price, Consensus and EPS Surprise

Parker-Hannifin Corporation price-consensus-eps-surprise-chart | Parker-Hannifin Corporation Quote

Quarterly adjusted earnings came in at $2.76 per share, down 2.8% year over year from $2.84. However, the bottom line outpaced the Zacks Consensus Estimate of $2.64.

Revenues for the fiscal first quarter were $3,334.5 million, down 4.2% year over year. However, the top line beat the consensus estimate of $3,314 million.

Segmental Breakup

North American segment’s revenues came in at $1,624.6 million, down 3.4% year over year.

The company’s International top-line figure declined 12.6% to $1,078.8 million.

Aerospace Systems segment generated revenues of $631.1 million, up 11.8%.

Costs/Margins

Cost of sales in the fiscal first quarter was $2,479.7 million, down 4.4% year over year. Selling, general and administrative expenses were $399.2 million, up from $394.3 million. Adjusted operating margin was 17.3%, up 10 basis points.

Balance Sheet/Cash Flow

Exiting the fiscal first quarter, Parker-Hannifin had cash and cash equivalents of $3,627.4 million, up from $3,219.8 million recorded on Jun 30, 2019. At the end of the reported quarter, long-term debt was $7,366.9 million compared with $6,520.8 million as of Jun 30, 2019.

In first three months of fiscal 2020, the company generated $449.1 million cash from operating activities, up from $159.4 million in first-quarter fiscal 2019.

Outlook

Parker-Hannifin intends to boost its near-term revenues and profitability on the back of its Win Strategy. The company revised its earnings view for fiscal 2020 to $10.10-$10.90 from $11.50-$12.30 per share guided earlier.

Zacks Rank & Stocks to Consider

Parker-Hannifin currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are Brady Corporation BRC, Cintas Corporation CTAS Dover Corporation DOV. All these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Brady delivered average earnings surprise of 9.68% in the trailing four quarters.

Cintas delivered average earnings surprise of 6.26% in the trailing four quarters.

Dover pulled off average positive earnings surprise of 6.70% in the trailing four quarters.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

Parker-Hannifin Corporation (PH) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance