The past year for Vishay Precision Group (NYSE:VPG) investors has not been profitable

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Vishay Precision Group, Inc. (NYSE:VPG) shareholders over the last year, as the share price declined 15%. That falls noticeably short of the market return of around 22%. The silver lining (for longer term investors) is that the stock is still 5.6% higher than it was three years ago.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Check out our latest analysis for Vishay Precision Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

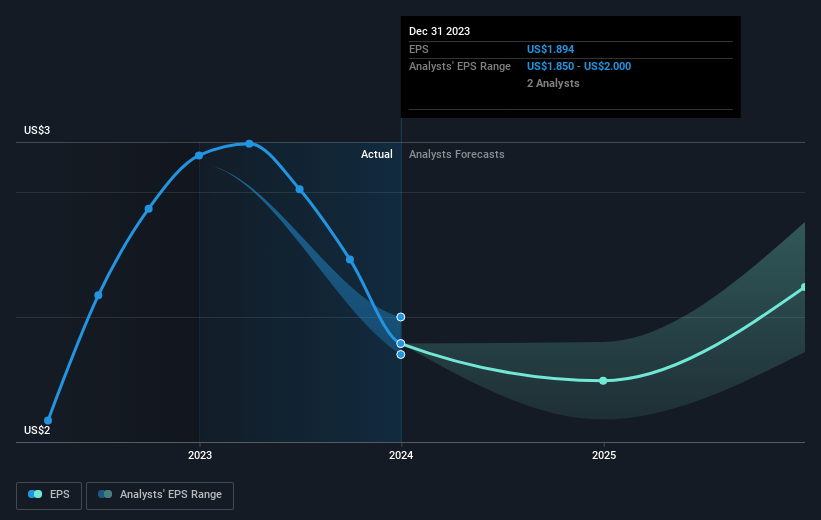

Unhappily, Vishay Precision Group had to report a 28% decline in EPS over the last year. This fall in the EPS is significantly worse than the 15% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Vishay Precision Group has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Vishay Precision Group's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 22% in the last year, Vishay Precision Group shareholders lost 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Vishay Precision Group you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance