The past year for WeCommerce Holdings (CVE:WE) investors has not been profitable

As every investor would know, you don't hit a homerun every time you swing. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So spare a thought for the long term shareholders of WeCommerce Holdings Ltd. (CVE:WE); the share price is down a whopping 71% in the last twelve months. That'd be a striking reminder about the importance of diversification. WeCommerce Holdings may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 57% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for WeCommerce Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

WeCommerce Holdings managed to increase earnings per share from a loss to a profit, over the last 12 months.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

WeCommerce Holdings managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

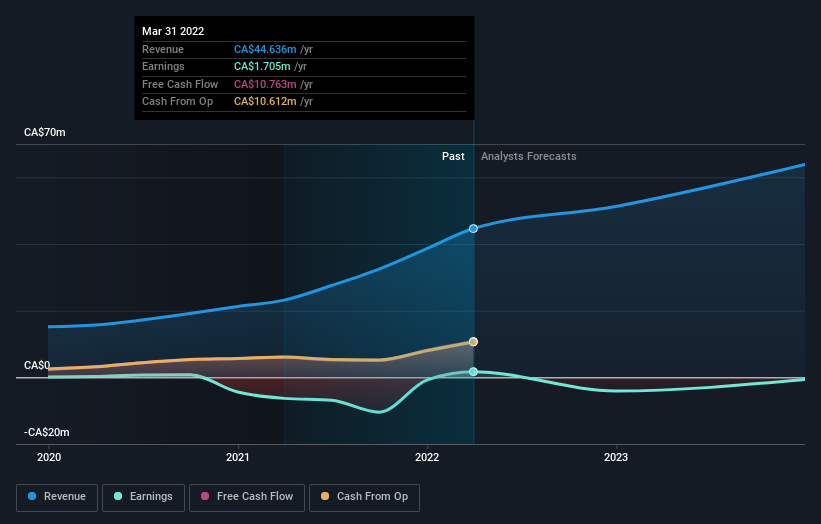

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for WeCommerce Holdings in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 0.3% in the last year, WeCommerce Holdings shareholders might be miffed that they lost 71%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 57%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for WeCommerce Holdings (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance