Paul Tudor Jones Adjusts Portfolio, Major Reduction in NVIDIA Amidst Strategic Shifts

Insight into the Investment Shifts of a Hedge Fund Pioneer in Q1 2024

Paul Tudor Jones (Trades, Portfolio), the founder and chief investment officer of Tudor Investment Group, has made significant changes to his investment portfolio in the first quarter of 2024. Known for his pioneering work in the hedge fund industry, Jones has a reputation for a strategic approach that combines both discretionary macro trading and systematic investment techniques. His recent 13F filing reveals a dynamic strategy with substantial buys, sells, and adjustments across a variety of sectors.

Summary of New Buys

Paul Tudor Jones (Trades, Portfolio) has strategically expanded his portfolio by adding a total of 470 stocks. Noteworthy new acquisitions include:

Micron Technology Inc (NASDAQ:MU), purchasing 523,466 shares, which now comprise 0.39% of the portfolio, valued at $61.71 million.

PayPal Holdings Inc (NASDAQ:PYPL), with 888,239 shares, making up about 0.38% of the portfolio, valued at $59.50 million.

Tricon Residential Inc (NYSE:TCN), adding 5,001,114 shares, accounting for 0.35% of the portfolio, valued at $55.76 million.

Key Position Increases

Significant increases in existing positions also marked Tudor's Q1 2024 strategy:

Zoetis Inc (NYSE:ZTS) saw an addition of 337,594 shares, a staggering 1,594.83% increase, bringing the total to 358,762 shares valued at $60.71 million.

iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) increased by 587,640 shares, a 4,736.74% rise, totaling 600,046 shares valued at $56.78 million.

Key Position Reduces

Reductions were also a significant part of Jones's strategy, with major cuts in several stocks:

NVIDIA Corp (NASDAQ:NVDA) saw a reduction of 103,337 shares, a 78.27% decrease, impacting the portfolio by -0.41%. The stock had an average trading price of $724.8 during the quarter.

Aon PLC (NYSE:AON) was reduced by 129,931 shares, a 99.13% decrease, impacting the portfolio by -0.31%. The stock traded at an average price of $310.03 during the quarter.

Portfolio Overview

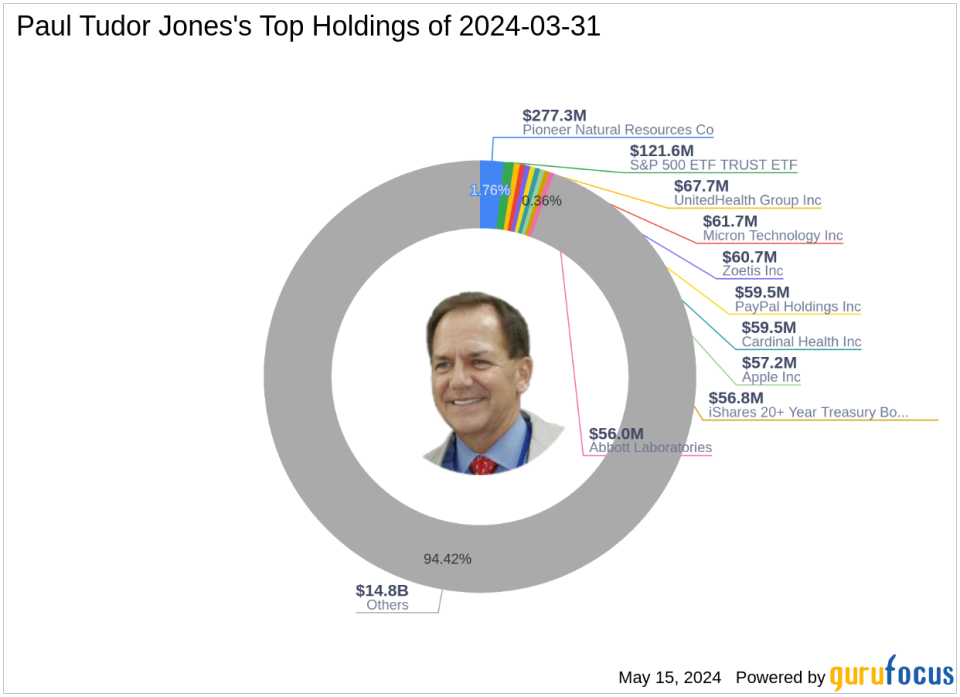

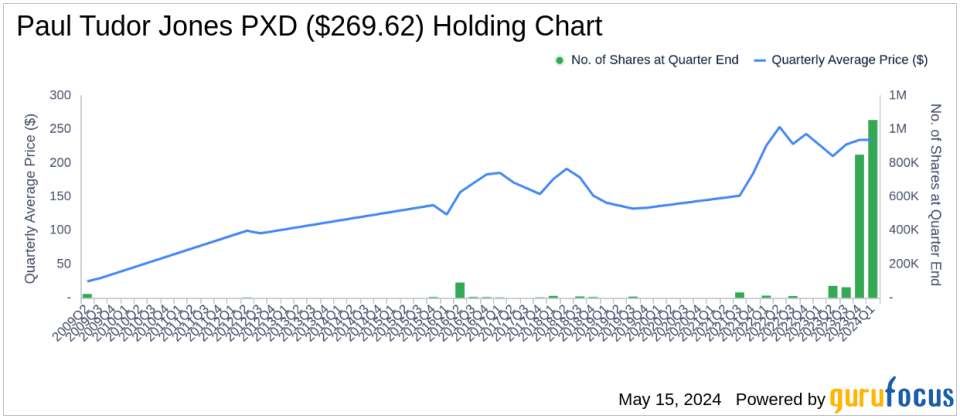

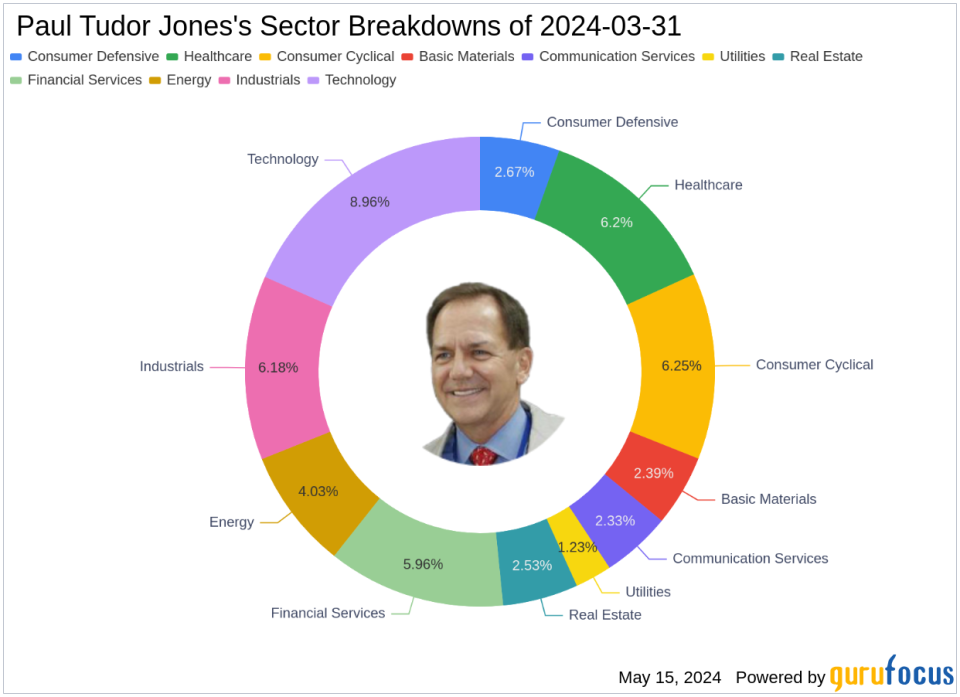

As of the first quarter of 2024, Paul Tudor Jones (Trades, Portfolio)'s portfolio included 2,144 stocks. Top holdings were 1.76% in Pioneer Natural Resources Co (NYSE:PXD), 0.77% in S&P 500 ETF TRUST ETF (SPY), and 0.43% in UnitedHealth Group Inc (NYSE:UNH). The portfolio shows a diverse range of investments across all 11 industries, with significant positions in Technology, Consumer Cyclical, and Healthcare sectors.

This strategic realignment in Paul Tudor Jones (Trades, Portfolio)'s portfolio highlights a sophisticated approach to capital allocation, reflecting broader market trends and individual stock performances. Investors and market watchers will undoubtedly keep a close eye on how these changes play out in the coming quarters.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance