Payment Giant Lags Ahead of Earnings: Buying Opportunity or Warning Sign?

I still remember Visa’s initial public offering back in 2008.

While it wasn’t the best market environment for an IPO, the initial price decline provided investors with an incredible opportunity. The stock fell under (split-adjusted) $10/share during the depths of the Great Recession.

Fast forward sixteen years, and Visa celebrated its anniversary by hitting an all-time high last month of $290/share.

The stock has since pulled back along with the general market. Fiscal second-quarter earnings from the payment technology company – which are due out this evening – will provide an update on the health of the consumer.

Visa Earnings – What Should Investors Expect?

Investors would be hard-pressed to find a more reliable company when it comes to Visa’s track record of surpassing earnings estimates.

In fact, I was surprised to learn that since its IPO, Visa V hasn’t missed the Zacks Consensus Estimate even once. By my count, there have been just 3 times the credit card giant met estimates, and the rest Visa exceeded the mark.

Visa has delivered a trailing four-quarter average earnings surprise of 4.09%. Consistently beating earnings estimates is a recipe for success.

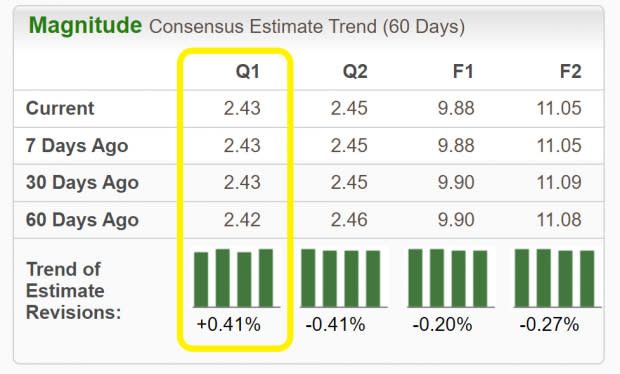

Estimates for the latest quarter have inched up over the past 60 days. Analysts covering V increased their fiscal Q2 estimates by 0.41%:

Image Source: Zacks Investment Research

After the closing bell on Tuesday, Visa is expected to report Q2 earnings of $2.43/share, which would mark a 16.3% improvement relative to the year-ago period. Revenues are projected to have risen 7.7% to $8.6 billion.

I wouldn’t be surprised in the least to see Visa post another earnings beat, likely on the back of increased spending in travel and entertainment. Higher spending volumes translates into more revenues in the form of transaction processing fees.

The Zacks Consensus Estimate for Q2 total processed transactions indicates year-over-year growth of 9.5%. The ongoing adoption of digital payment methods is likely to have continued, contributing positively to overall results.

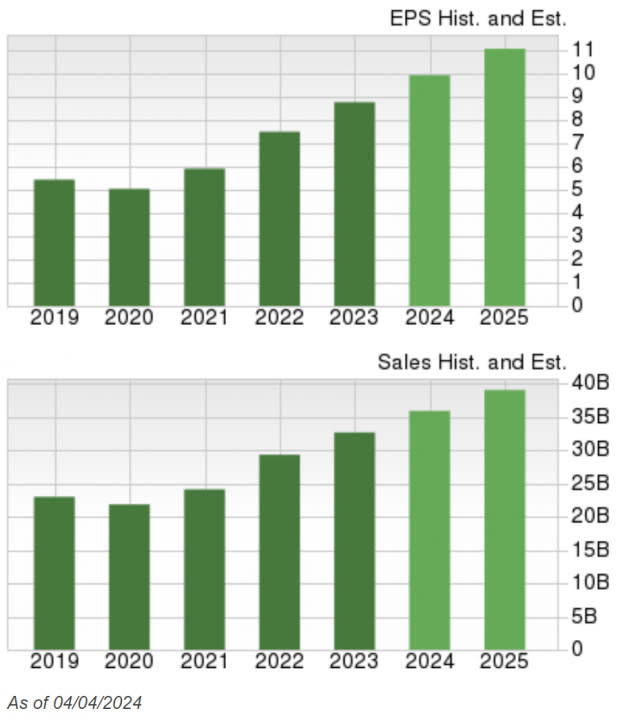

Visa’s strategic acquisitions and alliances are fostering long-term growth and consistently driving its revenues. Fiscal 2023 revenues witnessed an 11% increase, while the first quarter of fiscal ’24 saw a 9% year-over-year advance. Visa expects its growth story to continue this year, with earnings anticipated to climb 11.8% ($11.05/share) on net revenue growth of 9.2% ($35.65 billion):

Image Source: Zacks Investment Research

Visa Stock Performance

Visa has certainly been a steady performer over the years.

The stock rose nearly 18% in the past year and has added about 5% this year. V stock remains in a durable uptrend, and the recent pullback may present a buying opportunity ahead of earnings.

Image Source: StockCharts

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Visa has recently witnessed positive revisions. As long as this trend remains intact (and V continues to deliver earnings beats), the stock will likely continue its bullish run this year.

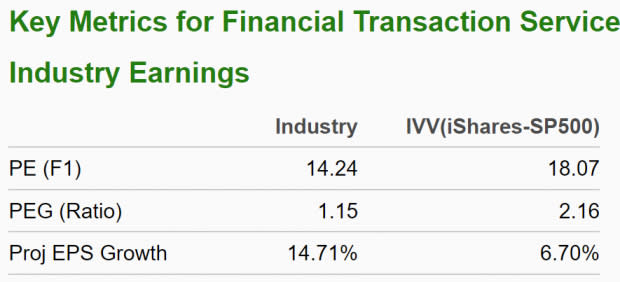

Visa is part of the Zacks Financial Transaction Services industry group, which is currently ranked in the top 35% of all Zacks Ranked Industries. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market.

Quantitative research studies have shown that roughly half of a stock's price movement can be attributed to its industry group. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Also note the favorable valuation characteristics for this industry group:

Image Source: Zacks Investment Research

What the Zacks Model Reveals

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to find companies that have recently witnessed positive earnings estimate revision activity. This more recent information can be a better predictor for future earnings and can give investors a leg up during earnings season.

The technique has proven to be quite useful for finding positive earnings surprises. In fact, when combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year back test.

Visa is a Zacks Rank #3 (Hold) and boasts a +0.59% Earnings ESP. Another beat may be in the cards when the company reports results this evening.

Bottom Line

Visa continues to innovate in the digital payments space. The stock is backed by a leading industry group and a robust history of earnings beats, recently hitting new all-time highs. This should be viewed as a sign of strength.

Make sure to keep an eye on this payment leader as the earnings announcement approaches.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance