Furlough scheme close fails to derail UK jobs recovery

Britain’s jobs market has continued to rebound strongly despite the end of the furlough scheme in September as official figures signalled the once much-feared jump in redundancies has not come to pass.

The Office for National Statistics (ONS) said the number of payrolled workers surged by 160,000 or 0.6% between September and October to 29.3 million.

It said the payrolled worker numbers were now “well above” levels seen before the pandemic struck, up 235,000 since February 2020.

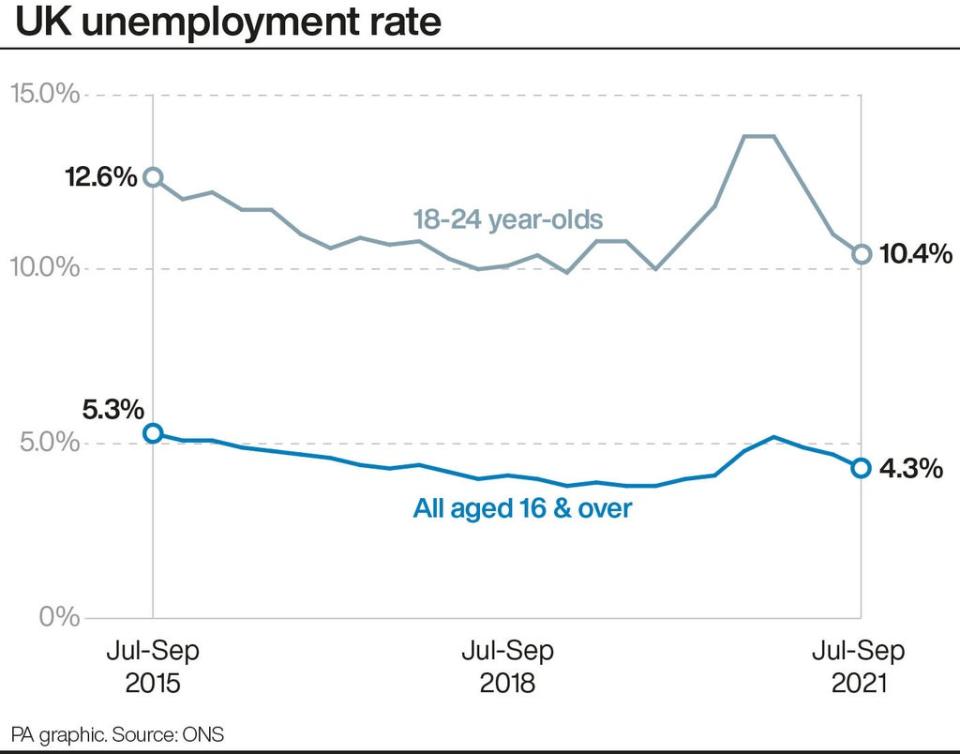

The unemployment rate also fell once more to 4.3% between July to September, down from 4.5% between June and August, in spite of the furlough scheme coming to an end on September 30.

The ONS said survey responses so far suggest only a small number of redundancies have been made among the 1.1 million still on furlough when the scheme closed, with vacancies hitting also another record high.

The robust data has reinforced expectations that the Bank of England will move to hike interest rates to cool rampant inflation before Christmas, if next month’s jobs figures just before the policymaker vote remain as rosy.

It might take a few months to see the full impact of furlough coming to an end, as people who lost their jobs at the end of September could still be receiving redundancy pay

Sam Beckett, ONS

Chancellor Rishi Sunak hailed the latest jobs figures as being “testament to the extraordinary success of the furlough scheme”.

But the ONS cautioned the full effect of furlough closing may yet be felt, with some workers let go still potentially working out their notice and on redundancy pay.

Sam Beckett, ONS head of economic statistics, said: “It might take a few months to see the full impact of furlough coming to an end, as people who lost their jobs at the end of September could still be receiving redundancy pay.

“However, October’s early estimate shows the number of people on the payroll rose strongly on the month and stands well above its pre-pandemic level.”

She added: “There is also no sign of an upturn in redundancies and businesses tell us that only a very small proportion of their previously furloughed staff have been laid off.”

There were almost nine million British workers on furlough support at the peak, but this had dwindled to just over a million in its final weeks and business surveys suggest most on furlough returned to work in October.

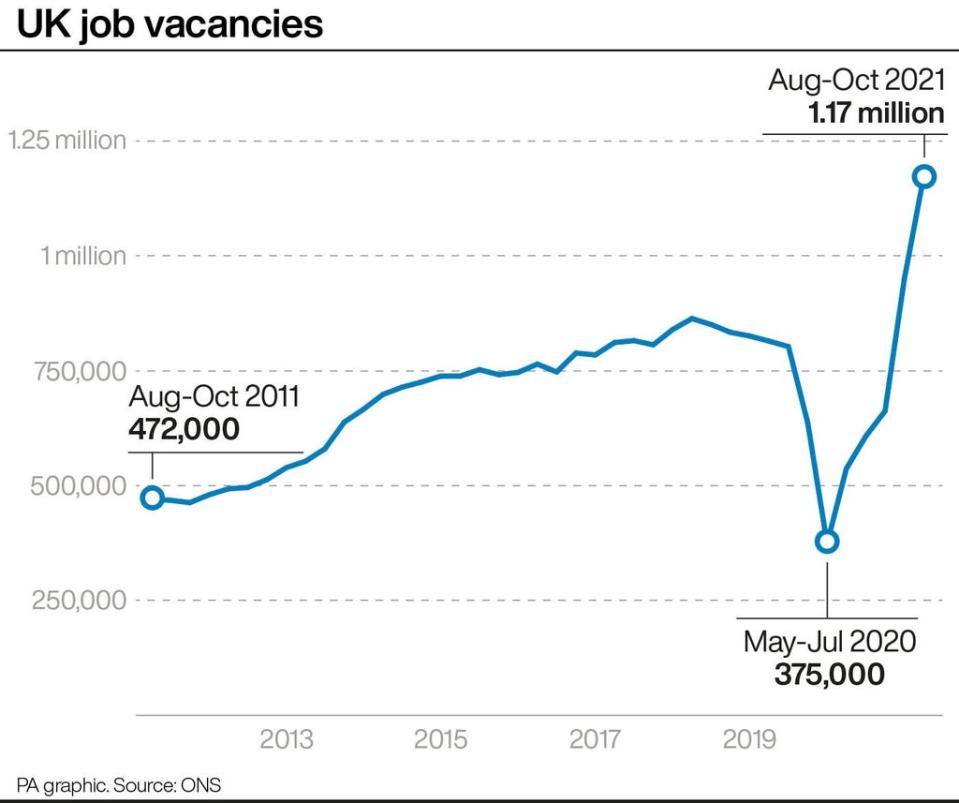

The data also showed that job vacancies soared 222,000 quarter on quarter to a record 1.17 million in the three months to October – and 388,000 higher than before the pandemic as firms battled to hire amid mounting labour shortages.

Job vacancies averaged 1.172 million in August to October 2021, up 222,000 compared with the previous three months.

Early figures show almost 1.3 million vacancies in October https://t.co/5OZ6XAOoz7 pic.twitter.com/6HD5tkHCg6— Office for National Statistics (ONS) (@ONS) November 16, 2021

Economists said the figures have increased the chances of a rate hike at the Bank’s next meeting in December.

The Bank surprised financial markets by holding off from a rate rise at its November meeting, but said a move was likely in the “coming months”.

Bank governor Andrew Bailey told MPs on Monday he was “very uneasy” about spiking inflation, though policymakers wanted to see how the jobs market was holding up after furlough before increasing rates.

Investec economist Philip Shaw said: “After today’s figures we are modestly more confident over our baseline case that the MPC will bite the bullet and raise the Bank rate by 0.15% to 0.25% next month.”

The data showed there were 1.4 million unemployed between July and September, down 152,000 on the previous quarter, while employment rose 247,000 to 32.5 million.

Wages growth eased back, with total average weekly earnings up 5.8% between July and September, down from a 7.2% hike previously.

Earnings figures continue to be skewed by certain factors, with lower paid jobs being hit hardest by the pandemic, but the growth is thought to be easing as fewer people came off furlough and saw their pay recover.

Read More

Home communication provider complaints fall to pre-pandemic levels – Ofcom

Wagamama owner The Restaurant Group’s shares leap after earnings upgrade

Landsec reveals ‘cautious optimism’ after swinging to profit

Vodafone sales boosted as travelling brings in roaming fees

Mr Kipling owner sees sales fall as pandemic comfort eating wanes

Yahoo Finance

Yahoo Finance