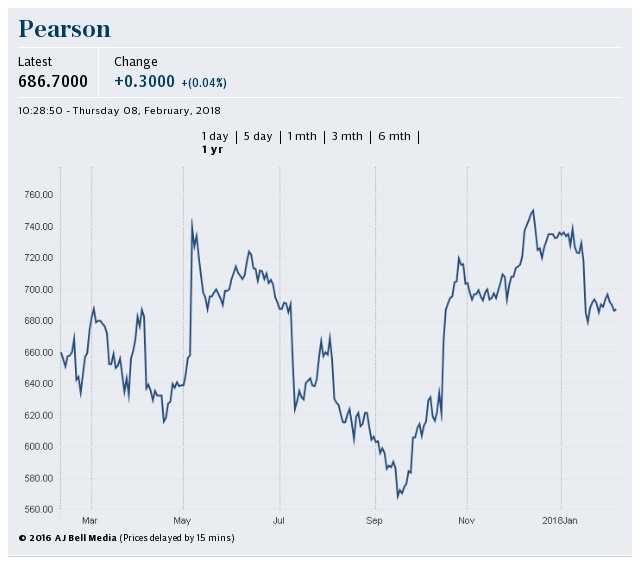

Pearson shares jump on steady outlook

Shares in education giant Pearson hit their highest level in 18 months after the publisher's first quarter results suggested it was on track with a major turnaround the struggling business.

Revenues increased by 1pc in the three months to March, while John Fallon, chief executive, confirmed Pearson was expected to report profit growth this year. The news sent shares in the company up by as much as 6.8pc to 886p.

Mr Fallon is attempting to revive the business by casting off non-core assets and cutting the debt pile following a collapse in sales and string of profit warnings over the past four years.

In February, Pearson reported that it had returned to profit after reporting a £2.5bn loss the year before on the back of a major impairment of its US business.

Mr Fallon said the cost cutting programme announced in August last year would deliver £300m of annual savings by 2020 and would save Pearson £95m by the end of 2018.

Net debt in the first quarter fell to £0.6bn, from £1.1bn at this time last year.

Sales in North America increased by 3pc in the quarter, thanks to good growth in student assessment services, professional certification and an online education programme called Virtual Schools.

Pearson's sales performance in the UK, Australia and Italy was helped by growth in its English language testing products and online program management business, where it helps universities manage postgraduate degree courses online.

Yahoo Finance

Yahoo Finance