Peer-to-peer Isas: your guide to new accounts paying up to 6pc

Zopa, the first peer-to-peer lender, has finally announced the launch of its new Isa. But who else is offering the peer-to-peer Isa and what rates can you get?

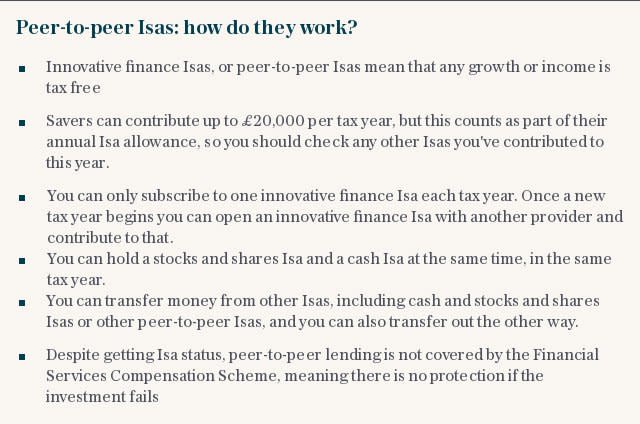

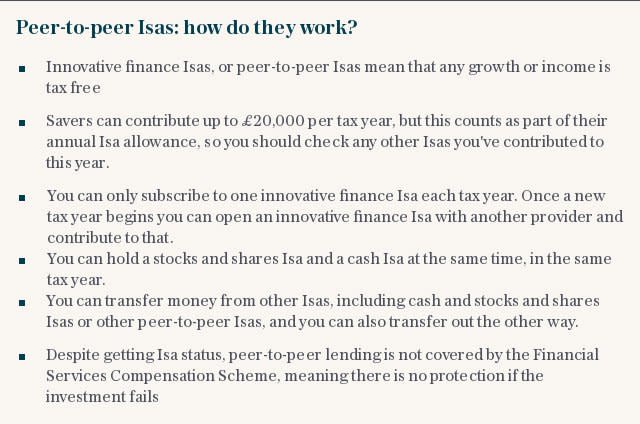

The new Innovative Finance Isa, or peer-to-peer Isa, was launched in April 2016, after being announced by former Chancellor George Osborne in 2015. This form of investing, where lenders' cash is matched to a borrower via an online platform, has become hugely popular during a period of record low savings rates.

The Isa allows peer-to-peer lending to now be placed within the tax shelter of an Isa. However, more than a year after the launch many providers are still unable to launch their version of the product.

In order to be able to offer the new Isa, peer-to-peer providers first have to get authorisation from City watchdog the Financial Conduct Authority. They must then be granted Isa manager status by HM Revenue & Customs.

The first process has taken the longest, delaying many launches, particularly among the largest providers.

Zopa

Zopa has launched its Isa to existing customers. It will offer two options: "Zopa Core" will offer returns of 3.9pc after fees and expected credit losses, while "Zopa Plus" will target a higher 6.1pc return by lending to riskier borrowers.

However, if you're not an existing Zopa customer you'll have to wait longer.

Initially the Zopa Isa will only be offered to existing customers, then during July current customers can sell their existing loans and buy them back within the Isa.

From August existing customers can transfer their Isas with other providers into Zopa. Only after that will new customers be allowed to open the Zopa Isa.

Zopa has also scrapped its previous "safeguard" protection scheme, which means it offers no cover if loans default and do not pay out.

Lending Works

Lending Works was the first large peer-to-peer company to offer the Isa. It offers two rates: 3.3pc for money tied up for up to three years and 4.4pc for money tied up for up to five years. These rates have fallen since the Isa launch in February, following customer demand. The rates were 4pc and 4.7pc, respectively.

Lending Works has a reserve fund to help customers who lose money due to people defaulting on the loans.

Abundance

Abundance is not a usual peer-to-peer lender, instead investors can commit money to help fund renewable energy projects in return for a fixed interest payment.

The Abundance Isa does not have a fixed rate, and depends on the projects available to invest in and the rates on offer. Currently it is paying 2pc interest on any cash held in the Isa until the end of July. This money can sit in the Isa until a project comes along that savers want to invest in.

The latest offer, launched last week, is a three-year bond issued The Green Deal Finance Company Group, which provides finance to homeowners and landlords in order to buy renewable energy or energy efficient products for homes. The bond will pay 12pc a year interest.

However, once sufficient funds have been raised this offer will end and savers will have to wait for the next one.

Crowd2Fund

Crowd2Fund matches investors with companies that want loans to grow their business.

A recent example is Indiebrands, a UK drinks distribution company, which has raised £50,000 to help expand the business, paying lenders 9pc a year over four years.

Crowd2Fund said that on average its Isa will pay an estimated 8.7pc a year interest rate, which is based on previous loans and default rates.

Landbay

Landbay connects landlords who are looking for a buy-to-let mortgage with investors who are willing to loan money.

The minimum investment is £5,000 - higher than many others. The expected annual return is 3.7pc.

However, loans are not fixed for any period. Instead, investors can sell the loans on the "secondary market", meaning they sell them on to other investors. There is no guarantee there will be a buyer for the loan.

Landbay said it automatically diversifies investments across multiple buy‐to‐let mortgages with terms of up to 10 years.

The platform has a reserve fund to help protect investors against losses, but as with all these protections they are not guaranteed and may not cover all losses.

CrowdStacker

CrowdStacker works in the same way as Crowd2Fund, offerings loans to businesses for a fixed rate. The exact rate investors earn depends on the businesses they choose to invest in, the rates on offer and the time period they invest their money.

At the moment just one loan is available, paying 7pc a year for three years from bar operator BurningNight Group. The minimum investment is £500 and it closes on June 23, or before if it raises the £7m it is looking for.

Lending Crowd

The LendingCrowd Growth Isa splits your money between different peer-to-peer loans in an attempt to spread the risk. No more than 5pc of your funds are invested in any one loan.

It targets a 6pc annual interest rate. This is after ongoing management fees and estimated bad debt, but is before the 1pc fee to withdraw any money. There is a minimum investment of £1,000.

Crowd for Angels

This also matches investors with businesses looking for loans.

It offers an Isa and its "crowd bonds" can be put inside the Isa. Currently just two investments are available, but more will appear.

One is car finance company Asset Exchange, which is paying 12pc a year for an 18-month term. The other is Explanar, which has created a golf training aid, and is offering 12pc for a two-year loan.

Yahoo Finance

Yahoo Finance