Is Pendragon (LON:PDG) Using Debt Sensibly?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Pendragon PLC (LON:PDG) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Pendragon

What Is Pendragon's Debt?

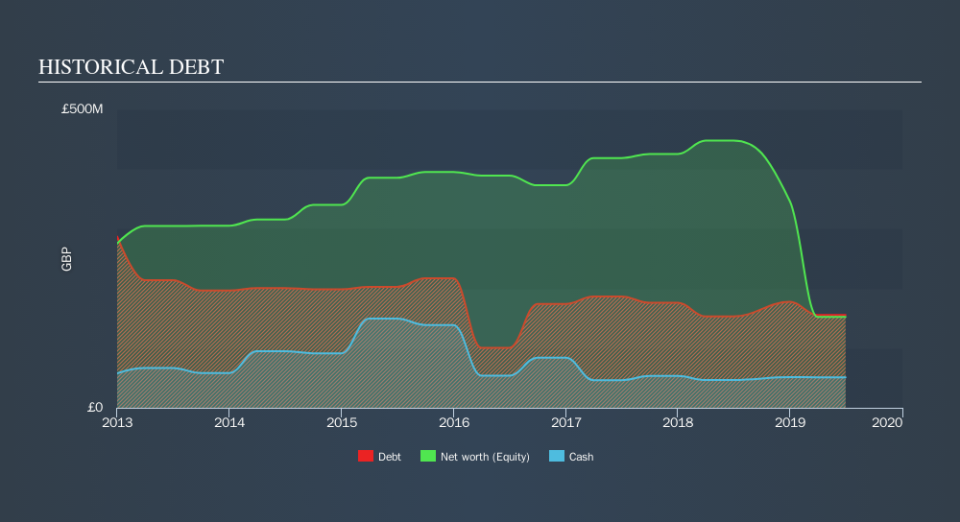

The chart below, which you can click on for greater detail, shows that Pendragon had UK£155.5m in debt in June 2019; about the same as the year before. On the flip side, it has UK£51.2m in cash leading to net debt of about UK£104.3m.

How Strong Is Pendragon's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Pendragon had liabilities of UK£1.28b due within 12 months and liabilities of UK£563.2m due beyond that. Offsetting this, it had UK£51.2m in cash and UK£159.0m in receivables that were due within 12 months. So it has liabilities totalling UK£1.63b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the UK£150.2m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt After all, Pendragon would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Pendragon can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Pendragon made a loss at the EBIT level, and saw its revenue drop to UK£4.1b, which is a fall of 4.1%. That's not what we would hope to see.

Caveat Emptor

Importantly, Pendragon had negative earnings before interest and tax (EBIT), over the last year. Its EBIT loss was a whopping UK£96m. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it burned through UK£53m in the last year. So we consider this a high risk stock, and we're worried its share price could sink faster than than a dingy with a great white shark attacking it. For riskier companies like Pendragon I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance