Pendragon's (LON:PDG) Shareholders Are Down 70% On Their Shares

It is doubtless a positive to see that the Pendragon PLC (LON:PDG) share price has gained some 65% in the last three months. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 70% in the period. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

Check out our latest analysis for Pendragon

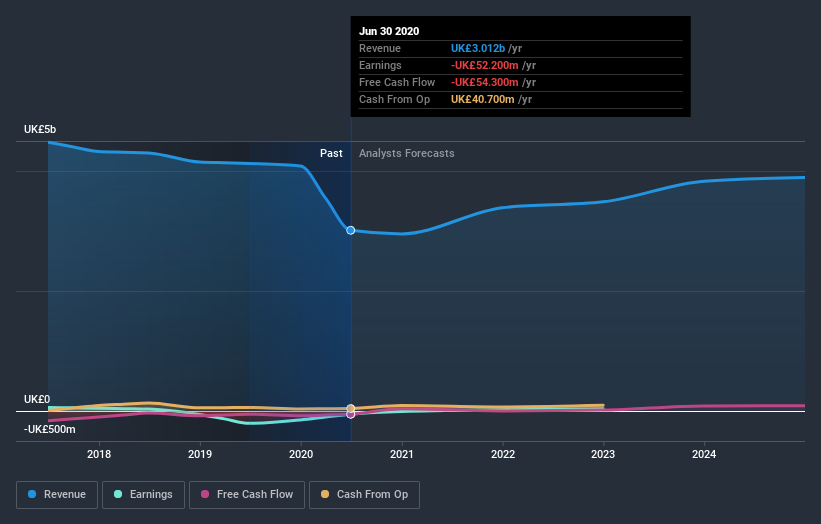

Given that Pendragon didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Pendragon saw its revenue shrink by 4.1% per year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 11% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Not that many investors like to invest in companies that are losing money and not growing revenue.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Pendragon's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Pendragon's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Pendragon shareholders, and that cash payout explains why its total shareholder loss of 64%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While it's never nice to take a loss, Pendragon shareholders can take comfort that their trailing twelve month loss of 9.1% wasn't as bad as the market loss of around 17%. What is more upsetting is the 10% per annum loss investors have suffered over the last half decade. While the losses are slowing we doubt many shareholders are happy with the stock. It's always interesting to track share price performance over the longer term. But to understand Pendragon better, we need to consider many other factors. For instance, we've identified 2 warning signs for Pendragon (1 is a bit concerning) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance