Pentair Bets on Robust Pool Demand (PNR) Amid Cost Inflation

Pentair plc PNR has been riding on increased demand for swimming pools as consumers continue to enhance their at-home quality of life by investing in pools. However, cost inflation and supply chain disruptions will play spoilsports in the near term. Nevertheless, focus on expanding digital transformation, innovation, technology and brand building, and making acquisitions in the areas of pool and residential and commercial water treatment remain key catalysts. Its ongoing transformation program to accelerate growth and drive margin expansion is expected to bear fruit in the long haul.

Strong Q3 Results & Upbeat 2021 Guidance

Pentair reported third-quarter 2021 adjusted earnings per share of 89 cents, beating the Zacks Consensus Estimate of 84 cents. The bottom line improved 27.1% from the 70 cents reported in the prior-year quarter on strong demand. The company ended the quarter with a record backlog.

Backed by this upbeat performance, Pentair expects earnings per share in 2021 between $3.34 and $3.40. The mid-point of the range indicates year-over-year growth of 35%. Sales growth for the year is projected at approximately 22% to 23% on a reported basis. Pentair’s productivity improvement efforts and price increases implemented to counter the impact of cost inflation are likely to aid margins. Segment income guidance is expected to be up approximately 32% to 34%.

Strong Residential Demand to Boost Revenues

Pentair has been witnessing strong demand for swimming pools as consumers stayed home amid the pandemic, which triggered the desire to invest in their backyards. The momentum is strong even this year as consumers continue to enhance their at-home quality of life by investing in pools. Several builders are reporting backlogs well into next year. Apart from pool construction, demand for pool maintenance remains strong. Considering that nearly 80% of the Consumer Solutions segment serves residential markets, this trend bodes well for the segment.

In the first quarter of 2021, Industrial & Flow Technologies segment returned to growth for the first time in five quarters driven by strong performance in residential and recovery in commercial and industrial businesses. This segment has been performing well ever since.

Margin Expansion Efforts in Place

During second-quarter 2021, Pentair launched a Transformation program to accelerate growth and drive margin expansion. The program, structured in multiple phases, is expected to drive operational efficiency, streamline processes, and reduce complexity while meeting financial objectives. It will also be utilizing automation to increase productivity. Pentair is projecting at least 300 basis points of margin expansion by 2025 through the program.

Innovation, Acquisitions Remain Key Catalysts

Pentair is investing in digital transformation, innovation and technology and acquisitions in the high-growth areas of pool and residential and commercial water treatment, which is commendable. In line with this in 2019, Pentair acquired Aquion, Inc. and Pelican Water Systems. In December 2020, the company completed the buyout of Rocean in a bid to expand its core water treatment solutions in the residential and commercial water business. In May 2020, Pentair completed the acquisition of assets of Ken’s Beverage, Inc, which provides the company a valuable national direct service network to expand its commercial water treatment business. Recently, it completed the Pleatco acquisition, which not only adds strong aftermarket filtration products to its flagship Pool business but also to the Industrial Filtration business.

Cost Inflation, Supply Chain Acting as Headwinds

Pentair has been witnessing inflationary increases due to high demand and tight supply of raw materials such as metals, resins and electronics, along with increased logistics costs. While it has taken pricing actions and is focusing on productivity improvements that could help offset these increases, supply chain pressures and inflationary increases are expected to continue in the fourth quarter of 2021 and next year as well. This is likely to dent Pentair’s margins in the near term.

Price Performance

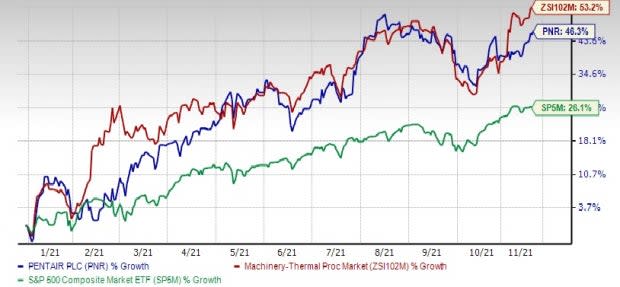

Image Source: Zacks Investment Research

Shares of Pentair have gained 46.3% in the past year compared with the industry and the S&P 500’s rally of 53.2% and 26.1%, respectively.

Zacks Rank & Stocks to Consider

Pentair currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector include Encore Wire Corporation WIRE, Heritage-Crystal Clean, Inc. HCCI and Casella Waste Systems, Inc. CWST. All of these stocks flaunt a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Encore Wire has an expected earnings growth rate of around 491% for the current year. The Zacks Consensus Estimate for the current-year earnings has been revised upward by 37% in the past 60 days.

Encore Wire’s shares have surged a whopping 144% so far this year. The company has a trailing four-quarter earnings surprise of 271%, on average.

Heritage-Crystal has a projected earnings growth rate of around 553% for 2021. The Zacks Consensus Estimate for the current-year earnings has been revised upward by 9.3% in the past 60 days.

The company’s shares have appreciated 61% in a year. Heritage-Crystal has a trailing four-quarter earnings surprise of 62.3%, on average. It has a long-term earnings growth of 15%.

Casella Waste has an estimated earnings growth rate of around 6% for the current year. In the past 60 days, the Zacks Consensus Estimate for the current-year earnings has been revised upward by 11.4%.

The company’s shares have increased 44% in the past year. Casella Waste has a trailing four-quarter earnings surprise of 42.1%, on average. It has a long-term earnings growth of 14.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pentair plc (PNR) : Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST) : Free Stock Analysis Report

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

HeritageCrystal Clean, Inc. (HCCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance