Peoples Financial Services Corp. Reports Substantial Earnings Dip Amid Rising Costs and Lower Income

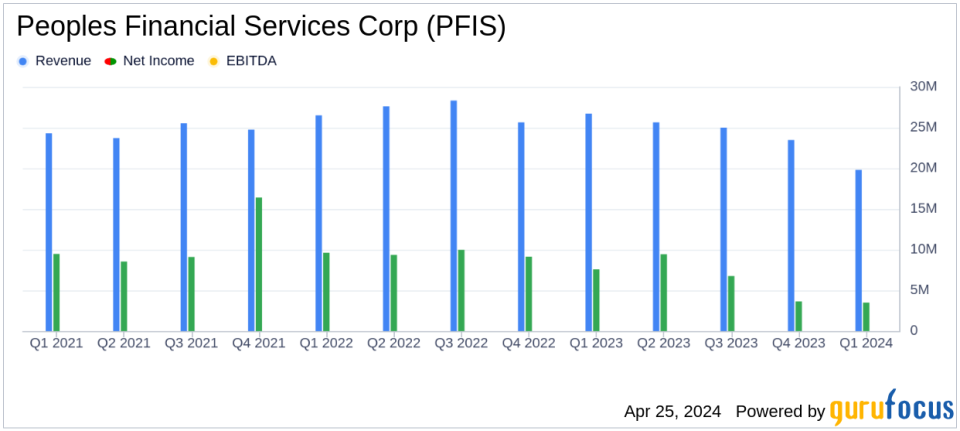

Net Income: $3.5 million, a significant decrease of 54.3% compared to $7.6 million in the prior year, falling short of the estimated $4.7 million.

Earnings Per Share (EPS): Reported at $0.49 per diluted share, below the estimated $0.65, reflecting a decrease from $1.05 per diluted share year-over-year.

Revenue: Tax-equivalent net interest income fell by 15.9% to $19.8 million, due to increased interest expenses offsetting higher interest income from loans and investments.

Operating Expenses: Rose by $1.6 million or 9.6% to $18.1 million, driven by higher IT and facilities costs, alongside $0.5 million in acquisition-related expenses.

Provision for Credit Losses: Lowered to $0.7 million from $1.3 million in the previous year, reflecting a decrease in model loss rates and favorable loan portfolio performance.

Noninterest Income: Decreased slightly by $0.3 million to $3.4 million, primarily due to reduced swap income from lower origination volumes.

Dividends: Declared dividends remained stable at $0.41 per share, representing an 83.8% payout ratio of net income.

On April 25, 2024, Peoples Financial Services Corp. (NASDAQ:PFIS) disclosed its financial performance for the first quarter of 2024 through its 8-K filing. The company reported a net income of $3.5 million or $0.49 per diluted share, a significant decline from the $7.6 million or $1.05 per diluted share recorded in the same period last year. This result falls short of the analyst estimates which projected earnings of $0.65 per share and a net income of $4.7 million.

Peoples Financial Services Corp., a prominent bank holding company, operates through its subsidiary, Peoples Security Bank and Trust Company, offering a comprehensive range of financial services across several U.S. states. The bank's services cater to individuals, businesses, and government entities, providing products such as loans, savings accounts, and advisory services.

Financial Performance and Strategic Developments

The reported quarter saw a 15.9% decrease in tax-equivalent net interest income, which stood at $19.8 million, driven by a substantial rise in interest expenses due to higher deposit costs. This was partially offset by an increase in tax-equivalent interest income resulting from higher yields and a larger balance of earning assets. Noninterest income also dipped by $0.3 million due to lower swap income, while noninterest expenses climbed by 9.6%, influenced by acquisition-related costs and higher IT expenses.

Amid these financial challenges, Peoples is navigating a strategic merger with FNCB Bancorp, Inc., expected to close in the second half of 2024. This merger is anticipated to enhance the company's market presence and operational efficiencies.

Balance Sheet and Asset Quality

As of March 31, 2024, Peoples reported total assets of $3.7 billion with loans and deposits amounting to $2.9 billion and $3.2 billion, respectively. The bank managed a modest loan growth of 1.2% during the quarter, aligning with its strategy to moderate the pace of loan expansions. The asset quality metrics remained robust, with nonperforming assets constituting only 0.27% of total loans and foreclosed assets.

Outlook and Investor Considerations

The downturn in Peoples Financial Services Corp.'s earnings highlights the pressures faced by the banking sector, including rising interest rates and operational costs. However, the company's strategic initiatives, such as the impending merger with FNCB Bancorp, could provide pathways to recovery and growth. Investors and stakeholders will likely monitor how these strategies unfold in the coming quarters, particularly in terms of synergy realization and market expansion.

For detailed financial metrics and further information, refer to the official SEC filings of Peoples Financial Services Corp.

Explore the complete 8-K earnings release (here) from Peoples Financial Services Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance