PepsiCo (PEP) Agrees to Offload Its Juice Brands to PAI

PepsiCo Inc. PEP, in a quest to expand its profitable portfolio of brands, has decided to offload its juice businesses, including Tropicana, Naked and other select juice brands, across North America and Europe. The company has agreed to sell the aforementioned businesses to Paris, France-based PAI Partners (“PAI”) for $3.3 billion in cash.

The agreement includes an irrevocable option to sell certain juice businesses in Europe. Additionally, the company will retain a 39% non-controlling interest in the newly formed joint venture with PAI relating to the sale of these brands. PepsiCo will also keep its exclusive distribution rights for the brands in the United States in the chilled Direct Store Delivery for small-format and foodservice channels, including restaurants and other venues.

The decision to sell the juice business came after an evaluation of its operating margins, which have been witnessing soft trends over the past decade. The company generated about $3 billion in sales from the juice business in 2020, while the operating margins for the business remained below the company’s average. The sale is likely to help PepsiCo streamline its vast portfolio of beverages in sync with changing consumer needs and enhance profit margins. PepsiCo bought Tropicana back in 1998 and Naked juice in 2006.

Over the past decade, the juice category has been witnessing a decelerating sales trend as consumers continue to move away from sugary drinks due to the rising health awareness on obesity and diabetes. Juice and fruit drinks have greater sugar content when compared to the other low-calorie and zero-sugar counterparts. This has led PepsiCo and arch-rival The Coca-Cola Company KO to make portfolio decisions to skew away from sugary drinks and expand the on-trend low-sugar and energy drinks portfolio.

Coca-Cola has discontinued several brands in a bid to streamline its portfolio in the past year, including the likes of TaB diet soda and Coca-Cola Energy brands in the United States. It also divested its ZICO coconut water brand due to the underperformance of the category.

Coming back to PepsiCo and the deal, the PAI-PepsiCo deal will help free up funds to invest in the growing portfolio of healthier snacks as well as zero-calorie and low-sugar beverages. The company will also focus more on products like SodaStream, which is a fast-growing business. The sale will enable it to boost margins. The company plans to use the proceeds from the sale to reduce debt. The joint venture will enable it to realize upfront value through contributions in revenues from the divested juice brands.

As for the private equity firm, PAI, the transaction will mark its first stand-alone transaction in the United States. It is one of the many deals of PAI with food and beverage companies in the last few years. In 2019, PAI bought the U.S. ice cream business of Nestle, including brands like Häagen-Dazs, Drumstick, and Mövenpick through Froneri, its joint venture with Nestle. In the current deal, PAI sees significant growth potential in the brands through investments in product innovation, expansion into adjacent categories, and enhanced scale in branded juice drinks and other chilled categories.

Both companies expect the transaction to close in late 2021 or early 2022, conditioned upon the completion of customary conditions and regulatory approvals.

Last month, PepsiCo reported blockbuster second-quarter 2021 results, wherein earnings and revenues beat the Zacks Consensus Estimate and improved significantly year over year. The company's results reflected favorable year-over-year comparisons as it lapped the pandemic-led closures of the prior-year quarter. It witnessed strong revenue growth across developed and developing as well as emerging economies as the impacts related to closures subsided. The company also gained from the resilience and strength in its global snacks and foods business as well as growth in the beverage category.

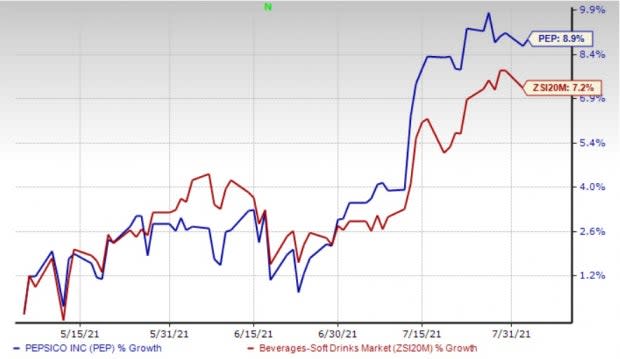

Image Source: Zacks Investment Research

PepsiCo continues to benefit from investments in brands, go-to-market systems, supply chain, manufacturing capacity and digital capabilities to build competitive advantages.

Shares of the Zacks Rank #2 (Buy) company grew 8.9% in the past three months compared with the industry’s 7.2% growth.

Don’t Miss These Other Beverage Stocks

Heineken NV HEINY, with a long-term earnings growth rate of 5.2%, currently has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Duckhorn Portfolio, Inc. NAPA has an expected long-term earnings growth rate of 10.5%. It presently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company The (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Heineken NV (HEINY) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance