Perrigo (PRGO) Surpassed Earnings in Q4, Revenues Down Y/Y

Perrigo Company plc PRGO reported fourth-quarter 2017 adjusted earnings of $1.28 per share, which beat the Zacks Consensus Estimate of $1.24 by 3.2%. The bottom line also increased 3.2% from the year-ago figure.

Net sales in the reported quarter declined 3.6% to $1.28 billion as divestitures of some businesses hurt the top line. But the metric surpassed the Zacks Consensus Estimate of $1.25 billion.

Excluding the impact of divestitures, sales nudged up 2.1% on the back of positive execution across all business segments.

Perrigo was down more than 2% in after-hours trading on Mar 1 following the earnings release. Moreover, the company’s shares have underperformed the industry in a year’s time. The stock has gained 5.3% compared with the industry’s rally of 10.9%.

Segment Discussion

Effective Jan 1, 2017, the company’s reporting segments are: Consumer Health Care Americas (CHCA), Consumer Health Care International (CHCI), Prescription Pharmaceuticals (RX) and Other Segment.

CHCA: CHCA net sales in the fourth quarter of 2017 came in at $644 million, up 2.7% year over year. This upside can be attributed to a strong performance from the gastrointestinal and analgesics categories compared with the year-ago quarter. New product sales of $17 million also contributed to the top line, led by the store brand version of Nexium, launched last September, and smoking cessation products.

However, this upside was partially offset by lower sales from nutritional drink products in the infant nutrition category as well as pricing pressure in certain OTC (over the counter) categories.

CHCI: CHCI segment reported net sales of $374 million, down 10.8% (declined 16.9% on a constant-currency basis) from the year-ago period. Excluding contributions from the divested European distribution businesses and favorable currency movements, organic net sales increased approximately 3.3% owing to higher sales of new products.

The company also witnessed higher new sales in the personal care category as well as the store brand business in the U.K. However, this was partially offset by lower net sales in the anti-parasite category.

Prescription Pharmaceuticals (RX): The Prescription Pharmaceuticals segment net sales slipped 1.7% to $261 million on a reported basis and 1.8% on a constant-currency basis. This sales dip can be attributed to lower sales of Entocort due to competitive pressures and price erosion.

2017 Results

Full-year sales decreased 6.3% year over year to $4.9 billion. The metric was however, in line with both the Zacks Consensus Estimate and preliminary results.

The 2017 earnings per share of $4.93 were slightly higher than the Zacks Consensus Estimate of $4.89 but declined 2.8% compared with the year-ago figure.

2018 Earnings Outlook

Perrigo expects revenues in the range of $5.0-$5.1 billion in 2018, above the 2017 revenues of 4.9 billion.

The company projects earnings in the band of $5.05-$5.45 per share, also ahead of the full-year adjusted earnings of $4.93.

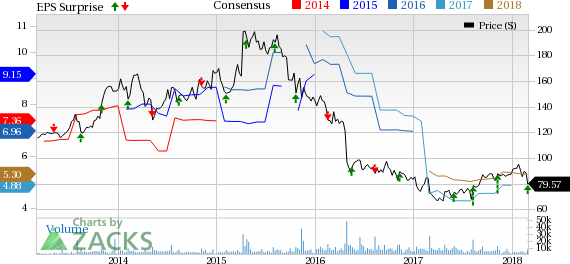

Perrigo Company plc Price, Consensus and EPS Surprise

Perrigo Company plc Price, Consensus and EPS Surprise | Perrigo Company plc Quote

Zacks Rank & Key Picks

Perrigo carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the health care sector are Regeneron Pharmaceuticals, Inc. REGN, Ligand Pharmaceuticals Incorporated LGND and Enanta Pharmaceuticals, Inc. ENTA. While Regeneron sports a Zacks Rank #1 (Strong Buy), Ligand and Enanta carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.38 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters with an average beat of 9.15%.

Ligand’s earnings per share estimates have moved up from $3.54 to $3.78 for 2018 in the last 60 days. The company delivered a positive surprise in three of the trailing four quarters with an average beat of 24.88%. Share price of the company has surged 51.6% over a year.

Enanta Pharma came up with a positive surprise in three of the last four quarters with an average beat of 373.1%. Share price of the company has skyrocketed 169.9% over a year.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Enanta Pharmaceuticals, Inc. (ENTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance