Peru Set to Cut Rates After Inflation Hits 2% Target

(Bloomberg) -- Peru will likely cut its benchmark interest rate for a third straight month Thursday, after inflation cooled faster than expected this year to hit the central bank’s target last month.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Producer Prices Surprise With Biggest Decline Since October

Gavin Newsom Wants to Curb a Labor Law That Cost Businesses $10 Billion

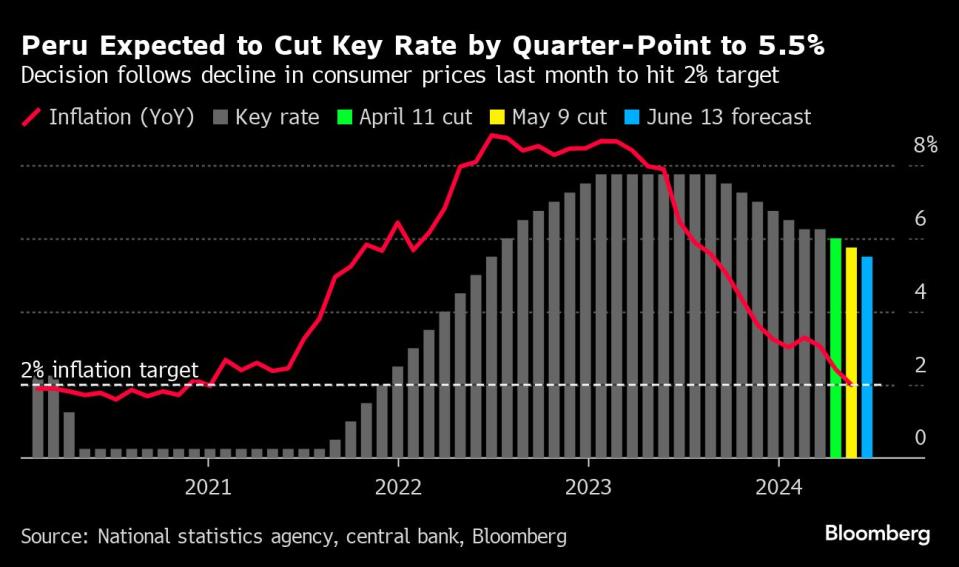

Policymakers are expected to cut the key rate by a quarter-point to 5.5% from 5.75% according to 9 of 10 economists surveyed by Bloomberg. The outlier analyst sees the bank holding borrowing costs at 5.75%. Peru had cut interest rates for six straight months before pausing in March in the wake of February’s surprise jump in consumer prices.

The central bank has cut rates eight times since September from a high of 7.75%, while inflation has now slowed to 2%, the center of the target band. The decision is slated for 7 p.m. New York time.

Peru’s inflation has slowed from nearly 9% in mid-2022, and its economy remains weak after shrinking 0.6% in 2023, the largest contraction in 33 years excluding the pandemic. While it is on a path to a very modest recovery, analysts expect it to enter a stage of low growth similar to much of Latin America.

Peru’s fight to bring inflation back to target contrasts with the struggle other big economies in the region now confront. Both Brazil and Mexico may hold rates unchanged this month in the face resurgent consumer prices while Chile may slow the pace of easing for a third straight meeting.

What Bloomberg Economics Says

“We expect policymakers to keep the door open for additional moves and reiterate that future decisions will depend on new data. External financial conditions could limit room for further cuts, but the BCRP could use alternative tools to provide more accommodation.”

— Felipe Hernandez, Latin America economist

— Click here for full report

Led by President Julio Velarde, Peru’s monetary authority now expects inflation to stay relatively stable and close the year between 2% and 2.2%..

Rate cuts have narrowed the interest rate difference in Peru with that of the Federal Reserve’s, currently at 25 basis points. Velarde said at an event last month that it is possible the Peruvian interest rate can fall some 100 basis points below that of Fed’s. “We cannot be 400 basis points below the Fed, but 100 basis points we probably can,” he said at the time.

The Finance Ministry has also called on Velarde to increase the pace of rate cuts in order to boost the economy. The economy expanded 1.4% in the first quarter compared to a year earlier, but the central bank expects growth to speed up now to hit 3% for full-year of 2024.

--With assistance from Rafael Gayol.

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance