Petrobras (PBR) to Report Q3 Results: What to Look Out For

Petroleo Brasileiro S.A., or Petrobras PBR is set to release third-quarter 2021 results on Oct 28. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 61 cents per share on revenues of $22.3 billion.

Let’s delve into the factors that might have influenced Brazil's state-run energy giant’s results in the upcoming earnings. But it’s worth taking a look at Petrobras’ previous-quarter performance first.

Highlights of Q2 Earnings

In the last reported quarter, the integrated energy major beat the consensus mark owing to the rally in oil prices, strong downstream results and favorable currency effects. Petrobras had reported earnings per ADS of $1.18, ahead of the Zacks Consensus Estimate of 92 cents. The company’s revenues of $21 billion had also outperformed the Zacks Consensus Estimate by 9.5%.

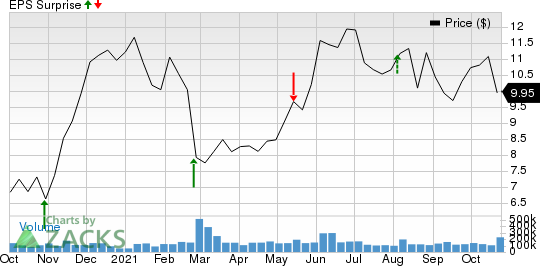

Petrobras beat the Zacks Consensus Estimate thrice in the last four quarters and missed in the other, delivering an earnings surprise of 321.62%, on average. This is depicted in the graph below:

Petroleo Brasileiro S.A. Petrobras Price and EPS Surprise

Petroleo Brasileiro S.A. Petrobras price-eps-surprise | Petroleo Brasileiro S.A. Petrobras Quote

Factors to Consider

In the April to June period, the average sales price of oil in Brazil soared 173.4% from the year-earlier period to $65.57 per barrel. The uptick is most likely to have continued in the third quarter, thanks to the sharp rebound in commodity prices that revisited their multi-year highs following the vaccine progress and the ongoing macroeconomic recovery. This price boost is likely to have buoyed the results of the upstream unit of Petrobras.

The company is also expected to have reaped the reward of a strengthening Brazilian market. Per Petrobras, in third-quarter 2021, the sale of oil products in the domestic market increased again, with a sales volume of 1,946 thousand bpd. The highlights were the increase in sales of diesel, gasoline and jet fuel. The company sold 441 million bpd of gasoline domestically, marking increases of 14.3% sequentially and 17.9% year over year. Domestic diesel sales were 867 bpd, up 6.4% sequentially and 15.7% year over year.

But on a somewhat bearish note, the company is likely to have faced a decline in liquids production that makes up some 80% of its total volumes. Per Petrobras’ recently issued update, the company produced 2.269 million barrels per day of oil and NGLs in the third quarter, down 4% year over year. The decline could be blamed on the elimination of some older productive resources as part of Petrobras’ extensive divestment strategy. This might have impacted the company’s revenues and cash flows in the September quarter.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Petrobras is likely to beat estimates in the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Petrobras has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 61 cents per share each.

Zacks Rank: Petrobras currently carries a Zacks Rank #1, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult this earnings season.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

While an earnings beat looks uncertain for Petrobras, here are some firms from the energy space that you may want to consider on the basis of our model:

CNX Resources Corp. CNX has an Earnings ESP of +2.79% and a Zacks Rank #1. The firm is scheduled to release earnings on Oct 28.

ExxonMobil XOM has an Earnings ESP of +1.57% and is Zacks #1 Ranked. The firm is scheduled to release earnings on Oct 29.

SM Energy Company SM has an Earnings ESP of +34.21% and a Zacks Rank #1. The firm is scheduled to release earnings on Oct 28.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance