Pfizer (PFE), BioNTech Provide New Data on BA.4/BA.5 Boosters

Pfizer PFE and partner BioNTech BNTX have announced data from a new analysis which showed that their Omicron BA.4/BA.5-adapted bivalent vaccines elicit a greater increase in neutralizing antibody titers against newer Omicron sublineages, including BA.4.6, BA.2.75.2, BQ.1.1 and XBB.1 than the original vaccines.

The data showed that a month after a 30-µg booster (fourth) dose of the Omicron BA.4/BA.5-adapted bivalent COVID-19 vaccine was administered, neutralizing antibody titers against emerging Omicron sublineages increased 3.2- to 4.8-fold compared to the companies’ original COVID-19 vaccine. Against emerging Omicron sublineages BA.4.6, BA.2.75.2, BQ.1.1 and XBB.1, neutralizing antibody titers increased 4.8- to 11.1-fold from pre-booster levels following a booster dose of the bivalent vaccine.

Earlier this month, Pfizer/BioNTech announced updated data from a phase II/III study on its Omicron BA.4/BA.5-adapted bivalent COVID-19 vaccine. The data showed that BA.4/BA.5 booster elicited substantially higher immune responses against BA.4/BA.5 sublineages compared to the companies’ original COVID-19 vaccine. In individuals older than 55 years of age, the booster produced approximately four-fold higher neutralizing antibody titers against Omicron BA.4/BA.5 sublineages compared to the original COVID-19 vaccine.

The companies said that the BA.5 subvariant is still the most prevalent sublineage in the United States. It accounts for nearly 30% of cases while the newly emerging BA.1.1 sublineage accounts for almost 25% of cases.

Pfizer’s stock is down 18.3% this year so far compared with growth of 6.2% for the industry.

Image Source: Zacks Investment Research

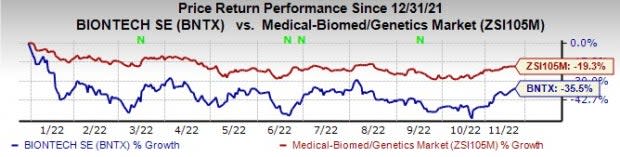

BioNTech’s shares are down 35.5% this year so far compared with the industry’s decrease of 19.3%.

Image Source: Zacks Investment Research

Pfizer/BioNTech’s Omicron BA.4/BA.5-adapted bivalent vaccines were granted emergency use authorization (EUA) for use as a single booster dose in people aged 12 and above by the FDA in August. In October, the BA.4/BA.5 booster vaccines were authorized for use in kids aged five and above. The “updated booster” contains 15-µg of an mRNA encoding the spike protein present in the original vaccine and 15-µg of an mRNA encoding the spike protein common in the Omicron BA.4 and BA.5 variants.

Along with Pfizer/BioNTech, the FDA authorized Moderna’s MRNA Omicron BA.4/BA.5-adapted bivalent vaccine for individuals 18 years of age and older.

Last week, Moderna announced data from a phase II/III study in more than 500 adults which showed its bivalent Omicron-targeting booster candidates (mRNA-1273.214 and mRNA-1273.222) induced significantly higher neutralizing antibody titers against BA.4/BA.5 subvariants compared to a booster dose of the original COVID vaccine (mRNA-1273). Importantly, the BA.4/BA.5 boosters showed neutralizing titers against emerging subvariant BQ.1.1 in an exploratory analysis

Zacks Rank and Stocks to Consider

Both Pfizer and BioNTech currently have a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A better-ranked large drugmaker is Merck MRK, which has a Zacks Rank #1 at present.

Merck’s earnings per share estimates for 2022 have increased from $7.31 per share to $7.38, while that for 2023 have increased from $7.21 per share to $7.34 in the past 30 days. The stock is up 36.0% in the year-to-date period.

Merck beat earnings expectations in all the trailing four quarters. The company delivered a four-quarter earnings surprise of 16.07%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance