Pharma Stock Roundup: JNJ Reports Q4 Earnings, SNY Inks M&A Deal With INBX

J&J JNJ kicked off the fourth-quarter earnings season for the pharma sector with a beat. Sanofi SNY announced a deal to acquire Inhibrx’s INBX pipeline candidate, INBRX-101, for an aggregate transaction value of nearly $2.2 billion. Ionis IONS announced positive top-line data from a phase III study evaluating its pipeline candidate, donidalorsen, for treating hereditary angioedema (HAE), a rare and life-threatening genetic disease.

Recap of the Week’s Most Important Stories

J&J Begins Q4 Earnings Season: J&J reported strong fourth-quarter results, beating estimates for earnings as well as sales. Its Innovative Medicines unit outperformed expectations, with sales of several key drugs like Darzalex, Stelara, Tremfya and Imbruvica beating estimates. The MedTech segment also beat the Zacks Consensus Estimate. Sales of J&J’s Innovative Medicines segment rose 4% on an operational basis, while that of the MedTech segment rose 13.4%.

J&J re-confirmed its full-year adjusted earnings and sales growth guidance that it had issued in December. For 2024, J&J expects total revenues in the range of $87.8 billion-$88.6 billion, which implies growth in the range of 4.5%-5.5%, driven by its Innovative Medicine and MedTech segments. The company maintained its operational sales growth guidance in the range of 5-6% and also its adjusted earnings per share guidance in the range of $10.55-$10.75. The earnings range implies growth in the range of 6.4%-8.4%.

Sanofi to Buy Inhibrx: Sanofi announced a definitive agreement to acquire INBRX-101, a rare disease pipeline candidate, from Inhibrx following the spin-off of non-INBRX-101 assets into a new publicly traded company called New Inhibrx. INBRX-101 is being developed in a phase II study to treat alpha-1 antitrypsin deficiency, an inherited rare disease characterized by low levels of AAT protein, which mainly affects lung function.

For the merger agreement, shareholders of Inhibrx will receive a consideration of $30 per share in cash plus a contingent value right equal to $5 per share plus 0.25 shares in New Inhibrx. In addition, Sanofi has agreed to pay off Inhibrx's outstanding debt balance and will also capitalize New Inhibrx with $200 million in cash. Sanofi will have an equity stake of 8% in New Inhibrx. All these add up to an aggregate transaction value of $2.2 billion. The transaction has been approved by the board of directors of both companies and is expected to be closed in the second quarter of 2024.

Ionis’ Donidalorsen Meets Goal in HAE Study: Ionis’ phase III study evaluating its pipeline candidate donidalorsen for treating HAE achieved its primary endpoint. The OASIS-HAE study showed a statistically significant reduction in the rate of angioedema attacks in patients treated with donidalorsen every four weeks or patients treated every eight weeks, compared to placebo. In addition, donidalorsen achieved statistical significance on all secondary endpoints in the 4-week arm and key secondary endpoints in the 8-week arm. Based on these results, Ionis plans to file a new drug application for donidalorsen with the FDA. Ionis’ partner, Otsuka, is also looking to file a marketing authorization application in Europe.

The NYSE ARCA Pharmaceutical Index declined 0.19% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

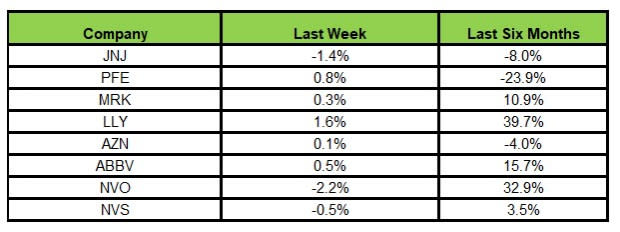

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, Lilly rose the most (1.6%), while Novo Nordisk declined the most (2.2%).

In the past six months, Lilly has risen the most (39.7%), while Pfizer has declined the most (23.9%).

(See the last pharma stock roundup here: MRK to Buy Harpoon, JNJ to Acquire Ambrx Biopharma & More)

What's Next in the Pharma World?

Watch for fourth-quarter earnings of Pfizer, Sanofi, Merck, AbbVie and Novo Nordisk and regular pipeline and regulatory updates next week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report

Inhibrx, Inc. (INBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance