Pharma Stock Roundup: JNJ's Q1 Results, LLY, ABBV, RHHBY's Successful Study Data

This week, J&J JNJ began the first-quarter 2024 earnings season for the pharma space with mixed results. Eli Lilly’s LLY tirzepatide, which is marketed as Mounjaro for diabetes and Zepbound for obesity, succeeded in late-stage studies for obstructive sleep apnea (OSA). AbbVie’s ABBV phase III study on its successful drug Rinvoq (upadacitinib) for treating giant cell arteritis (“GCA”) met its primary endpoint and key secondary endpoints. Roche’s RHHBY combination study evaluating its marketed lymphoma drug, Columvi, for earlier line of use met its primary endpoint of overall survival (“OS”).

Recap of the Week’s Most Important Stories

J&J Begins Q1 Earnings Season: J&J’s first-quarter results were mixed as it beat estimates for earnings but missed the same for sales. Higher sales of key products such as Darzalex, Stelara, Tremfya, Uptravi and Erleada drove the segment’s growth. New drugs like Carvykti, Tecvayli and Spravato also contributed to growth. The growth was partially dampened by lower sales of Imbruvica, COVID-19 vaccine and generic/biosimilar competition to drugs like Zytiga and Remicade. However, sales of Stelara missed expectations. The MedTech unit’s sales also missed estimates.

J&J tightened its previously issued sales and earnings growth expectations for 2024. J&J now expects total revenues to come in the range of $88.0 billion-$88.4 billion compared with the prior expectation of $87.8 billion-$88.6 billion. Adjusted earnings per share are expected in the range of $10.57-$10.72 compared with $10.55-$10.75 expected previously. J&J also announced a 4.2% increase in its quarterly dividend from $1.19 per share to $1.24 per share.

Lilly’s Sleep Apnea Studies on Tirzepatide Meet Goal: Lilly announced positive data from two phase III studies evaluating its pipeline candidate tirzepatide in adults with OSA and obesity. Lilly’s tirzepatide, a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA), is marketed by the name of Mounjaro for type II diabetes and as Zepbound for obesity.

The studies met all primary and key secondary endpoints. OSA is a common sleep-related breathing disorder, which causes repeated interruptions in breathing during sleep. The SURMOUNT-OSA studies met the primary endpoints by showing that tirzepatide injection (10 mg or 15 mg) significantly reduced the apnea-hypopnea index (AHI) compared to placebo. AHI measures the number of times a person's breathing shows a restricted or complete block of airflow per hour of sleep and is used to evaluate the severity of OSA. Data from the SURMOUNT-OSA studies showed that treatment with tirzepatide resulted in a mean AHI reduction of up to 63%. This means tirzepatide has the potential to significantly improve the severity of OSA.

Based on data from these studies, Lilly plans to file a regulatory application to the FDA and other regulatory bodies by mid-2024.

AbbVie’s Rinvoq Meets Goal in Giant Cell Arteritis Study: AbbVie announced positive data from the phase III SELECT-GCA study evaluating its drug Rinvoq for treating GCA, an autoimmune disease-causing inflammation of the large arteries. Data from the study showed that 46% of the GCA patients treated with Rinvoq plus 26-week steroid taper regimen achieved the primary endpoint of sustained remission (absence of GCA signs and symptoms) from week 12 through week 52 versus 29% of patients administered placebo with a 52-week steroid taper regimen. The study also met its key secondary endpoints, with 37% of patients in the Rinvoq arm achieving sustained complete remission compared to 16% of patients in the placebo arm.

Rinvoq is already approved to treat several autoimmune diseases like rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, atopic dermatitis, axial spondyloarthropathy, Crohn’s disease and ulcerative colitis.

Roche Columvi Lymphoma Study Meets Overall Survival Goal: Roche’s phase III study evaluating its lymphoma drug, Columvi, in combination with chemotherapy for relapsed or refractory diffuse large B-cell lymphoma (R/R DLBCL), met its primary endpoint of OS. Data from the STARGLO study showed that Columvi plus gemcitabine and oxaliplatin demonstrated a statistically significant improvement in OS in R/R DLBL patients who have received at least one prior line of therapy and are not candidates for autologous stem cell transplant versus MabThera/Rituxan plus gemcitabine and oxaliplatin.

Columvi is presently approved, on an accelerated basis, to treat R/R DLBCL after two or more lines of systemic therapy. Data from the STARGLO study will be submitted to health authorities to seek approval for Columvi for this earlier line of use.

The FDA approved Roche’s Alecensa as an adjuvant treatment for people with ALK-positive early-stage resected non-small cell lung cancer (NSCLC) based on data from the phase III ALINA study. In the study, Alecensa reduced the risk of disease recurrence or death by 76% versus chemotherapy in these newly diagnosed patients with early-stage ALK-positive NSCLC. Alecensa is currently approved as first- and second-line treatment for ALK-positive metastatic NSCLC.

The NYSE ARCA Pharmaceutical Index declined 2.1% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

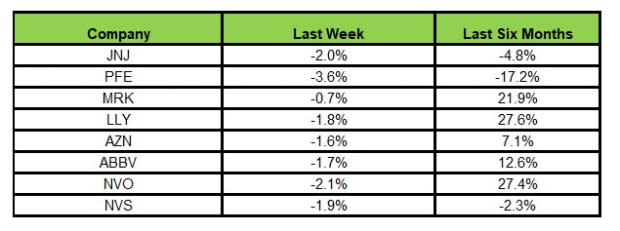

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, all the stocks were in the red, with Pfizer declining the most (3.6%).

In the past six months, Lilly has risen the highest (27.6%), while Pfizer has declined the most (17.2%).

(See the last pharma stock roundup here: JNJ to Buy Shockwave Medical, Other Pipeline & Regulatory News)

What's Next in the Pharma World?

Watch this space for first-quarter earnings of Merck, Novartis, Sanofi, AstraZeneca and AbbVie alongside regular pipeline and regulatory updates next week.

Lilly, AbbVie and J&J have a Zacks Rank #3 (Hold) each, while Roche has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance