Pharma Stock Roundup: NVS, JNJ Q1 Sales & Earnings Top, MRK & BMY Active at AACR

This week was ruled by cancer data presentations by drug companies at the annual meeting of the American Association for Cancer Research (AACR) in Chicago. Other than that, J&J JNJ and Novartis NVS kicked off 2018 pharma earnings on a strong note, beating the Zacks Consensus Estimate for both earnings and sales in the first quarter of 2018.

Recap of the Week’s Most Important Stories

J&J Beats on Q1 Earnings, Raises Sales Guidance: J&J’s first-quarter 2018 earnings came in at $2.06 per share while sales were $20 billion. Both the numbers increased 12.6% year over year. Though quite a few key products in J&J’s portfolio like Remicade and Concerta faced generic competition, we believe that new products like plaque psoriasis drug, Tremfya (guselkumab), cancer drugs, Darzalex, Imbruvica and Zytiga, currency tailwinds and contribution from acquisitions helped J&J deliver strong sales and profit in the first quarter of the year and led it to raise the sales outlook for the whole year. (Read more: J&J Tops Q1 Earnings Estimates, Raises Sales Guidance).

Novartis’ first-quarter earnings came in at $1.28 per share, which beat the Zacks Consensus Estimate of $1.25. Revenues increased 10% year over year to $12.7 billion and beat the Zacks Consensus Estimate of $12.3 billion. Strong performance of key drugs Cosentyx and Entresto led to the impressive performance in the quarter. Novartis re-iterated the previously issued guidance for 2018. (Read more: Novartis Beats Earnings and Revenue Estimates in Q1).

Merck Presents Successful Keytruda Data: At AACR, Merck MRK presented full data from the pivotal KEYNOTE-189 study, which evaluated Keytruda, in combination with Alimta (pemetrexed) and platinum chemotherapy (cisplatin or carboplatin) for the first-line treatment of patients with metastatic non-squamous NSCLC regardless of PD-L1 expression. The data showed that the Keytruda combo significantly improved overall survival, reducing the risk of death by half (51%) compared to chemotherapy alone.

In January, Merck had announced that the study met both its primary endpoints, progression-free survival (PFS) and OS (co-primary endpoint).

Notably, in May 2017, this combination therapy was granted an accelerated approval by the FDA for the aforementioned indication. The approval was based on tumor response rate and PFS data from the KEYNOTE-021 study. Hence, the positive readouts from the KEYNOTE-189 confirmatory study will help the company gain continued approval for the combo therapy, which should support uptake and sales. (Read more: Merck's Keytruda Betters Survival in Lung Cancer Combo Study).

Merck also presented updated data from the phase III EORTC1325/KEYNOTE-054 study, which evaluated Keytruda monotherapy in high-risk stage III melanoma patients in the adjuvant setting. Data from the study demonstrated that as an adjuvant treatment, Keytruda increased recurrence free survival (“RFS”), reducing the risk of disease recurrence or death by 43% over placebo after surgery in such patients. (Read more: Merck's Keytruda Reduces Death Risk in Melanoma Patients).

Separately, Merck and AstraZeneca AZN announced final overall survival (“OS”) data from a phase III study evaluating PARP inhibitor, Lynparza, in metastatic breast cancer at the AACR. The median OS was 19.3 months in the Lynparza arm, compared to 17.1% for chemotherapy.

Bristol-Myers’s Opdivo in Focus: Bristol-Myers BMY presented initial results from the phase III study, CheckMate-227, which evaluated a combination of its PD-L1 inhibitor Opdivo plus Yervoy for the first-line treatment of advanced NSCLC in patients with high tumor mutational burden. The initial results showed that the one-year PFS rate was more than triple with the combination versus chemotherapy (43% vs. 13%). However, while the results were encouraging, investors were disappointed as Merck’s Keytruda seemed to have fared better than Opdivo and Yervoy combination. (Read more: Bristol-Myers Down as Merck NSCLC Study Fares Better).

Opdivo also demonstrated a statistically significant overall survival (primary endpoint) benefit compared to chemotherapy in a late-stage study (CheckMate-078) evaluating it in a predominantly Chinese population with previously treated non-small cell lung cancer. Opdivo reduced the risk of death by 32% versus chemotherapy. (Read more: Bristol-Myers Reports Positive Data in NSCLC Trial on Opdivo).

In another development, Opdivo was approved in combination with Yervoy for the treatment of intermediate- and poor-risk advanced renal cell carcinoma in previously untreated patients. Also, Bristol-Myers’ supplemental Biologics License Application (sBLA) to expand the use of Opdivo monotherapy to previously-treated patients with small cell lung cancer (SCLC) was granted priority review by the FDA. The FDA is expected to give its decision on Aug 16, 2018.

Separately, Bristol Myers struck a collaboration with Illumina, Inc. to develop and commercialize companion diagnostics for Bristol Myers’ oncology immunotherapies.

Bristol-Myers also inked a deal with Johnson & Johnson for the development and commercialization of Bristol Myers’ factor XIa (FXIa) inhibitor, BMS-986177 for the prevention and treatment of major thrombotic conditions. Both companies are expected to advance BMS-986177 into phase II trials in the second half of 2018.

Roche’s Hemlibra Gets BTD for New Indication: Swiss pharma giant Roche’s RHHBY haemophilia drug, Hemlibra was granted breakthrough therapy designation by the FDA for the treatment of haemophilia A without factor VIII inhibitors based on positive data from the phase III HAVEN 3 study.

Hemlibra (emicizumab) was approved for routine prophylaxis of bleeding episodes in people with haemophilia A with factor VIII inhibitors in EU in February and in the United States in November last year. It has been successfully launched in the United States. (Read more: Roche Hemophilia Drug Gets Breakthrough Therapy Designation).

Shire Agrees to Sell Oncology Unit: Shire announced a definitive agreement to sell its Oncology business to French company, Servier for $2.4 billion. The Dublin, Ireland drug giant plans to return the proceeds from the sale to its shareholders through a share buyback. Japan’s Takeda considered taking over Shire and the latter’s oncology business was one the key areas of interest to Takeda. (Read More: Shire Sells Oncology Unit Ahead of Takeda's Potential Offer). Shire, however, on Thursday, rejected Takeda’s third offer of 46.50 pounds per share as well saying that it undervalued Shire’s growth prospects and pipeline.

Meanwhile, Allergan AGN issued a press release on the same day saying that it is in the “early stages of considering a possible offer for Shire”. However, later in the day, it issued another press release saying it does not intend to make an offer for Shire.

Bayer Sells Stake to Singapore’s Temasek: Germany’s Bayer has struck a deal to sell its 3.6% stake to Singapore's investment company Temasek for total gross proceeds of 3 billion euro. With the latest purchase, Temasek will own approximately 4% of Bayer’s stock. The equity sale raises funds for Bayer’s upcoming merger with seed maker Monsanto Company.

AstraZeneca’s Tagrisso Gets FDA Nod in First-Line Setting: AstraZeneca’s lung cancer drug Tagrisso gained FDA approval for the first-line treatment of adult patients with metastatic NSCLC whose tumors have EGFR mutations. The sNDA was based on data from the phase III FLAURA study.A similar label expansion application is under review in the EU. Until now, Tagrisso was approved in the United States, European Union, Japan and China as a second-line treatment option for patients with EGFR mutation-positive NSCLC. (Read more: FDA Nods to AstraZeneca's Tagrisso for First-Line NSCLC).

The NYSE ARCA Pharmaceutical Index declined 1.3% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

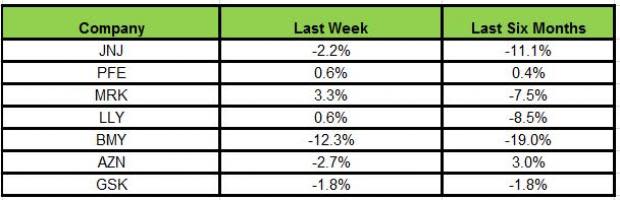

Here is how the seven major stocks performed in the last five trading sessions:

While Merck was the biggest gainer last week, rising 3.3%, Bristol Myers declined 12.3%.

In the last six months, AstraZeneca has been the biggest gainer (3%), while Bristol Myers declined the most (19%).

(See the last pharma stock roundup here: Pharma Stock Roundup: NVS to Buy AveXis, PFE & ABBV’s Drugs Succeed in Phase III).

What's Next in the Pharma World?

Watch out for first quarter 2018 earnings results from several drug giants and other pipeline and regulatory updates.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY) : Free Stock Analysis Report

Allergan plc (AGN) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance