Philadelphia Fed's Harker: U.S. economy could contract by 5% in 2020

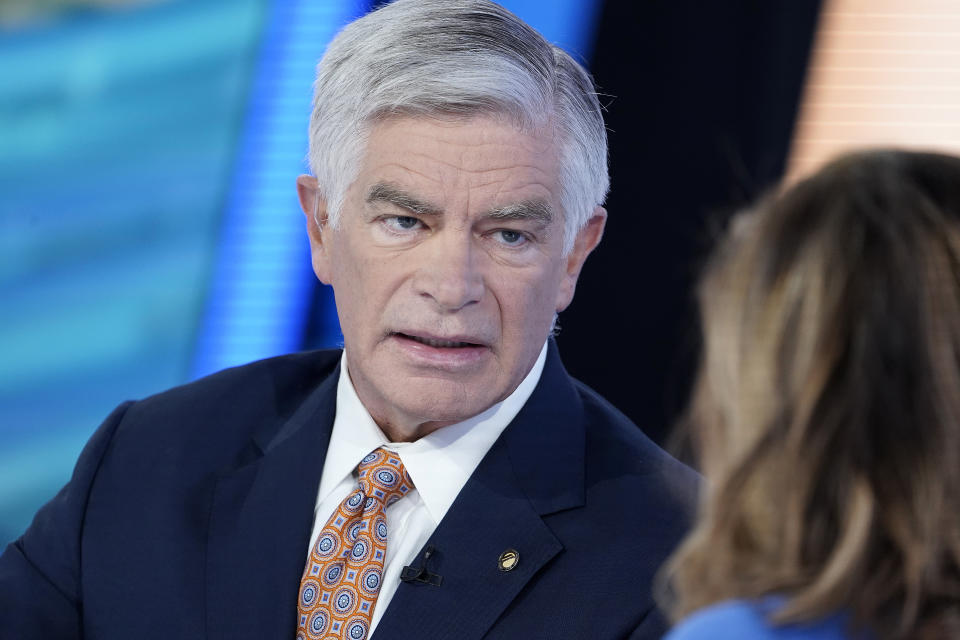

Federal Reserve Bank of Philadelphia President Patrick Harker told Yahoo Finance on Friday that the U.S. economy should brace for “very bad” data in coming quarters, predicting a sharp contraction in U.S. GDP for 2020 amid the COVID-19 lockdown.

In an interview with Yahoo Finance, Harker said his economic forecast can change depending on how quickly medical sciences can come up with ways to address the coronavirus.

“If that happens sooner, the damage is less, but right now we’re looking at year-over-year, probably around 5% hit on GDP,” he said.

Harker said the economy could start to climb out of the negative figures in the third quarter, but could see unemployment reaching the “mid-teens.” Over a recent four-week period, over 22 million Americans filed for unemployment claims as businesses across the U.S. remain closed to avoid the spread of the novel coronavirus.

[See also: Richmond Fed's Barkin: Unemployment rate could soar to high teens]

Harker, a voting member of the monetary policy-setting Federal Open Market Committee, said the Fed remains committed to supporting the U.S. economy. Over the past month-and-a-half, the Fed has slashed interest rates to zero, resumed its crisis-era policy of asset purchases through quantitative easing, and launched nine liquidity facilities to backstop markets ranging from U.S. Treasuries to high-yield corporate debt ETFs.

“I'm committed at the Fed to doing what it takes to help us get through this period, because we have to try to get through this period with as much of the economic infrastructure that we have intact,” Harker said.

Challenges for mortgage servicers, ‘micro-businesses,’ and nonprofits

Harker said he and other colleagues at the Fed are discussing pressure in the mortgage servicing market. As renters across the country struggle to meet monthly payments, mortgage servicers that rely on the income to stay afloat are now at risk.

[See also: Atlanta Fed's Bostic: Economy could 'turn on again' in the third quarter]

The Fed is already buying the securitized market for mortgages, having taken on hundreds of billions of dollars in agency mortgage-backed securities and agency commercial mortgage-backed securities since mid-March.

“We’re strongly committed to supporting that market, and you see that in our actions in the purchases we’ve made to date,” Harker said.

Harker said mom-and-pop “micro businesses” and nonprofits like universities also face “significant challenges,” adding that the Fed is “thinking a lot about what, if anything, we could do.”

Harker said it is “too premature” to think about using larger-scale monetary policy tools like yield curve control. He added that the liquidity facilities are to ensure that markets function well, not to “pick winners and losers.”

More broadly, Harker worried about the distributional effects of the downturn.

Philadelphia Fed research notes that those workers most at risk are those likely to be lower-income and without a bachelor’s degree. Harker said jobs like construction, for example, are likely to come back at some point but other industries could see a “very slow” return.

The Philadelphia Fed estimates that of the 152.3 million workers analyzed, about 38 million workers are at risk, with the most at-risk occupations being sales and food services employees at the front lines of the crisis.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

IMF: 'The Great Lockdown' to be worst recession since Great Depression

Powell: Fed will act 'forcefully, proactively, and aggressively' to support the US economy

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance