Philip Morris chief attacks critics as Vectura bid tests investors

The chief executive of Philip Morris International has lashed out at opponents of his widely condemned bid for the British inhaler maker Vectura, accusing them of “settling old scores” against the tobacco industry.

Jacek Olczak claimed critics of the £1.1bn takeover, which include the charities Asthma UK and the British Lung Foundation, were “not interested in progress” and seeking to prevent the company moving away from cigarette sales.

Writing for The Telegraph (below) he said: “If we allow vocal groups of critics—critics not interested in progress, but rather in settling old scores—to prevail, then we run the risk that efforts around corporate change, sustainable investing, and ESG [environmental, social and governance] all become hollow havens for irrationality.”

Philip Morris, the maker of Marlboro cigarettes which reported sales of more than $76bn last year, has come under heavy fire over its bid for Vectura.

The Wiltshire-based company specialises in inhaled medicines, including for diseases caused by smoking. Mr Olczak insisted PMI was “not surprised” by the strength of scepticism about his plan to make Vectura part of a decisive move away from cigarettes.

However, the company has been forced to pursue the takeover via a less advantageous mechanism owing to a rival but less generous bid from the private equity firm Carlyle.

Mr Olczak said: “It is puzzling that those who call on us to stop selling cigarettes are criticizing us for making efforts to ... stop selling cigarettes. Would they rather we do nothing?”

Philip Morris said on Thursday it had increased its stake in Vectura from less than 23pc on Wednesday to nearly 30pc via purchases on the open market as it scrambles to secure the deal.

The company said it did not intend to make any further purchases ahead of a takeover, however. Above 30pc City rules demand a cash offer at the highest price paid for the shares in the previous 12 months.

Philip Morris needs more than 50pc of shareholders to accept its offer by September 15.

Hitting that target has been complicated by concerted pressure from critics, who have directly contacted shareholders, urging them to block the takeover and arguing that it comes as a test of their ethical credentials.

Earlier this week, a group of more than 35 health charities, experts and doctors from the UK, US, Europe and Australia wrote to shareholders over the damaging effect tobacco has on United Nations sustainable development goals.

Many of Vectura’s largest backers, such as Legal & General and Axa, have yet to accept the offer and have remained silent on the deal.

Vectura’s board has recommended the Philip Morris bid, saying the approach would mean more cash for shareholders than another offer put forward by Carlyle and would also provide firepower for its research activities.

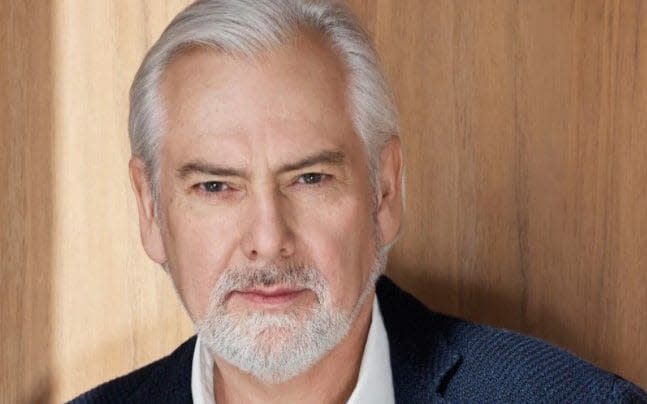

Comment: Jacek Olczak, Philip Morris International chief executive

Philip Morris International (PMI) is in the midst of a major transformation. It’s been much in the news of late in the United Kingdom. In case you missed it, the gist is this: PMI is committed to a future without cigarettes, and our recent offer to acquire Vectura Group plc, a UK-based developer of innovative inhaled drug delivery solutions, is a key part of our broader change.

These actions have been met with scepticism; we’re not surprised by that, in fact we welcome constructive conversation

about our change. However, when scepticism morphs into opposition with no regard to actions or consequences, it can

be an impediment towards outcomes global society needs.

PMI’s commitment is unalterable. The aim is simple: Step one, move adults who would otherwise continue to smoke away from cigarettes to scientifically substantiated smoke-free products that are better alternatives to continued smoking.

Step two, evolve beyond nicotine by moving into areas where we have expertise - for example, inhalation technology. Some may say this is just convenient-speak, but the evidence of our efforts is undeniable.

Today, 30pc of PMI’s revenues are from smoke-free products, up from essentially zero in 2015 and continuing to grow - our goal to be a majority smoke-free company by 2025.

We are also building a Beyond Nicotine framework and our plan to acquire Vectura is one our first steps in this effort to leverage company expertise to enter new business areas.

So, it is puzzling that those who call on us to stop selling cigarettes are criticizing us for making efforts to … stop selling cigarettes.

Would they rather we do nothing? It’s becoming clearer that’s exactly what many of our critics want. The irony: Those who oppose us are, in effect, opposing our efforts to change.

This is the fundamental debate, and it can be viewed as a referendum on every single company embracing change.

All companies, not just tobacco companies, need to make decisions to address the evolving dynamics of the world we share. It’s a debate on which companies are allowed to change, on what terms, and who gets to decide.

How these questions are answered can either accelerate radical business change or simply extend the status quo.

The logic of preventing those changes is dangerously flawed. If we allow vocal groups of critics—critics not interested in progress, but rather in settling old scores - to prevail, then we run the risk that efforts around corporate change, sustainable investing, and ESG all become hollow havens for irrationality.

It is entirely legitimate to question what is real and what is merely corporate talking points, but those questions should be part of an effort to enable change by examining the facts, rewarding action, and offering constructive solutions from both shareholders and stakeholders.

Over the next decades, people will live differently than they do now, we will all make new choices. Naturally, companies of all shapes and sizes must respond to these trends.

Some, like PMI, will completely transform and leave their legacy businesses behind. It is in the best interests of our evolving planet that positive change is enabled, allowed and encouraged.

Yahoo Finance

Yahoo Finance