Philip Morris (PM) Q3 Earnings & Revenues Beat Estimates

Philip Morris International Inc. PM posted third-quarter 2022 results, wherein the top and bottom lines increased year over year and came ahead of their respective Zacks Consensus Estimate.

Quarter in Detail

Adjusted earnings per share (EPS) came in at $1.53, which increased 8.2% year over year on a currency-neutral basis. On a proforma basis, the adjusted EPS of $1.33 grew 8.3% on a currency-neutral basis. The Zacks Consensus Estimate was pegged at $1.38. The year-over-year upside was backed by solid net revenues, elevated pricing and operating cost efficiencies amid certain margin pressures.

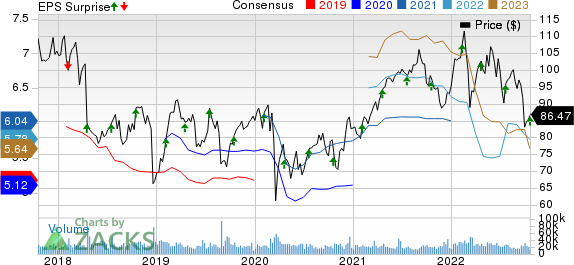

Philip Morris International Inc. Price, Consensus and EPS Surprise

Philip Morris International Inc. price-consensus-eps-surprise-chart | Philip Morris International Inc. Quote

Net revenues of $8,032 million increased by 6.7% on an organic basis. Proforma adjusted net revenues grew 6.9% on an organic basis. The top line surpassed the Zacks Consensus Estimate of $7,225 million. The proforma adjusted net revenue growth was backed by the total shipment volume increase, a continued mix shift from cigarettes to smoke-free products and improved pricing variance.

Smoke-free product pro forma net revenues jumped 14.2% organically, while combustible product pro forma adjusted net revenues rose 4.1%.

During the quarter, net revenues from combustible products were up 4.1% to $5,613 million (on an organic basis). Likewise, revenues from reduced risk products or RRPs jumped 12.9% to $2,362 million.

Total cigarette and heated tobacco unit shipment volumes increased by 0.6% to 189.5 billion units. Cigarette shipment volumes dropped 1.7% to around 162 billion units in the quarter, while heated tobacco unit shipment volumes of 27.5 billion units rose 17.1% year over year. The proforma total shipment volume rose 2.3%.

The proforma adjusted operating income margin fell 1 point on an organic basis. The decline can be attributed to investments related to expanding IQOS ILUMA, the elevated initial cost of ILUMA devices and related heated tobacco units or HTUs, supply-chain constraints (mainly due to the Ukraine war) and global cost inflation.

Region-Wise Performance

Net revenues in the European Union increased by 10.8% on an organic basis to $3,074 million. This was backed by an improved volume/mix, partly negated by adverse pricing (stemming from reduced device pricing and HTU net pricing). Total shipment volumes rose 3.9% to 50,956 million units.

In Eastern Europe, net revenues increased by 9.5% organically to $1,109 million on improved pricing variance, somewhat negated by an adverse volume/mix. Total shipment volumes fell by 6.8% to 29,034 million units.

In the Middle East & Africa, net revenues jumped 9.7% to $980 million due to a positive volume/mix and pricing. Total shipment volumes in the region dipped 1.1% to 35,354 million units.

Revenues in South & Southeast Asia advanced 13.9% on an organic basis to $1,138 million. This was a result of improved pricing variance and a favorable volume/mix. Shipment volumes ascended by 4.6% to 37,301 million units.

Revenues from East Asia & Australia tumbled 10.6% to $1,200 million on an organic basis due to an adverse volume/mix and pricing variance. Total shipment volumes declined 2.5% to 20,038 million units.

Revenues from America increased by 5.5% to $474 million on an organic basis on positive pricing variance, countered by an adverse volume/mix. Total shipment volumes grew 3.6% to 16,791 million units.

Wellness and Healthcare Unit

Philip Morris acquired Fertin Pharma A/S, Vectura Group plc. and OtiTopic, Inc. in the third quarter of 2021. It consolidated these businesses to form a Wellness and Healthcare category on Mar 31, 2022.

The company reports the results of this business under the Wellness and Healthcare segment (formerly the Other category), which is evaluated separately from regional units. Net revenues from this segment came in at $57 million during the quarter.

Other Financials

Philip Morris ended the quarter with cash and cash equivalents of $5,368 million. It had long-term debt of $21,762 million and a shareholders’ deficit of $7,403 million as of Sep 30, 2022.

Management expects operating cash flow of nearly $10.5 billion in 2022, with the capital expenditure likely to be around $1 billion. The effective tax rate is envisioned in the 21-22% band.

Swedish Match AB Offer

Earlier today, Philip Morris Holland Holdings B.V. (“PMHH”), an affiliate of PMI, announced a rise in the price of its recommended public offer to Swedish Match AB’s (Swedish Match) stockholders, taking it to SEK 116 in cash per share (compared with the SEK 106 in cash per share offered previously).

On May 11, 2022, PMHH declared a recommended public offer to the stockholders of Swedish Match to tender all Swedish Match (excluding treasury shares) shares to PMHH at SEK 106 per share (in cash). On Jun 28, the document associated with the recommended offer was made public. The transaction is likely to conclude in the fourth quarter of 2022, subject to regulatory and other approvals.

Update on the Ukraine War

Philip Morris announced the temporary suspension of its operations in Ukraine, including its factory in Kharkiv, on Feb 25, 2022. In the second quarter, the company resumed some retail activities per safety. However, production at the company's factory in Kharkiv remains suspended.

For Russia, Philip Morris had earlier announced concrete steps it had undertaken to suspend planned investments and scale down manufacturing operations in the country. It still plans to exit Russia in an orderly fashion.

Guidance

Adjusted EPS for 2022 is envisioned in the $5.81-5.96 band compared with the $6.13 reported in 2021. Proforma adjusted EPS, excluding currency impacts, is expected to grow 10-12% to the $6.09-$6.20 range.

Management expects continued gradual recovery in the duty-free business outside Asia. The total international industry volume growth (proforma basis) is estimated in the range of flat to an increase of 1%, excluding China and the United States.

The total cigarette and HTU shipment volume growth (proforma) is likely to come in the range of nearly 2-3% (up from the previous forecast of 1.5-2.5%). Proforma HTU volumes are envisioned between 89 and 91 billion units (compared with 90 to 92 billion units expected earlier).

For 2022, PM expects proforma adjusted net revenues to increase by nearly 6.5-8% on an organic basis (compared with 6-8% before). The proforma adjusted operating margin growth on an organic basis is likely to come in the range of a decline of 50 basis points to flat (compared with flat to an increase of 50 basis points expected earlier).

The gross margin is expected to be lower due to a considerable rise in IQOS device volumes (with supply restrictions easing), the increased initial cost of IQOS ILUMA, elevated logistic costs, growth-oriented investments in the smoke-free space, raw material and energy cost inflation and incremental supply-chain costs. These are likely to be partially compensated by a continued product mix shift from cigarettes to smoke-free products.

Management expects net revenues of about $275 million for the Wellness and Healthcare segment for the full year.

Shares of this Zacks Rank #4 (Sell) company have dropped 7.6% in the past three months compared with the industry’s decline of 5.8%.

Stocks Worth a Look

Some better-ranked stocks from the sector are Lancaster Colony LANC, Lamb Weston LW and TreeHouse Foods THS.

Lancaster Colony, which manufactures and markets food products for the retail and foodservice markets, currently sports a Zacks Rank of 1 (Strong Buy). LANC delivered an earnings surprise of 170% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lancaster Colony’s current financial-year sales and EPS suggests growth of 9.6% and 38.3%, respectively, from the corresponding year-ago reported figures.

Lamb Weston, a frozen potato product company, currently sports a Zacks Rank #1. LW has a trailing four-quarter earnings surprise of 47.3%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 14.8% and 42.3%, respectively, from the year-ago reported numbers.

TreeHouse Foods, which manufactures and distributes private label foods and beverages, sports a Zacks Rank #1 at present. TreeHouse Foods has a trailing four-quarter earnings surprise of 45.2%, on average.

The Zacks Consensus Estimate for THS’ current financial-year sales and earnings suggests growth of 16.8% and 15.1%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Lancaster Colony Corporation (LANC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance