Philippe Laffont's Coatue Management Acquires New Stake in Hut 8 Corp

Introduction to the Transaction

On June 28, 2024, Coatue Management, led by Philippe Laffont (Trades, Portfolio), marked a significant portfolio addition by purchasing 9,149,131 shares of Hut 8 Corp (NASDAQ:HUT). This transaction, categorized as "New Holdings," was executed at a price of $14.99 per share. The acquisition not only reflects a substantial investment but also impacts Coatues portfolio with a 0.54% change, establishing a 9.20% position in the companys holdings.

Profile of Philippe Laffont (Trades, Portfolio) and Coatue Management

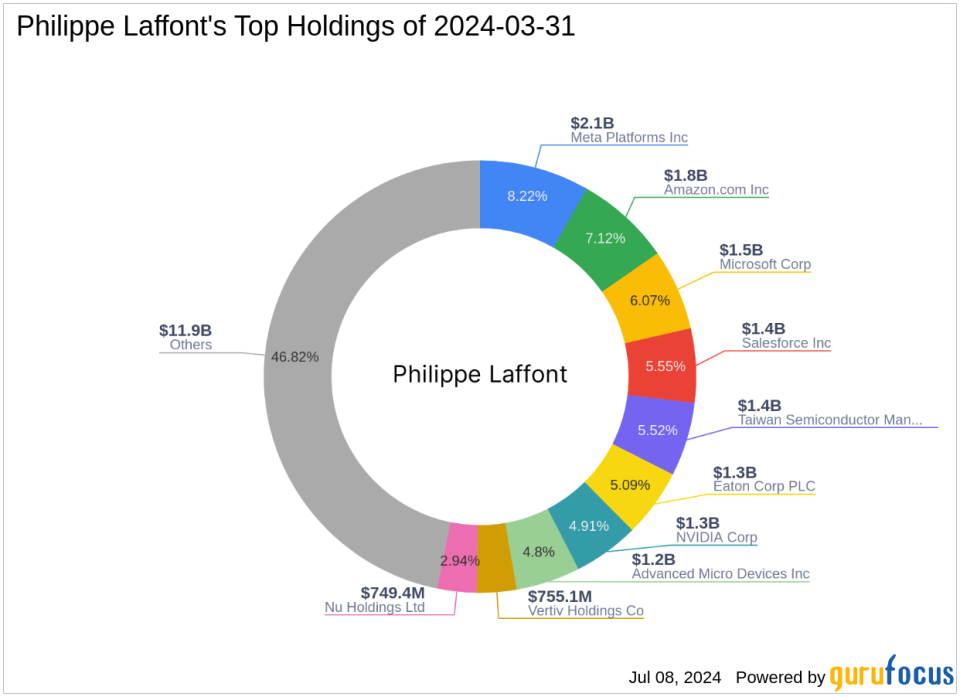

Founded in 1999 by Philippe Laffont (Trades, Portfolio), a protege of Julian Robertson at Tiger Management (Trades, Portfolio), Coatue Management operates as a technology-focused hedge fund. The firm is renowned for its rigorous fundamental analysis combined with both long and short strategies, primarily investing in the technology and communication services sectors. With a portfolio equity of $25.5 billion, Coatue Management holds significant positions in major companies such as Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and Microsoft Corp (NASDAQ:MSFT).

Overview of Hut 8 Corp

Hut 8 Corp, headquartered in the USA, specializes in the mining of digital assets, particularly Bitcoin. Since its IPO on December 4, 2023, the company operates through various segments including Digital Assets Mining and High Performance Computing - Colocation and Cloud. Despite its recent entry into the market, Hut 8 has achieved a market capitalization of $1.58 billion, with a current stock price of $17.48, reflecting a significant gain of 16.61% since the transaction date.

Significance of the Trade

The acquisition of a 9.20% stake in Hut 8 Corp aligns with Coatue Managements strategic focus on technology and innovation-driven companies. This new holding could leverage Coatues expertise in technology investments, potentially enhancing the firm's portfolio performance given the burgeoning sector of digital assets and blockchain technology.

Market and Financial Analysis of Hut 8 Corp

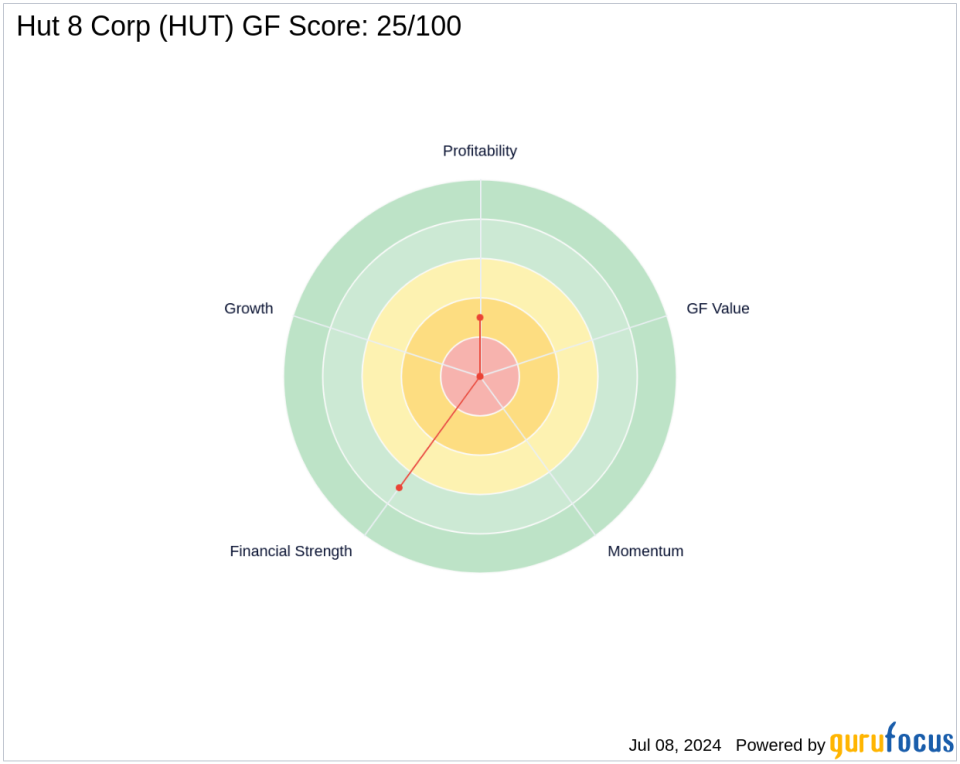

Hut 8s financial metrics reveal a PE ratio of 6.13, indicating profitability, but its GF Score of 25 suggests challenges in future performance. The companys strong Profitability Rank and interest coverage ratio of 11.77 denote solid earnings relative to interest expenses, yet its Growth Rank and Momentum Rank are areas of concern.

Future Outlook and Implications

Coatue Managements investment in Hut 8 Corp could be seen as a strategic move to capitalize on the growth potential of blockchain technology. Given the firm's history of successful tech investments and the increasing relevance of digital assets, this stake might not only diversify Coatues portfolio but also position it advantageously in an evolving market.

Comparative Analysis

When compared to other technology investments in Coatues portfolio, Hut 8 Corp presents a unique blend of technology and financial services. This investment diversifies the firm's holdings and taps into the digital currency mining boom, potentially offsetting risks associated with more traditional tech sectors.

In conclusion, Philippe Laffont (Trades, Portfolio)s Coatue Management has strategically positioned itself within the digital asset sector through its significant investment in Hut 8 Corp. This move not only diversifies its portfolio but also aligns with its long-term investment philosophy geared towards technology and innovation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance