Philips' Acquisition Spree Continues with VitalHealth Buy

In a bid to strengthen foothold in the healthcare markets, Koninklijke Philips N.V. PHG recently announced the acquisition of VitalHealth.

VitalHealth is a leading supplier of cloud-based population health management solutions for the delivery of personalized care outside the hospitals. VitalHealth’s strong portfolio of telehealth applications and care coordination platform would complement Philips Wellcentive’s solution that includes health informatics and patient engagement programs.

Together with the VitalHealth’s portfolio of solutions, the company’s Wellcentive solution will enable healthcare providers to better identify and deal with high-risk and high-cost patient populations. The buyout will strengthen the company’s population health management portfolio with advanced analytics, care coordination, patient engagement as well as outcome management solutions.

This apart, the company also recently acquired Forcare, a leading innovator in open-standards-based interoperability software solutions as it seeks to fortify clinical informatics portfolio.

Philips already enjoys a dominant position as a comprehensive clinical informatics solutions provider and believes this buyout will enable it to deliver more effective and seamlessly integrated informatics solutions. This will also facilitate the company to improve patient care, clinical workflow as well as optimize enterprise management. The terms of both the acquisitions were kept under wraps.

Existing Business Scenario

Though Philips has successfully morphed from a lighting company into a healthcare technology provider, the company’s near-term profitability is likely to be hurt by sluggish growth prospects of the healthcare market on a global scale.

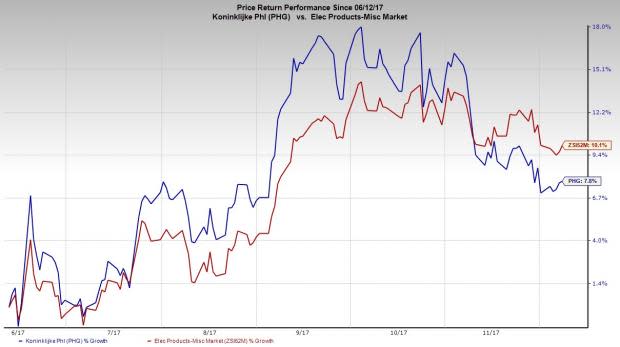

In light of uncertainties like slowing government spending and events surrounding the Affordable Care Act (“ACA”) legislation, the company expects the United States to witness low-single digit growth in the healthcare industry. The Zacks Rank #4 (Sell) company has returned 7.7% in the last six months, underperforming the

industry’s gain of 10.1%.

Further, the company anticipates high restructuring and acquisition related costs in fourth-quarter 2017 of approximately €150 million. Additionally, escalating taxes and restructuring charges are proving to be a drag on the company’s financials. These costs will negatively impact margins in the quarters ahead. This apart, the company is exposed to a number of compliance risks that can weigh on its financials.

Stocks to Consider

Some better-ranked stocks from the same space include IPG Photonics Corporation IPGP, Garmin Ltd. GRMN and Advanced Energy Industries, Inc. AEIS. While IPG Photonics sports a Zacks Rank #1 (Strong Buy), Garmin and Advanced Energy Industries carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

IPG Photonics has outpaced estimates in the preceding four quarters, with an average earnings surprise of 14.7%.

Garmin has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 15.9%.

Advanced Energy Industries has surpassed estimates in the preceding four quarters, with an average positive earnings surprise of 13.5%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

IPG Photonics Corporation (IPGP) : Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance