Philips (PHG) Expands Sonicare Portfolio With Latest Launch

Philips PHG added the Philips One for Kids toothbrush into its Sonicare family, in a bid to promote healthier oral hygiene among children.

Notably, Philips One for Kids features a compact head with soft bristles and a rubber back. It also features a two-minute SmarTimer for a thorough clean and QuadPacer for a guided experience.

Further, the electric toothbrush encourages children to track their daily brushing routines, fostering long-term healthy habits.

Philips is likely to gain solid traction across caregivers and households with kids on the back of its latest launch. Moreover, the new product is expected to drive momentum across its Sonicare product line.

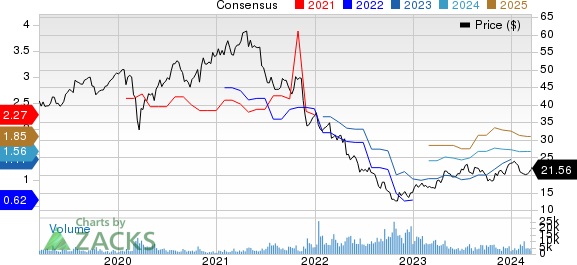

Koninklijke Philips N.V. Price and Consensus

Koninklijke Philips N.V. price-consensus-chart | Koninklijke Philips N.V. Quote

Strength in Personal Health Business

Apart from the Philips One for Kids toothbrush, the company launched the Sonicare DiamondClean 7900 Series electric toothbrush in China via e-commerce platforms like Alibaba and JD.com, expanding its customer base for personal healthcare products on the back of new launches.

Further, Philips recently unveiled the #ShareTheCare brand positioning campaign for Philips Avent in North America, urging families and communities to support mothers' well-being and self-care for babies, promoting women's empowerment in parenting. The campaign can be seen as a strategic move to boost clientele for Avent's adaptive solutions, like baby bottles and pacifiers.

All the above-mentioned endeavors are expected to bolster the Personal Health segment of the company.

In the fourth quarter, Personal Health revenues rose 1% year over year to €1.07 billion. The segment witnessed comparable sales growth of 7% year over year in the reported quarter.

Moreover, growing efforts to boost the Personal Health segment will likely aid the company in capitalizing on growth opportunities present in the global personal care market. Per a Verified Market Research report, the global personal care market is expected to reach $1.94 trillion by 2030, exhibiting a CAGR of 4.9% between 2024 and 2030.

Expanding Overall Portfolio

The latest move bodes well for the company’s continuous efforts to strengthen its overall product portfolio.

Notably, it introduced the Philips CT 5300 X-ray CT system, backed by robust AI capabilities. The AI-powered system enhances diagnostic confidence, workflow efficiency and system up-time, improving patient outcomes and department productivity in cardiac care, trauma care and interventional procedures.

The company also showcased BlueSeal MR Mobile, the world’s first helium-free mobile magnetic resonance imaging (MRI) system, at RSNA 2023. The new MRI system, which is designed to enhance diagnostic imaging, requires only 7 liters of liquid helium, offering cost and up-time advantages.

Strength in the company’s overall portfolio offerings will likely aid its top-line performance in the upcoming period.

Philips expects 2024 comparable sales growth in the band of 3-5%.

The Zacks Consensus Estimate for 2024 sales is pegged at $20.38 billion, indicating growth of 3.7% from the year-ago quarter.

Zacks Rank & Stocks to Consider

Currently, Philips carries a Zacks Rank #3 (Hold).

Its shares have lost 8.2% in the year-to-date period, underperforming the Zacks Medical sector’s growth of 6.3%.

Some better-ranked stocks in the broader medical market sector are DaVita DVA, Cardinal Health CAH and ICON ICLR. While DaVita sports a Zacks Rank #1 (Strong Buy) at present, Cardinal Health and ICON carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita shares have surged 32% in the year-to-date period. DVA’s long-term earnings growth rate is currently projected at 12.15%.

Cardinal Health shares have gained 10.2% in the year-to-date period. CAH’s long-term earnings growth rate is currently projected at 14.25%.

ICON shares have gained 17.8% in the year-to-date period. The long-term earnings growth rate for ICLR is currently projected at 14.90%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

ICON PLC (ICLR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance