Philips (PHG) Reports Q1 Earnings, Comparable Order Intake Up

Koninklijke Philips N.V. PHG first-quarter 2018 results were driven by growth in Diagnosis & Treatment businesses.

Total revenues in the quarter came in at €3.942 billion ($4.84 billion), down 2.3% from the year-ago figure. The year-over-year decline can primarily be attributed to lower sales at Connected Care & Health Informatics businesses and Personal Health segment. This was partially mitigated by impressive performances from Diagnosis & Treatment businesses. The company, however, registered 5% comparable year-over-year sales growth.

The company’s comparable order intake rose 10% year over year, driven by strong growth in Diagnosis & Treatment businesses.

The Dutch electronics giant posted first-quarter net income of €124 million, which declined 52.1% year over year. The bottom line was hurt by lower income from discontinued operations higher charges related to restructuring and acquisition and increased net financial expenses.

Top-Line Details

In the first quarter, Personal Health sales decreased 4.6% year over year to €1.64 billion. However, comparable sales grew 4% year over year. The upside in comparable sales was driven by high-single digit growth in Sleep & Respiratory Care, mid-single growth in Personal Care, while Health & Wellness as well as Domestic Appliances recorded growth in low-single digit. On a geographic basis, the company witnessed double-digit growth in Central & Eastern Europe and the Middle East and Turkey, and low single-digit growth in China due to decline in demand in the air purification market. Products in the segments like DreamWear Full Face mask and One Blade are promising.

Diagnosis & Treatment revenues rose 2.6% in the quarter to €1.530 billion. Comparable sales grew 9% for the quarter. Double-digit growth in Ultrasound and Image-Guided Therapy and mid-single digit growth in Diagnostic Imaging drove this segment’s sales. On a geographic basis, double-digit growth in China and high-single digit growth in North America acted as catalysts. Robust order growth from Azurion platform and strength in the devices business on Volcano and Spectranetics acquisitions backed results.

Connected Care & Health Informatics revenues were down 9.4% in the quarter to €663 million. Comparable sales remained flat for the quarter. Low single-digit decline in Therapeutic Cate impacted results. On a geographic basis, mature geographies remained flat due to mid-single-digit decline in Western Europe and low-single digit decline in North America. Double-digit growth in India and Latin America was offset by double-digit decline in Africa. The company expects it to further improve in the second half of the year.

Revenues in the Other segment increased 18.4% to €109 million due to license income from Lighting.

Margins

Philips’ adjusted earnings before interest, taxes and amortization (EBITA) — the company’s preferred measure of operational performance — was €344 million.

Adjusted EBITA margin increased 130 basis points (bps) to 8.7% year over year benefiting from growth, productivity programs and operational improvements.

Robust margin improvements in Connected Care & Health Informatics businesses and Diagnosis & Treatment businesses with adjusted EBITA expanding 180 and 140 bps, respectively drove results.

Balance Sheet & Other Details

As of Mar 31, 2018, Philips’ cash and cash equivalents were €1.982 billion compared with €1.939 million at the end of the previous quarter. The company’s long-term debt rose to €3.242 billion compared with €4.044 billion in the last quarter.

During the reported quarter, the company achieved procurement savings of €50 million, driven by the DfX program, while other productivity programs resulted in savings of €51 million. The company thereby delivered €101 million savings during the first quarter.

Meanwhile, net cash flow generated from operating activities came in at €92 million compared with net cash flow of €300 million in the prior-year quarter.

The company also completed an additional €350 million of the €1.5 billion share buyback program initiated in the third quarter of 2017.

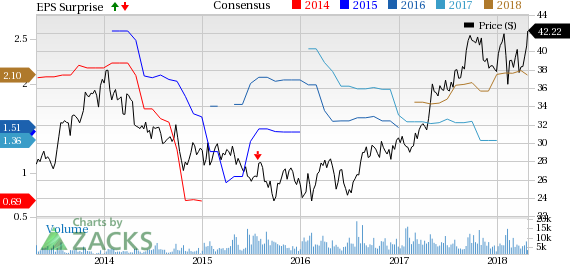

Koninklijke Philips N.V. Price, Consensus and EPS Surprise

Koninklijke Philips N.V. Price, Consensus and EPS Surprise | Koninklijke Philips N.V. Quote

Outlook

The company remains optimistic about the prospects of its Diagnosis & Treatment vertical on account of positive industry trends as Image-Guided Therapy and Ultrasound equipment sales are acting as major profit churners. However, management also mentioned that growth of Ultrasound might not be as good as in the first quarter.

Geographically, the company continues to expect U.S. health care market to grow in low single digits. Modest growth in Western Europe with low single-digit growth in health care market is anticipated. In China, the company expects high single-digit growth for 2018.

The company believes product innovation and an expanding portfolio to boost results in the second quarter as well as the second half of the year. Expansion in newer markets like Brazil is also expected to increase its share. The company considers oral care to be a significant growth driver going forward.

For full year 2018, Philips reiterated comparable sales growth of 4-6%. The company anticipates adjusted EBITA margin to improve around 100 basis points. Free cash flow is expected to be in the range of €1-€1.5 billion.

Zacks Rank and Stocks to Consider

Phillips carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector include Lam Research Corporation LRCX, Micron Technology MU and Western Digital WDC, all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Long-term earnings growth rate for Lam Research, Micron and Western Digital is projected to be 17.7%, 10% and 19%, respectively.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance