Piedmont Lithium Inc. (PLL) Q1 2024 Earnings Overview: Misses Revenue Estimates Amidst ...

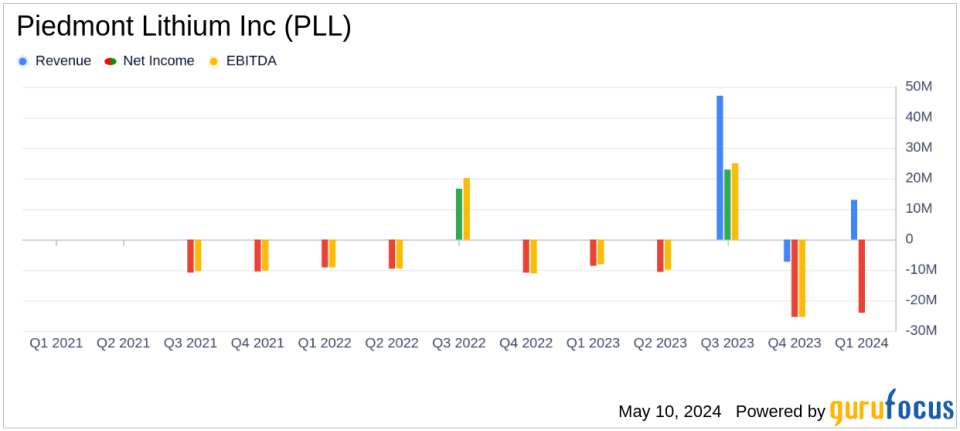

Revenue: Reported at $13.4 million, falling short of the estimated $15.37 million.

Net Loss: Deepened to $23.6 million, significantly above the estimated loss of $9.95 million.

Earnings Per Share (EPS): Recorded a loss of $1.22 per share, surpassing the estimated loss per share of $0.54.

Cash Position: Ended the quarter with $71.4 million in cash and cash equivalents, demonstrating strong liquidity.

Production Milestones: Achieved record quarterly production of 40,439 dmt of spodumene concentrate at North American Lithium.

Strategic Developments: Received the mining permit for Carolina Lithium, enhancing the project's development prospects.

Cost Management: Initiated a cost-savings plan expected to reduce annual operating expenses by $10 million.

Piedmont Lithium Inc. (NASDAQ:PLL), a prominent player in the North American lithium market, disclosed its financial outcomes for the first quarter of 2024 on May 9, 2024, through its 8-K filing. The company reported a revenue of $13.4 million from the sales of approximately 15,500 dry metric tons of spodumene concentrate, falling short of the analyst estimates which projected a revenue of $15.37 million.

Piedmont Lithium Inc., headquartered in Belmont, North Carolina, operates as a development-stage, multi-asset integrated lithium business. Its strategic projects include Carolina Lithium in North Carolina and Tennessee Lithium in Tennessee, aiming to bolster the U.S. and global energy security by supporting the clean energy economy.

Operational Highlights and Financial Performance

The quarter marked significant operational successes, including record production levels at North American Lithium (NAL), which is co-owned with Sayona Mining. NAL produced approximately 40,439 dry metric tons of spodumene concentrate, with lithium recoveries in March 2024 reaching a record high of 69%. This achievement is part of a broader strategy to ramp up production to full run-rate in the second half of 2024.

The financials reveal a net loss of $23.6 million for the quarter, a slight decrease from the $25.4 million loss recorded in the same period the previous year. This loss includes the impact of significant non-cash charges and the sale of equity investments, which resulted in a net proceeds of $49.1 million but also a reportable loss of $17.2 million from historical non-cash gains on dilution in Sayona Mining.

The company's balance sheet remains robust with $71.4 million in cash and cash equivalents as of March 31, 2024. This financial stability is supported by strategic asset monetization and cost-saving measures, including a workforce reduction which is expected to save $10 million annually.

Strategic Developments and Outlook

A milestone was achieved with the issuance of the mining permit for the Carolina Lithium project, which is anticipated to significantly contribute to the low-cost production of lithium hydroxide. This permit accelerates funding discussions with potential partners, including government loan agencies. The company plans to leverage the Inflation Reduction Act of 2022 and other local benefits to enhance the project's competitiveness.

Looking forward, Piedmont Lithium is set to focus on its core projects and expects to more than double its shipments in the latter half of 2024. The company forecasts shipping approximately 126,000 dry metric tons of spodumene concentrate throughout 2024, with capital expenditures projected to decrease significantly in the second half of the year.

As Piedmont Lithium continues to navigate the complexities of the lithium market, its strategic positioning and operational advancements are pivotal in its journey towards becoming a key player in North America's lithium hydroxide production landscape.

Conclusion

Despite the revenue shortfall this quarter, Piedmont Lithium's strategic project advancements and robust production performance highlight its potential to significantly impact the lithium supply chain critical for the electric vehicle industry. Investors and stakeholders may look forward to the company's continued progress and strategic execution in the coming periods.

Explore the complete 8-K earnings release (here) from Piedmont Lithium Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance