Pilgrim's Pride (PPC) Q2 Earnings Beat, Sales Improve Y/Y

Pilgrim's Pride Corporation PPC reported impressive second-quarter 2022 results, with the top and bottom lines increasing year over year. Earnings in the quarter surpassed the Zacks Consensus Estimate. The company registered top-line growth across all business units, fueled by impressive service levels to Key Customers, which led to a solid sequential profit rise. Quarterly results benefited from strength in diversified U.S. portfolio. Pilgrim's Pride demand in overall retail and foodservice operations remained impressive.

Pilgrim's Pride continues to benefit from long-term investments like automation and focus on service for key customers. Management unveiled some new investments in the United States. In this regard, management is investing in expanding the Athens, Georgia, facility to improve service levels and boost Key Customer growth. The company will undertake operational excellence improvements via automation throughout its U.S. footprint along with constructing a protein conversion plant for pet food ingredients in Georgia. In addition, Pilgrim's Pride will develop a Prepared Foods facility in the Southeast USA to support branded growth and further diversify its portfolio.

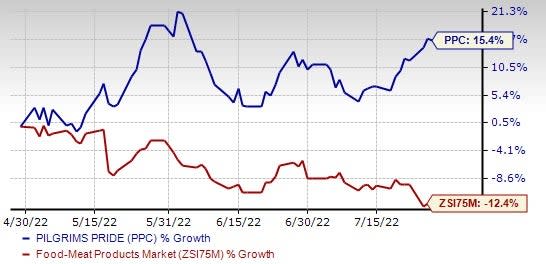

PPC’s shares rallied 2% in the after-market trading session on Jul 27, 2022, following the earnings release. Shares of the Zacks Rank #3 (Hold) have increased 15.4% in the past three months against the industry’s decline of 12.4%.

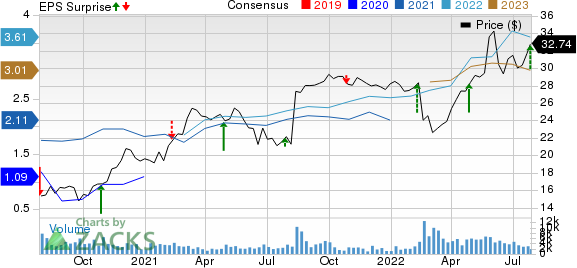

Pilgrim's Pride Corporation Price, Consensus and EPS Surprise

Pilgrim's Pride Corporation price-consensus-eps-surprise-chart | Pilgrim's Pride Corporation Quote

Q2 in Detail

The company reported adjusted earnings of $1.54 a share, up significantly from 63 cents in the year-ago quarter. Quarterly earnings also surpassed the Zacks Consensus Estimate of $1.12 per share.

The producer, marketer and distributor of fresh, frozen and value-added chicken and pork products generated net sales of $4,631.6 million, which increased 27.3% from the year-ago quarter’s level. Net sales increased in Mexico and Europe and the U.S. operations.

Net sales in the U.S. operations were $2,899.9 million, up from $2,248.5 million reported in the year-ago quarter. Management highlighted that its U.S. retail and foodservice business remained solid amid the rising inflationary environment. The company witnessed margin improvements supported by better market fundamentals in Big Bird Debone along with ongoing operational improvements. The company’s brand performance remained solid in its U.S. retail, with Just Bare and Pilgrim’s Prepared products rising more than 96% year over year. In addition, online business in U.S. branded portfolio more than doubled.

Mexico operations generated net sales of $486.7 million in the reported quarter, up from $453.4 million in the prior-year quarter. The Mexico business benefited from solid demand. Persistent improvements in the business countered seasonal challenges in live operations at the company’s locations.

Net sales from the U.K. and Europe operations rose to $1,245.1 million in the quarter under review from $935.8 million in the prior year. The company’s combined European business fueled bottom line growth, with greater implementation of operational efficiencies, focus on Key Customer partnerships and more diversification of product offerings.

Pilgrim's Pride’s cost of sales increased to $3,954.9 million from $3,257.5 million reported in the year-ago quarter. Gross profit climbed to $676.8 million from $380.2 million. Adjusted EBITDA of $623.3 million increased 67.7% from $371.6 million reported in the year-ago quarter. Adjusted EBITDA margin increased 330 basis points (bps) year over year to 13.5%.

Image Source: Zacks Investment Research

Other Financial Details

Pilgrim's Pride ended the quarter with cash and cash equivalents of $682.1 million, long-term debt (less current maturities) of $3,371.4 million and total shareholders’ equity of $2,872.1 million. The company generated $421.2 million of cash from operating activities for six months ended Jun 26, 2022.

Some Better-Ranked Staple Stocks

Some better-ranked stocks are Lamb Weston LW, Medifast MED and General Mills, Inc. GIS.

Lamb Weston, which produces, distributes and markets value-added frozen potato products, sports a Zacks Rank #1 (Strong Buy) at present. LW has a trailing four-quarter earnings surprise of 18.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LW’s current financial year sales suggests growth of 9.3% from the year-ago reported number.

Medifast, which manufactures and distributes weight loss, weight management, healthy living products and other consumable health and nutritional products, currently carries a Zacks Rank #2 (Buy). MED has a trailing four-quarter earnings surprise of 12.9%, on average.

The Zacks Consensus Estimate for Medifast’s current financial year sales and earnings per share (EPS) suggests growth of almost 19% and 13.4%, respectively, from the year-ago reported figures.

General Mills, which manufactures and markets branded consumer foods worldwide, currently carries a Zacks Rank of 2. GIS has a trailing four-quarter earnings surprise of 6.5%, on average.

The Zacks Consensus Estimate for General Mills’ current financial year sales and EPS suggests growth of almost 2% and 1.5%, respectively, from the corresponding year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance