Pinnacle Financial Partners Leads Three US Stocks Estimated To Be Trading Below Their Value

As the United States stock market experiences a mix of sharp declines and record highs, with sectors like technology facing significant volatility due to geopolitical tensions and regulatory concerns, investors are navigating through a complex landscape. In this environment, identifying stocks that are potentially undervalued becomes crucial, offering opportunities for those looking for value in a fluctuating market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Noble (NYSE:NE) | $47.70 | $93.11 | 48.8% |

UMB Financial (NasdaqGS:UMBF) | $96.84 | $190.25 | 49.1% |

Kanzhun (NasdaqGS:BZ) | $16.80 | $32.63 | 48.5% |

Daqo New Energy (NYSE:DQ) | $16.45 | $32.83 | 49.9% |

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA) | $21.41 | $41.25 | 48.1% |

Harvard Bioscience (NasdaqGM:HBIO) | $3.46 | $6.67 | 48.1% |

Vasta Platform (NasdaqGS:VSTA) | $3.01 | $5.89 | 48.9% |

TAL Education Group (NYSE:TAL) | $10.03 | $19.76 | 49.2% |

Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $240.02 | $479.55 | 49.9% |

MediaAlpha (NYSE:MAX) | $14.02 | $27.77 | 49.5% |

Here we highlight a subset of our preferred stocks from the screener.

Pinnacle Financial Partners

Overview: Pinnacle Financial Partners, Inc. is a bank holding company for Pinnacle Bank, offering a range of banking products and services to individuals, businesses, and professionals across the United States, with a market capitalization of approximately $6.98 billion.

Operations: The bank provides a variety of financial services and products across the U.S., with a market capitalization of approximately $6.98 billion.

Estimated Discount To Fair Value: 47.2%

Pinnacle Financial Partners is currently priced at US$93.97, significantly below the estimated fair value of US$178.13, indicating a potential undervaluation of 47.2%. Despite this, challenges persist as evidenced by a recent decline in profit margins from 37.9% to 26.1%, alongside significant insider selling over the past quarter. However, the company's earnings are expected to grow by 28.14% annually over the next three years, outpacing both its historical revenue growth and broader market expectations.

Equifax

Overview: Equifax Inc. is a data, analytics, and technology company with a market capitalization of approximately $32.71 billion.

Operations: The company generates revenue through three primary segments: International ($1.27 billion), Workforce Solutions ($2.32 billion), and U.S. Information Solutions ($1.76 billion).

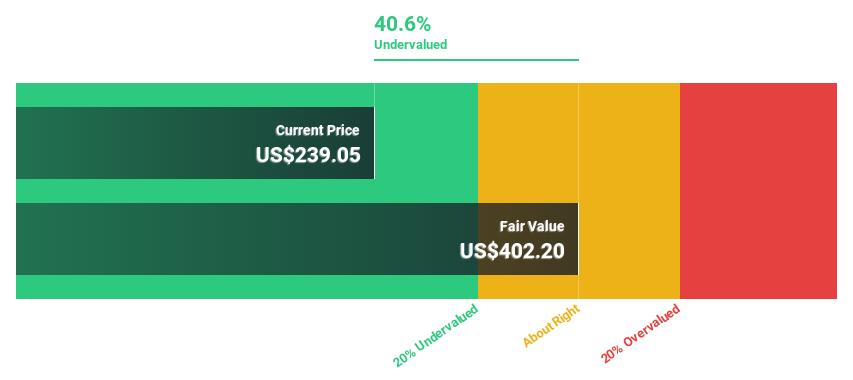

Estimated Discount To Fair Value: 38.6%

Equifax, with a current trading price of US$259.25, appears undervalued against a fair value estimate of US$422.32. Recent financials show a robust uptick with Q2 sales rising to US$1,430.5 million and net income increasing to US$163.9 million, supporting an optimistic outlook for sustained revenue growth and profitability enhancement. Despite this promising scenario, the company maintains significant debt levels which could temper its financial agility moving forward. Forecasted annual earnings growth at 22% per year over the next three years outstrips broader market expectations, positioning Equifax favorably in terms of recovery potential and long-term value generation.

On Holding

Overview: On Holding AG is a global company specializing in the development and distribution of sports products, with a market capitalization of approximately $12.50 billion.

Operations: The company generates its revenue primarily from athletic footwear, totaling CHF 1.88 billion.

Estimated Discount To Fair Value: 27.8%

On Holding, priced at US$40.36, trades 27.8% below its calculated fair value of US$55.88, indicating significant undervaluation based on cash flows. The company's earnings have surged by 44.2% over the past year with expectations to grow at 25.9% annually, outpacing the US market forecast of 14.8%. Despite a low projected Return on Equity of 19.8%, recent strategic moves like appointing Laura Miele to the Board and launching sustainable products such as the Cloudeasy Cyclon shoe highlight a robust growth trajectory and commitment to innovation.

Unlock comprehensive insights into our analysis of On Holding stock in this financial health report.

Where To Now?

Unlock our comprehensive list of 174 Undervalued US Stocks Based On Cash Flows by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:PNFP NYSE:EFX and NYSE:ONON.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com