Pinnacle West (PNW) Q2 Earnings & Revenues Beat Estimates

Pinnacle West Capital Corporation PNW reported second-quarter 2022 operating earnings per share (EPS) of $1.45, which surpassed the Zacks Consensus Estimate of $1.30 by 11.5%.

However, the bottom line decreased by 24.1% from the prior-year quarter’s earnings of $1.91 per share. The unfavorable decision on the general rate case was the primary driver for lower quarter-over-quarter earnings.

Total Revenues

Total revenues of $1,061.7 million for the second quarter of 2022 surpassed the Zacks Consensus Estimate of $954 million by 11.3%. The top line also improved by 6.1% from $1,000.2 million in the prior-year quarter.

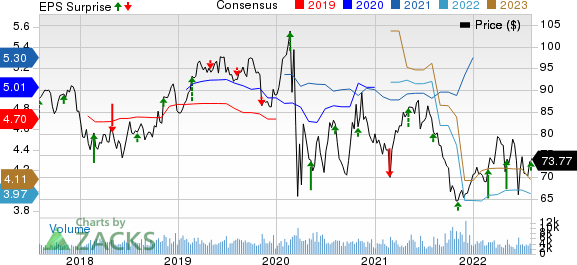

Pinnacle West Capital Corporation Price, Consensus and EPS Surprise

Pinnacle West Capital Corporation price-consensus-eps-surprise-chart | Pinnacle West Capital Corporation Quote

Operational Highlights

In the second quarter, total operating expenses were $838.6 million, up 16.2% from the year-ago quarter’s level, due to an increase in the fuel and power purchase cost along with higher operating and maintenance expenses.

The operating income in the second quarter was $223.1 million, down 19.9% from the year-ago quarter’s reading of $278.4 million.

Net interest expenses were $68.1 million, up 8.4% from the year-ago quarter’s reading of $62.8 million.

Pinnacle West recorded robust 2% year-over-year customer growth and experienced stronger-than-projected sales growth of 3.2%.

Financial Highlights

Cash and cash equivalents were $29.2 million as of Jun 30, 2022 compared with $10 million as of Dec 31, 2021.

The long-term debt less current maturities was $7,241.3 million as of Jun 30, 2022, higher than $6,913.7 million as of Dec 31, 2021.

Net cash flow provided by operating activities in the first six months of 2022 was $588.3 million compared with $312.4 million in the year-ago period.

Guidance

Pinnacle West reiterated 2022 EPS in the range of $3.90-$4.10. The Zacks Consensus Estimate for 2022 earnings of $3.97 per share is 0.8% lower than the midpoint of the guided range of $4.00.

The utility reiterated the investment plan of $4.7 billion in the 2022-2024 period to support customer growth, reliability and clean transition. Out of the total, PNW plans to invest $1.53 billion in 2022.

Zacks Rank

Pinnacle West currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

PNM Resources PNM is slated to report second-quarter 2022 earnings on Aug 4 before market open. The Zacks Consensus Estimate for the second-quarter EPS is pegged at 55 cents. PNM Resources’ long-term earnings growth is currently pegged at 5%.

Alliant Energy Corp. LNT is slated to report second-quarter 2022 earnings on Aug 4 after market close. The Zacks Consensus Estimate for the second-quarter EPS is pegged at 58 cents. Alliant Energy’s long-term earnings growth is currently pegged at 5.7%.

Hawaiian Electric Industries HE is scheduled to announce first-quarter 2022 results on Aug 8 after market close. The Zacks Consensus Estimate for earnings is pegged at 52 cents per share. Hawaiian Electric Industries’ long-term earnings growth is projected at 3.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Hawaiian Electric Industries, Inc. (HE) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance