Pinterest's (PINS) Q2 Loss Widens Y/Y, Revenues Increase

Pinterest PINS reported second-quarter 2020 non-GAAP loss of 7 cents per share, narrower than the Zacks Consensus Estimate of a loss of 15 cents per share. However, the figure was wider than a loss of 6 cents reported in the year-ago quarter.

Revenues increased 4.3% year over year to $272.4 million and beat the Zacks Consensus Estimate by 6.4%.

While revenues from the United States declined 2.5% to $232 million, international revenues soared 70.8% year over year to $41 million.

User Base & Advertising Business Details

Monthly active users (MAUs) Global increased 39% to 416 million. Users who began engaging in Pinterest during COVID-19 continued to have high levels of engagement even after shelter-in-place restrictions were eased in the reported quarter.

Moreover, overall engagement including saves, board creation and searches that peaked in mid-April and early May partially subsided as lockdowns ended but remained stable well above pre-COVID-19 levels for the rest of the quarter.

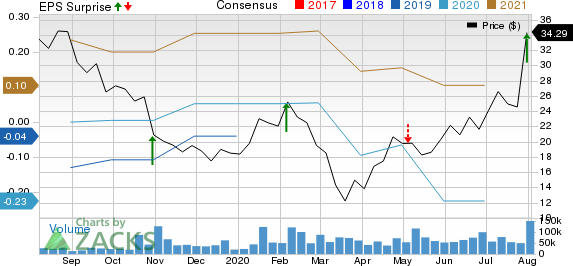

Pinterest, Inc. Price, Consensus and EPS Surprise

While United States MAUs increased 13% to 96 million, International MAUs increased 49% to 321 million.

In the United States, user growth was driven by strength coming from resurrected users (many who returned to Pinterest after a lapse of several years) as well as from users under age 25, who grew twice as fast as users 25 years old and above.

However, average revenue per user (ARPU) Global decreased 21% to 70 cents. This contraction in global APRU was driven by the increase in MAUs and a decrease in advertising demand due to the COVID-19 pandemic.

While ARPU United States declined 11% year over year to $2.5, ARPU International increased 21% on a year-over-year basis to 14 cents.

Key Q2 Developments

During the second quarter, total organic and paid daily video views grew over 150% year over year, while unique video uploads grew more than 600% year over year.

Catalog feed uploads increased 350% sequentially in the second quarter and grew 10X in the first half of 2020, boosted in part by the Shopify SHOP integration, which became available in early May, and also by infrastructure improvements to feed uploader.

Additionally, the company’s partnership with Shopify is helping smaller merchants to get on Pinterest. Currently, the integration is live to all Shopify merchants in the United States and Canada.

With just a few clicks on the Shopify merchant dashboard, merchants can seamlessly set up their Pinterest Tag, upload their Product Catalogs to Pinterest and create Pinterest ad campaigns. However, the company does not expect this integration to significantly impact near-term revenues.

Moreover, features like the Shop tab and the ability to shop from boards have improved Pinners’ ability to quickly discover the products in Pinterest’s expanding inventory. Users who visited ‘shopping only’ surfaces grew more than 50% in the first half of 2020, and product-only searches grew 8X in the same period.

During second quarter, revenues from both conversion optimization (oCPM) and shopping ads continued to grow faster than the overall revenues while attributed conversions grew 2.7X year over year. The rapid progress in delivering conversions was driven by improved conversion capture (accelerated Pinterest Tag adoption and tag health) as well as consumer behavior (adoption of new shopping surfaces and increased online transactions due to shelter-in-place).

Operating Details

Pinterest’s second-quarter 2020 total expenses declined 73.6% year over year to $377 million, which includes $62 million of share-based compensation (SBC) following its April 2019 IPO.

In the reported quarter, research and development expenses declined 83% to $136 million. Sales and marketing expenses decreased 70.9% year over year to $86.4 million due to COVID-19-related expense reductions, partially offset by higher headcount.

General and administrative expenses declined 79.6% year over year to $45.6 million.

Adjusted EBITDA loss was $34 million in second-quarter 2020. The company had reported adjusted EBITDA loss of $26 million in the year-ago quarter.

Non-GAAP costs and expenses grew 7.2% year over year to $314.6 million, attributable to headcount growth.

Loss from operations was $104.5 million compared with loss of $1.16 billion in the year-ago quarter.

Balance Sheet

The company ended Jun 30, 2020 with cash, cash equivalents, and marketable securities of $1.7 billion compared with $1.74 billion in the previous quarter and an undrawn $500 million revolving credit facility.

Guidance

Given the uncertainties related to the ongoing COVID-19 pandemic and the rapidly shifting macroeconomic conditions, the company did not provide guidance for 2020 revenues and adjusted EBITDA.

Pinterest expects revenue growth for the month of July to be more than 50% year over year through July 29 in third-quarter 2020. The company expects overall growth in the mid-30% range year over year.

Zacks Rank & Stocks to Consider

Pinterest currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Benefitfocus, Inc. BNFT and Analog Devices ADI. While both Dropbox and Everbridge sport a Zacks Rank #1 (Strong Buy), Analog Devices carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Benefitfocus and Analog Devices are scheduled to report earnings on Aug 5 and Aug 19, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Click to get this free report Analog Devices, Inc. (ADI) : Free Stock Analysis Report Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report Shopify Inc. (SHOP) : Free Stock Analysis Report Pinterest, Inc. (PINS) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance