Our Take On PipeHawk's (LON:PIP) CEO Salary

Gordon Watt is the CEO of PipeHawk plc (LON:PIP), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for PipeHawk

How Does Total Compensation For Gordon Watt Compare With Other Companies In The Industry?

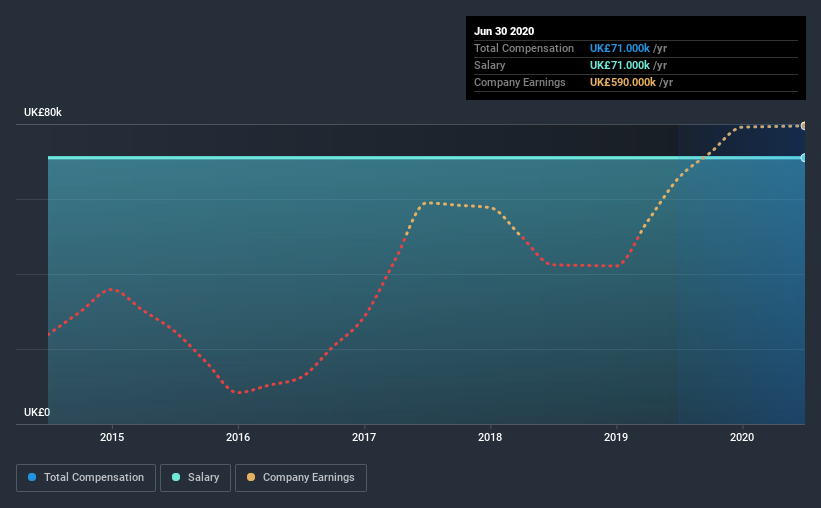

Our data indicates that PipeHawk plc has a market capitalization of UK£2.6m, and total annual CEO compensation was reported as UK£71k for the year to June 2020. That's mostly flat as compared to the prior year's compensation. Notably, the salary of UK£71k is the entirety of the CEO compensation.

In comparison with other companies in the industry with market capitalizations under UK£150m, the reported median total CEO compensation was UK£227k. Accordingly, PipeHawk pays its CEO under the industry median. What's more, Gordon Watt holds UK£429k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£71k | UK£71k | 100% |

Other | - | - | - |

Total Compensation | UK£71k | UK£71k | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. On a company level, PipeHawk prefers to reward its CEO through a salary, opting not to pay Gordon Watt through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at PipeHawk plc's Growth Numbers

PipeHawk plc has seen its earnings per share (EPS) increase by 46% a year over the past three years. It achieved revenue growth of 24% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has PipeHawk plc Been A Good Investment?

Most shareholders would probably be pleased with PipeHawk plc for providing a total return of 100% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

PipeHawk rewards its CEO solely through a salary, ignoring non-salary benefits completely. As previously discussed, Gordon is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. Considering robust EPS growth, we believe Gordon to be modestly paid. And given most shareholders are probably very happy with recent shareholder returns, they might even think Gordon deserves a raise!

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for PipeHawk (of which 3 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance