How You Should Play Mastercard (MA) Ahead of Q1 Earnings

Mastercard Incorporated MA is set to beat on earnings for the first quarter of 2024, with results slated for release on May 1, before the opening bell. Factors such as robust consumer spending, expanding cross-border transactions, growth in Gross Dollar Volume (GDV) and increased processed transactions are expected to bolster its performance.

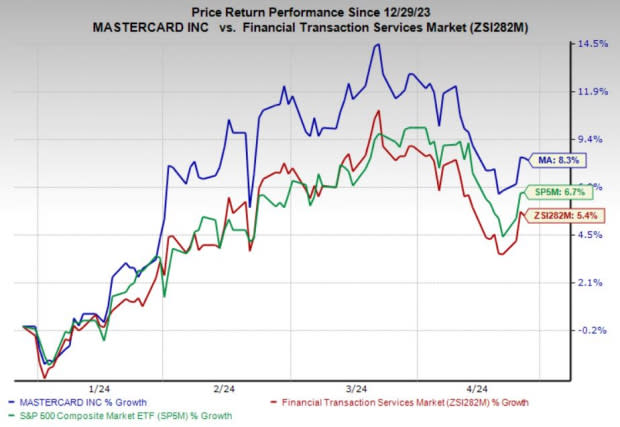

These factors, along with other favorable conditions, are likely to contribute positively to its price performance, which is already outperforming the competition in 2024. Year-to-date, Mastercard shares have gained 8.3%, surpassing both the industry's 5.4% growth and the S&P 500 Index's 6.7% rise.

Image Source: Zacks Investment Research

Q1 Beat in the Cards

The Zacks Consensus Estimate for the company’s total GDV for all MA-branded programs suggests an 11.4% rise from the prior-year quarter’s reported figure, while our estimate indicates a 13.8% jump. Processed transactions are also expected to see a notable uptick, fueled by resilient consumer spending and expanded contactless acceptance efforts by the payment technology giant. The Zacks Consensus Estimate for its processed transactions indicates a 10.5% rise from the prior-year quarter’s reported figure, whereas our estimate points to nearly a 9% increase.

The Zacks Consensus Estimate for first-quarter earnings per share of $3.22 suggests a 15% increase from the prior-year period. The consensus mark has remained stable over the past week. It beat estimates in all the trailing four quarters, delivering an average surprise of 3.5%. Also, the consensus estimate for first-quarter revenues of $6.3 billion indicates a 10.1% year-over-year increase.

Our proven model predicts a likely earnings beat for the company this time around. MA has an Earnings ESP of +0.39% as the Most Accurate Estimate of $3.24 per share is currently pegged higher than the Zacks Consensus Estimate of $3.22. Also, it currently has a Zacks Rank #3 (Hold). The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 increases the chances of an earnings beat, which is precisely the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

To Invest or Not to Invest

Mastercard’s tremendous growth opportunity, backed by its technology upgrades, product diversification, transaction growth, geographic expansion, strategic acquisitions and alliances, make it a lucrative investment option. Its sheer size makes it too big to fail. Add another earnings beat to that mix and you have a company, which is potentially up for another bull run.

However, given its popularity and major market presence, it's reasonable to assume that any significant developments have likely already influenced the stock price. Also, the forward 12-month price-to-earnings ratio of 30.7X, notably above the industry average of 22.8X, suggests that the stock may not be as attractively priced for investors.

Additionally, the Credit Card Competition Act, which is trying to break the duopoly of Mastercard and another payment giant, Visa Inc. V, in the credit card industry, can lead to greater competition in the market. This makes their smaller rivals with strong growth potential to gain market share more attractive to investors, especially if u consider the long run.

In conclusion, while MA has a higher likelihood of surpassing earnings estimates in the first quarter, along with substantial long-term growth prospects, its unfavorable valuation and a potential increase in market competition position it as a significant stock to monitor closely at present.

Other Stocks That Warrant a Look

Here are some other companies worth considering from the broader Business Services space, as our model shows that these, too, have the right combination of elements to beat on earnings this time around:

Bit Digital, Inc. BTBT has an Earnings ESP of +700.00% and a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Bit Digital’s bottom line for the to-be-reported quarter suggests a 133.3% year-over-year jump. The estimate remained stable over the past week. Furthermore, the consensus mark for BTBT’s revenues is pegged at more than $25.6 million, indicating a 209.6% year-over-year surge.

Fidelity National Information Services, Inc. FIS has an Earnings ESP of +10.79% and is a Zacks #3 Ranked player.

The Zacks Consensus Estimate for Fidelity National’s bottom line for the to-be-reported quarter is pegged at 96 cents per share, which remained stable for the past week. It beat earnings twice in the past four quarters and missed on other occasions. Moreover, the consensus mark for FIS’ revenues is pegged at nearly $2.5 billion.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Bit Digital, Inc. (BTBT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance