Pluristem Therapeutics Shares Jump on Covid-19 Study Results

When the name of a company and Covid-19 appear in the same sentence these days, investors are taking note.

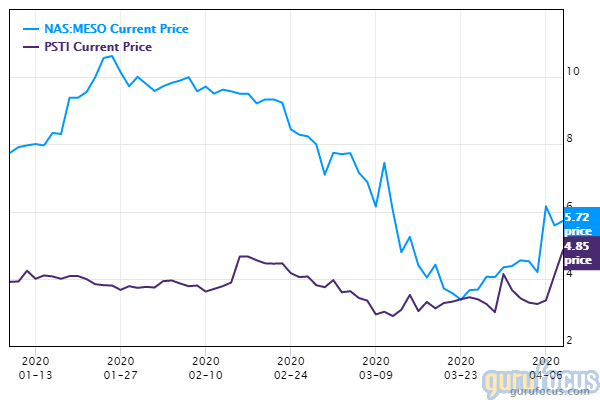

That certainly appears to be the case with a small Israel-based biotech company. Shares of Pluristem Therapeutics (PSTI) climbed more than 65% to nearly $7 days after the company reported promising results from a small study of patients suffering complications due to the novel coronavirus.

Six infected patients that were considered high-risk for mortality survived after receiving Pluristem's placenta-based cell-therapy product, according to an article in the Jerusalem Post. The patients were treated at three different Israeli medical centers for one week under the country's compassionate use program. They were suffering from acute respiratory failure and inflammatory complications associated with the virus. Four of the patients also demonstrated failure of other organ systems, including cardiovascular and kidney failure.

Pluristem said that four of the patients that survived demonstrated improved breathing capability, and three of them are far along in getting off ventilators. Furthermore, two patients with pre-existing medical conditions appear to be nearing recovery.

"We are pleased with this initial outcome of the compassionate use program and committed to harnessing PLX cells for the benefit of patients and healthcare systems," said Pluristem President and CEO Yaky Yanay.

Pluristem's PLX cells, which are derived from human placenta, are aimed at reversing the body's over-activation of the immune system, thus reducing the fatal symptoms of pneumonia and inflammation of lung tissue. Earlier animal studies showed PLX cells were effective in treating pulmonary hypertension, lung fibrosis, acute kidney injury and gastrointestinal injury. The company plans to ask regulators to start a multinational trial for treating complications of the coronavirus.

Founded in 2001, Pluristem went public in 2003. Two analysts offering 12-month targets for the company in the last 3 months set the average price target at $11.75, with a high forecast of $15.50 and a low of $8, reported TipRanks. Based on these estimates, its shares appear to be a bargain.

H.C. Wainwright, analyst Swayampakula Ramakanth said he was encouraged by Pluristem's early data and thinks the company's treatment could bring the company substantial gains, according to the TipRanks article. He thinks Pluristem could complete initial studies and report results in the second half of this year.

The company's promising study outcome seems to have ignited investor interest in other firms working in regenerative medicine, including Mesoblast Limited (MESO) of Australia. On April 9, the company's shares climbed more than 20% to just under $7. Two private companies are also working in the field--Celltex Therapeutics and Wuhan Hamilton Biotechnology Co. Ltd.

Pluristem is also testing its PLX technology to treat critical limb ischemia (CLI), a serious condition in which there is inadequate blood flow and oxygen to a specific part of the body. This could be the hands, feet or other extremities. The company said a report by New York City-based Marwood Group showed that CLI is a significant unmet need indication and the market for a treatment could reach $2 billion in the U.S. by 2023.

Disclosure: The author holds no positions in any of the companies mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance