Polaris Inc (PII) Q1 2024 Earnings: Challenges Persist as Results Miss Analyst Forecasts

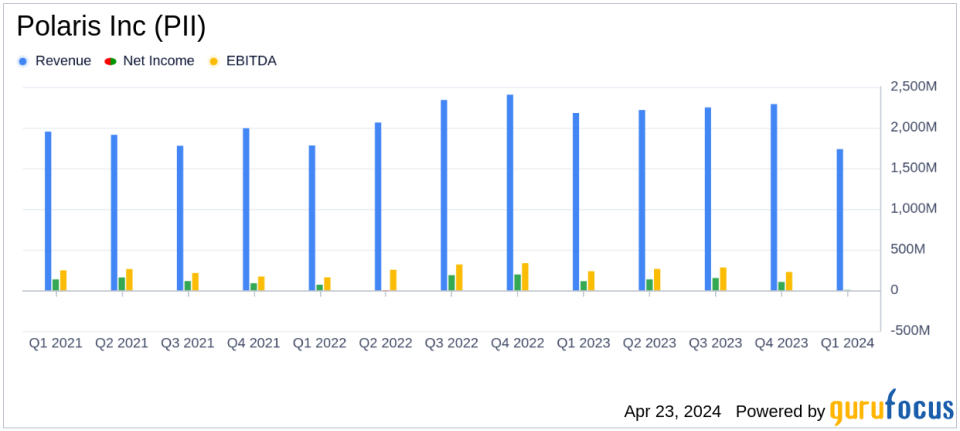

Revenue: Reported $1,736 million, a decline of 20% year-over-year, falling short of estimates of $1,747.92 million.

Net Income: Reported $3.8 million, down 97% year-over-year, slightly above estimates of $3.37 million.

Earnings Per Share (EPS): Reported diluted EPS of $0.07, down 96% from the previous year, exceeding the estimated EPS of $0.06.

Gross Profit Margin: Decreased by 250 basis points to 19.0%, impacted by higher promotional activity and warranty expenses.

Operating Expenses: Totalled $313 million, down from $325 million in the previous year, reflecting a decrease in selling and marketing expenses.

Market Share: Gains noted in off-road vehicles (ORV), motorcycles, and marine segments despite overall sales decline.

2024 Outlook: Expects sales to decrease by 5-7% and adjusted diluted EPS to decrease by 10-15% compared to 2023.

Polaris Inc (NYSE:PII) disclosed its first quarter 2024 financial results on April 23, 2024, revealing a considerable downturn in performance with sales and earnings that fell short of analyst expectations. The detailed earnings can be viewed in their 8-K filing. The company, a renowned manufacturer of off-road vehicles, motorcycles, and marine products, reported first quarter sales of $1,736 million, a 20% decrease from the previous year, significantly below the estimated $1,747.92 million.

The reported diluted earnings per share (EPS) was $0.07, starkly lower than the $0.23 adjusted EPS, both of which drastically underperformed against the analyst estimate of $0.06 EPS. The net income for the quarter stood at $3.8 million, again falling short of the expected $3.37 million. These figures represent a dramatic 97% drop in net income and a 96% decrease in EPS year-over-year.

Company Overview and Market Position

Polaris designs and manufactures a diverse range of vehicles including all-terrain and side-by-side vehicles, snowmobiles, and motorcycles. The company, which also owns Boat Holdings, has a broad distribution network through over 2,500 dealers in North America and numerous international dealers and distributors. Despite the challenging quarter, Polaris achieved market share gains in its off-road vehicles (ORV), motorcycles, and marine segments.

Financial and Operational Challenges

The significant decline in sales was attributed to lower volumes and net pricing, exacerbated by increased promotional spending, although somewhat offset by a favorable product mix. The gross profit margin also suffered, decreasing by 250 basis points to 19.0%. Operating expenses saw a slight decrease due to reduced selling and marketing expenses, but as a percentage of sales, these expenses increased by 314 basis points, reflecting the reduced sales volume and ongoing operational challenges.

Segment Performance

The Off Road segment, which includes vehicles for snow and other off-road activities, saw a 16% decrease in sales, primarily due to lower volumes in snow vehicles. The On Road segment, comprising motorcycles like the Indian Motorcycle, experienced a 14% sales drop, although Indian Motorcycle's North America unit retail sales were up in the low-teens percentage. The Marine segment faced the steepest decline with a 53% reduction in sales, driven by decreased volumes and lower net pricing.

Looking Ahead

For the full year 2024, Polaris anticipates a sales decline of 5% to 7% and an adjusted diluted EPS decrease of 10% to 15% compared to 2023. This guidance reflects the ongoing uncertainties in the macroeconomic environment and the company's focus on managing dealer inventory and operational improvements.

Executive Insights

"Our sales results for the first quarter were in line with our expectations and adjusted EPS came in above plan," stated Mike Speetzen, CEO of Polaris Inc. "With our competitive product portfolio, we gained share in ORV, motorcycles and Marine, and the recent launches in our best-selling full-size RANGER and Indian Scout lineups reflect our strategic focus on Rider-Driven Innovation."

The first quarter results highlight the resilience of Polaris Inc in a challenging market, though significant hurdles remain. Investors and stakeholders will be watching closely to see how the company navigates these challenges in the coming quarters.

Explore the complete 8-K earnings release (here) from Polaris Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance