Pollen Street PLC's (LON:POLN) Business Is Yet to Catch Up With Its Share Price

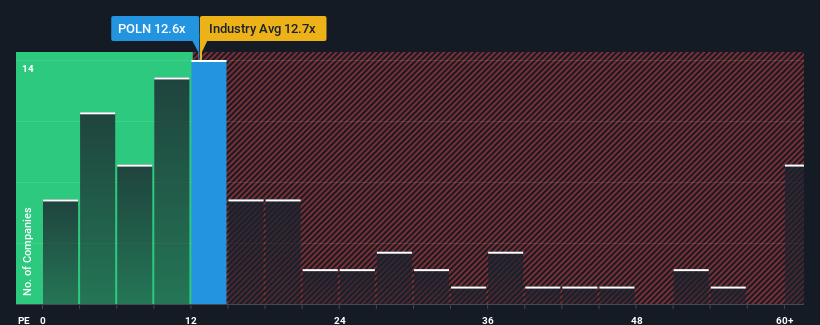

It's not a stretch to say that Pollen Street PLC's (LON:POLN) price-to-earnings (or "P/E") ratio of 12.6x right now seems quite "middle-of-the-road" compared to the market in the United Kingdom, where the median P/E ratio is around 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Pollen Street's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Pollen Street

Keen to find out how analysts think Pollen Street's future stacks up against the industry? In that case, our free report is a great place to start.

How Is Pollen Street's Growth Trending?

The only time you'd be comfortable seeing a P/E like Pollen Street's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 35%. The last three years don't look nice either as the company has shrunk EPS by 30% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 8.2% per annum during the coming three years according to the four analysts following the company. That's shaping up to be materially lower than the 12% per annum growth forecast for the broader market.

In light of this, it's curious that Pollen Street's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Pollen Street's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Pollen Street currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Pollen Street that you need to be mindful of.

If you're unsure about the strength of Pollen Street's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance