Pool (NASDAQ:POOL) Misses Q1 Sales Targets

Swimming pool distributor Pool (NASDAQ:POOL) fell short of analysts' expectations in Q1 CY2024, with revenue down 7.1% year on year to $1.12 billion. It made a GAAP profit of $2.04 per share, down from its profit of $2.58 per share in the same quarter last year.

Is now the time to buy Pool? Find out in our full research report.

Pool (POOL) Q1 CY2024 Highlights:

Revenue: $1.12 billion vs analyst estimates of $1.13 billion (0.8% miss)

EPS: $2.04 vs analyst estimates of $1.92 (6.2% beat)

Full year EPS guidance raised (to reflect additional tax benefits rather than fundamentals): $13.69 at the midpoint vs analyst estimates of $13.31 billion (2.9% beat)

Gross Margin (GAAP): 30.2%, down from 30.6% in the same quarter last year

Free Cash Flow of $128.4 million, similar to the previous quarter

Market Capitalization: $14.52 billion

“For the fourth consecutive year, we exceeded $1.0 billion of net sales in the first quarter despite headwinds that included challenges from current macroeconomic conditions and mixed weather. We also posted strong cash flows from operations of $145.4 million, a 41% improvement from last year, and added four additional locations to our expansive sales center network. Our team is energized for the swimming pool season ahead and we remain focused on our strategic goals, including organic growth of our sales center network and investments that provide our customers with convenient access to our broad assortment of products and tools to help them grow. With the introduction of new offerings from our Pool360 digital ecosystem, our customers are positioned with more capabilities for a successful year,” commented Peter D. Arvan, president and CEO.

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ:POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

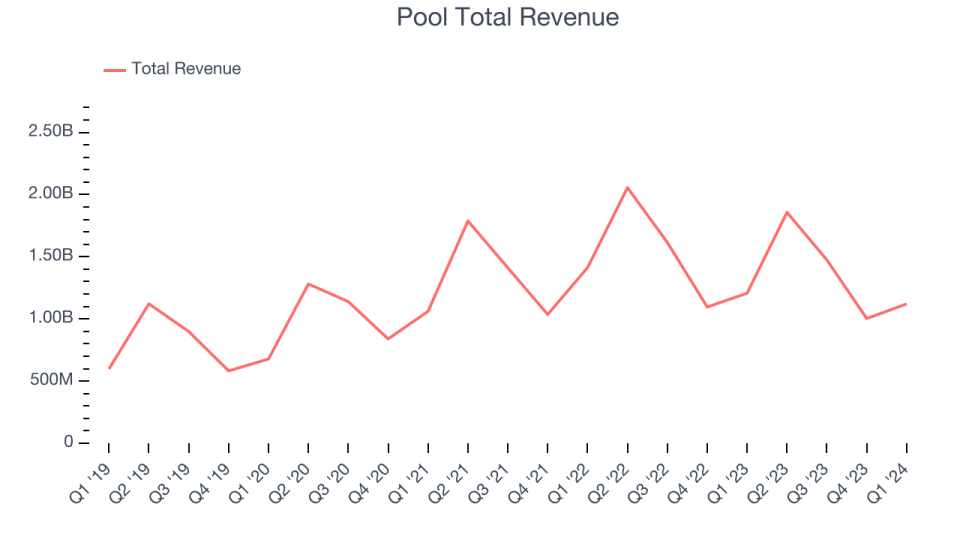

Sales Growth

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Pool's annualized revenue growth rate of 12.6% over the last five years was mediocre for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Pool's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 1.7% over the last two years.

This quarter, Pool missed Wall Street's estimates and reported a rather uninspiring 7.1% year-on-year revenue decline, generating $1.12 billion of revenue. Looking ahead, Wall Street expects sales to grow 4.2% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

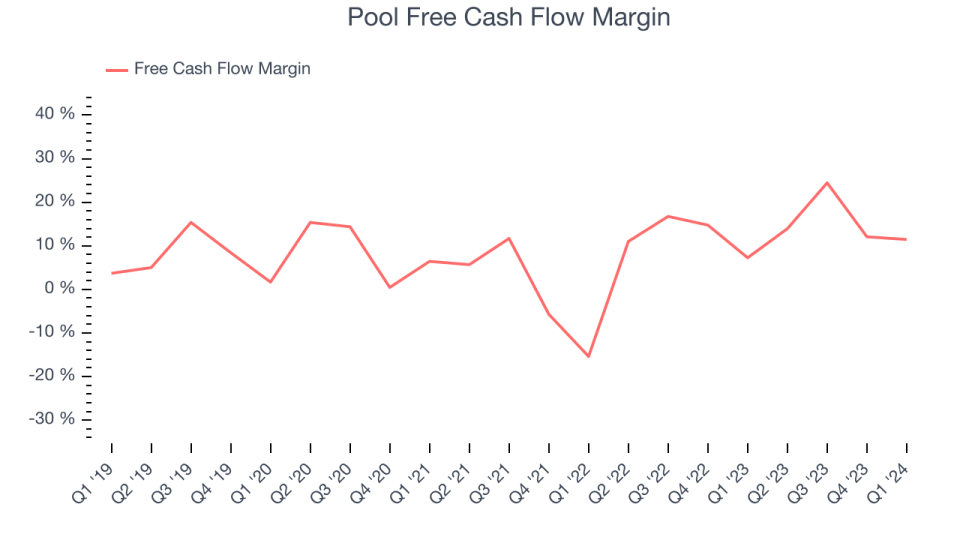

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Pool has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 14.1%, above the broader consumer discretionary sector.

Pool's free cash flow came in at $128.4 million in Q1, equivalent to a 11.5% margin and up 46.5% year on year. Over the next year, analysts predict Pool's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 15.9% will decrease to 9%.

Key Takeaways from Pool's Q1 Results

We enjoyed seeing Pool beat analysts' full-year earnings guidance expectations, although this guidance was raised to reflect expectations of additional tax credit benefits, not necessarily fundamentals. We were also glad its EPS outperformed Wall Street's estimates. On the other hand, its revenue unfortunately missed. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $377.39 per share.

So should you invest in Pool right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance