Post Holdings (POST) Up More Than 10% in 6 Months: Here's Why

Post Holdings, Inc. POST is well-placed on the back of portfolio strength, courtesy of prudent acquisitions. The consumer packaged goods company is benefiting from a recovery in the Foodservice channel. The upsides were seen in its fourth-quarter fiscal 2022 results, with the top and the bottom line increasing year over year and beating the Zacks Consensus Estimate.

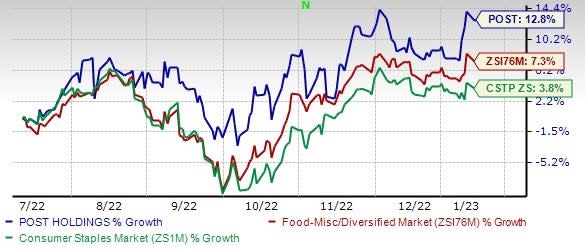

The Zacks Rank #2 (Buy) stock has increased 12.8% in the past six months compared with the industry’s 7.3% growth. The stock has comfortably outperformed the Zacks Consumer Staples sector’s 3.8% growth in the period.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s delve deeper.

Image Source: Zacks Investment Research

Solid Q4 Results, Foodservice Recovery

In the fourth quarter of fiscal 2022, Post Holdings benefited from strategic pricing actions to counter input and freight cost inflation. Adjusted earnings from continuing operations of 85 cents per share increased significantly from the 11 cents reported in the prior-year quarter. POST registered sales of $1,579.1 million, up 16.5%. The upside can be attributed to pricing actions in every segment and ongoing volume recovery across Foodservice business.

Post Holdings is benefiting from strength in the Foodservice business. During the fourth quarter of fiscal 2022, Foodservice sales increased 36.9% to $625.5 million. Revenues reflect the effects of inflation-driven pricing actions, the impact of commodity cost pass-through pricing model and avian influenza-driven pricing efforts. Volumes rose 3.6%. Management highlighted that its Foodservice business has completely recovered from COVID and turned profitable.

Acquisitions: Key Driver

Post Holdings has been focusing on acquisitions, helping it expand its customer base. On Apr 5, 2022, Post Holdings acquired Lacka Foods Limited. Lacka Foods is a U.K.-based marketer of high-protein, ready-to-drink (RTD) shakes under the UFIT brand. Post Holdings acquired Almark Foods (or Almark) on Feb 1, 2021. Almark, renowned for its hard-cooked and deviled egg products, provides conventional, organic and cage-free products. On Jan 25, Post Holdings acquired the Peter Pan peanut butter brand. On Jul 1, 2020, the company completed the acquisition of Henningsen Foods, Inc., which forms part of its Foodservice segment. In June 2021, the company stated that it had completed the acquisition of the PL RTE Cereal Business of TreeHouse Foods.

We believe that, such well-chalked expansion endeavors will likely help POST stay in investors’ good books.

Other Food Stock Benefiting From Buyouts

Several other companies in the food space, like The Kraft Heinz Company KHC, Hormel Foods Corporation HRL and Tyson Foods, Inc. TSN, are benefiting from acquisitions.

In April 2022, Kraft Heinz acquired a majority stake in a Brazil-based condiments and sauces company — Companhia Hemmer Industria e Comercio ("Hemmer"). The buyout widened Kraft Heinz's International Taste Elevation platform and enhanced its presence across emerging markets. In January 2022, KHC acquired an 85% stake in Germany-based Just Spices GmbH (“Just Spices”). The buyout enhanced its direct-to-consumer operations and go-to-market expansion.

Hormel Foods is strengthening its business through strategic acquisitions. Recently, HRL announced its acquisition of a minority stake in Indonesia-based food and beverage company, PT Garudafood Putra Putri Jaya Tbk. The move is likely to help Hormel Foods to expand its presence in Indonesia and Southeast Asia. In June 2021, HRL acquired the Planters snacking portfolio from Kraft Heinz. Prior to this, it acquired Texas-based pit-smoked meats company Sadler's Smokehouse in March 2020. The buyout was in sync with Hormel Foods’ initiatives to strengthen its position in the foodservice space.

Tyson Foods is focused on expanding into international markets as part of its strategic growth plan. In July 2022, TSN announced its strategic partnership with Tanmiah Food Company (Tanmiah) — a leading Middle Eastern provider of fresh and processed poultry, other processed meat products, animal feed and health products. The acquisitions will allow Tyson Foods to access poultry supplies across Saudi Arabia to cater to the rising protein demand in the Middle East and other markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hormel Foods Corporation (HRL) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance