Wage growth picks up to 2.2pc but continues to lag inflation; FTSE 100 snaps losing streak

Wage growth picks up to 2.2pc in the three months to August; unemployment remains at 4.3pc, a 42-year low

Sterling stuck in flat territory against the dollar, trading at $1.3180; little reaction to the latest jobs figures

FTSE 100 snaps three-day losing streak; consumer goods giant Reckitt Benckiser dips after cutting its sales forecast following June's cyber attack

More shareholders join attack against Millennium & Copthorne directors over sale bid

Disquiet among major shareholders in Millennium & Copthorne is growing after two companies accused the hotel group’s directors of “failing in their duty” to protect backers’ interests in a deal to take it private.

Last week, City Developments, the majority owner of Millennium, made a bid to buy the company which values it at £1.8bn. The firm’s independent directors had agreed to recommend the offer, at 552.5p in cash for each share.

But a letter to Millennium’s independent committee of directions, seen by The Daily Telegraph, said that shareholders International Value Advisers and MSD Partners thought the proposal “significantly undervalues” the company. Between them, the two investment firms own an almost 9pc stake in the company.

Read Rhiannon Bury's full report here

Wizz Air and Thomas Cook move to hedge Brexit outcome with new licences

Low-cost Eastern European carrier Wizz Air is applying for a UK registration as a hedge ahead of Brexit as tour operator Thomas Cook moved to secure a new Spanish licence.

The Hungary-based airline said its UK subsidiary had applied for an air operator’s certificate, known as an AOC, as well as an operating licence from the Civil Aviation Authority.

It said it expected Wizz Air UK to start flying in March 2018 with several UK-registered aircraft. The move comes shortly after the Hungarian division of the wider group opened a formal base at Luton airport.

Thomas Cook has also launched a new base on the Spanish island of Majorca and also applied for an AOC there for its new Thomas Cook Airlines Balearics division, which will also begin scheduling flights from early 2018.

Read Bradley Gerrard's full report here

Dow Jones pushes past 23,100; US housing data continues to be depressed by hurricane season

The bull keeps on running in New York. After notching another record close last night, the Dow Jones has advanced 0.5pc following the opening bell stateside with its healthcare stocks continuing to outperform.

Just a bit of housing data from the US to update you with today. Housing starts and building permits both came in below expectations at 1,127,000 and 1,215,000, respectively, but the figures are continuing to be depressed by hurricane season, according to Pantheon Macro chief economist Ian Shepherdson.

He added that today's 3.6pc rebound in mortgage applications suggests that new home sales in the final quarter of this year and the first of the next will strengthen and drag up construction activity.

Purplebricks 'surprised' at new ASA ruling for misleading advert

Online estate agent Purplebricks has said it is "surprised" the Advertising Standards Authority upheld a complaint against it for misleading viewers over its fee structure.

The ASA said that its "commisery" television advert had not made it clear enough that it charged a fee to list a property even if the house was not sold. It it did not uphold a claim that it implied to viewers there was no fee payable at all.

Michael Bruce, the chief executive, said: "We are surprised by the ASA judgement on the flat fee wording because prior to air our adverts went through the proper approvals process, including the official clearance body Clearcast who have continued to support their original judgement with the ASA.

Read Isabelle Fraser's full report here

Foxtons claims it is weathering the London property downturn - for now

Investors have rallied around Foxtons after the estate agent reported it is weathering the downturn in the London property market with a "resilient" lettings division.

Sales in the three months to 30 September fell 6.3pc to £35.1m, but this was in line with expectations as transactions in the capital continue to fall. The company's share price climbed 5pc in early trading.

Lettings grew modestly during the period, although the revenue, at £22.5m, was still slightly lower than the same time last year.

However, Foxtons warned that it faces a threat from Government plans to end letting fees, as well as an "downward pressure on rents".

Read Isabelle Fraser's full report here

Wage growth reaction: Labour market data leaves Bank of England decision on a knife edge

The Bank of England's Monetary Policy Committee's decision next month on interest rates is now on a knife-edge following today's labour market release, according to Pantheon Macro UK economist Samuel Tombs.

He explained:

"The recent fall in consumer confidence, meanwhile, likely will mean that fewer workers quit for new positions, easing the pressure on employers to pay staff more to retain them.

"Accordingly, we doubt that August’s uptick in wages is the start of a stronger trend, but it might be the last straw for some members of the MPC itching to raise rates."

J.K Rowling named the highest paid celebrity in Europe in 2017 - who else made the cut?

With earnings of $95m (£72m) over the past 12 months, Harry Potter author J.K Rowling is the highest-paid celebrity in Europe this year.

Almost half of the enormous sum earned, which doesn't take into account taxes or management fees, comes from her co-writing Harry Potter and the Cursed Child, a two-part stage play that sold 1.3m copies in 2016, and has been showing in theatres in London and New York.

Not only is Rowling the highest-paid celebrity in Europe, but she is also the world's highest-paid author and third highest-paid celebrity in the world, according to Forbes.

Read Sophie Christie's full report here

BAE and Cammell Laird join forces to bid for 'budget' frigates contract

BAE Systems is seeking to defend its virtual monopoly on Royal Navy shipbuilding by teaming up with the commercial player Cammell Laird to bid to construct new "budget" frigates.

The tie-up, which will see Merseyside-based Cammell act as prime contractor, is a direct response to the government’s National Shipbuilding Strategy aimed at spreading work around British shipyards as well as producing vessels which are attractive to export buyers.

Read Alan Tovey's full report here

Wage growth reaction: Expect three interest rate hikes next year if earnings growth picks up

In a world first from Jeremy Corbyn, he actually welcomes the fall in unemployment #PMQspic.twitter.com/wCxUIuUloa

— Gareth M (@mrgarethm) October 18, 2017

Let's get a bit more reaction on today's figures and what they mean for the Bank of England and next month's crucial interest rate decision.

Capital Economics' UK economist Andrew Wishart said that it was another "decent set" of figures that will keep the MPC on course for a November interest rate hike. No doubts have set in over there following yesterday's select committee appearance from BoE policymakers.

He says to expect three more hikes next year if earnings growth begins to pick up more momentum.

Three! After taking a decade to get to one increase, is the central bank suddenly going to become hike happy?

Shell director resigns amid Rio Tinto fraud allegations

A director of Shell has resigned after being charged with fraud in relation to his former job at global miner Rio Tinto.

Guy Elliott said he would step down from his non-executive director role at Shell with immediate effect after US regulator the Securities and Exchange Commission charged him in relation to a botched coal deal while he was chief financial officer at Rio.

Mr Elliott has been charged with fraud alongside Rio Tinto and its former chief executive Tom Albanese over allegations they hid the true value of coal assets in Mozambique following a disastrous acquisition.

Rio took a $3bn (£2.28bn) writedown on Riversdale Mining in 2013. It bought the coal project in the southern African country for $3.7bn in 2011 but sold it for just $50m three years later, after realising it would be unable to ship coal downriver to port.

Read Hannah Boland and Jon Yeomans' full report here

Lunchtime update: Wage growth picks up but still lags far behind inflation

Wage growth picked up to 2.2pc in the three months to August but UK households are still feeling the strain from earnings lagging far behind inflation.

Although unemployment remained at 4.3pc, a 42-year low, ahead of the Bank of England's crucial Monetary Policy Committee meeting in two weeks' time the fall in real wages has been under the spotlight once again. There has been a muted reaction to the figures on the currency markets with the pound stuck in flat territory against the dollar and euro.

Elsewhere, the FTSE 100 looks set to snap a three-day losing streak after rebounding 0.3pc this morning. Theme park owner Merlin Entertainments is suffering a hangover from yesterday's 16pc plunge and is rock bottom of the index for a second consecutive day while pressured Pearson is still rising following its more optimistic update to the market this week.

Consumer goods giant Reckitt Benckiser has dipped 1pc after reporting that sales are continuing to be hit by June's cyber attack.

Unemployment down again but pay struggles to take off

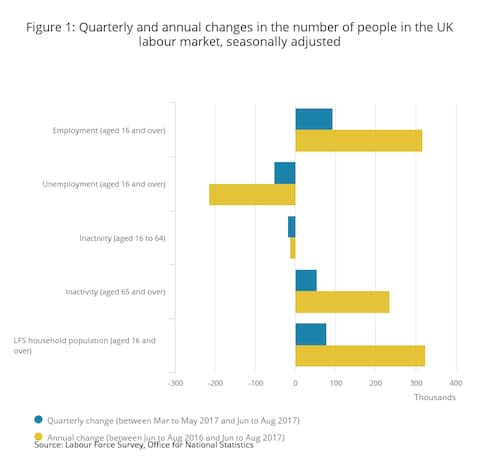

Unemployment fell again in the three months to August, keeping joblessness at its joint-lowest level in 42 years and reinforcing Britain’s employment recovery.

An extra 94,000 people were in work at the end of the three-month period, the majority of whom are women, the Office for National Statistics said.

Unemployment now stands at 1.44m, the lowest absolute number since 2005. The rate of 4.3pc is the joint-lowest level since 1975.

Overall employment rose to 32.1m - though it is down slightly compared with the overlapping three-month period to July.

Read Tim Wallace's full report here

Theme park owner Merlin continues to slide; Foxtons pops 5pc on 'resilient' third quarter

Let's have a quick run through of what stocks are moving in London this morning and why.

Merlin Entertainments' slide on the FTSE 100 has continued this morning with the Thorpe Park owner rock bottom of the index after shedding a further 2.4pc. Merlin nosedived 16pc yesterday after revealing that a soggy summer and terrorism hit its full-year profit forecast.

British Airways owner IAG has nudged up 1.6pc after Credit Suisse upped its price target for the firm while publisher Pearson is enjoying a second consecutive day among the top risers of the FTSE 100 following yesterday's more optimistic trading update.

Away from the blue-chip index, struggling estate agent Foxtons has popped 5.1pc after reporting on a "resilient" third quarter set against the "challenging conditions in the London property market". Precious metal miner Hochschild Mining has jumped 4.6pc after achieving record production levels in the third quarter while keeping costs under control.

Flybe's bid to make its planes more reliable set to hit profits

A hike in maintenance costs is set to hit profits at regional airline Flybe which has warned its investors that earnings will drop by at least a third in the first half of its trading year.

The carrier said it had undertaken a detailed review of its aircraft maintenance which had led led to higher costs as it worked to improve the reliability of its aircraft, particularly the Bombardier Q400 turboprop.

Chief executive Christine Ourmieres-Widener said a full review of the company's maintenance strategy was now underway with the aim of improving both the performance of its aircraft as well as the amount of money it spends maintaining them.

Read Bradley Gerrard's full report here

Wage growth reaction: Chancellor needs to be bold to combat falling real wages

Well wage growth returning swiftly after a recession is what happened in every other UK recession in recent history... This is unprecedented pic.twitter.com/ouvTqiBh1F

— Torsten Bell (@TorstenBell) October 18, 2017

Let's get back to the reaction to this morning's labour statistics.

The CBI has called on the Chancellor to be "bold" in his Budget to combat living standards being hit by the fall in real wages.

Its head of employment Matthew Percival said:

"Delivering urgent progress on large and small infrastructure projects, addressing underfunding in education and providing practical support for innovators are all steps the Government can take as part of a meaningful Industrial Strategy to boost productivity, the only sustainable route to improving people’s pay."

Wage growth cooled slightly in the three months to August, leaving it well below the rate of inflation, even as the jobless rate slipped. pic.twitter.com/lznktJJfaN

— Capital Moments (@CapitalMoments) October 18, 2017

Hargreaves Landsdown analyst Laith Khalaf describes lagging wage growth as a "sticky problem" that can in "large part attributed to the three Ps - productivity, public sector pay, and pensions".

He said on where this leaves the Bank of England:

"So the Bank of England is caught between a rock and a hard place. Markets have bought into the hawkish rhetoric emanating from the central bank of late, and are now pricing in a rate rise before the end of this year.

"The Bank of England does have form for disappointing spectators on this front, however looking out beyond a potential rate hike in the next few months, the longer term picture is still one of low interest rates dominating the economic landscape for some time to come."

It would be quite something if Mark Carney and co teased the markets for a third time in recent years without coming up with the goods on tightening monetary policy.

Reckitt Benckiser recovers to flat territory after sinking on slashed sales forecast

Reckitt Benckiser Gp Cuts 2017 View to flat comparable rev growth for base business; 3Q Affected by Challenging Mkts , Comp Revs -1%

— Mike van Dulken (@Accendo_Mike) October 18, 2017

Consumer goods giant Reckitt Benckiser has managed to reverse its early losses and recover to flat territory despite this morning's disappointing update to the market.

The Dettol and Nurofen maker cut its sales forecast, blaming June's cyber attack for impacting its supply.

Durex group Reckitt Benckiser latest to trim FY outlook, blames subdued growth in both developing and emerging markets

— Garry White (@GarryWhite) October 18, 2017

The FTSE 100 company said that it will now restructure its business to combat its struggling sales and split into two separate units.

IG chief market analyst Chris Beauchamp noted that Reckitt Benckiser managed to buck this week's trend of a poor update sparking "an almighty rout in the share price".

Mr Beauchamp added:

"Reckitt Benckiser managed to buck the trend seen so far this week, as a sharp downgrade to forecasts did not produce an almighty rout in the share price.

"Still, for a company trading at 24 times current earnings the prospect of another reorganisation coupled with an expectation of no growth should spark some serious revisions while Unilever looks to be a much better way of getting exposure to the sector."

Job data snap reaction: It doesn't move the dial for the Bank of England

Probably just a blip, this small dip in the employment rate, but one to watch.... pic.twitter.com/WYXTVKFXwd

— Sarah O'Connor (@sarahoconnor_) October 18, 2017

The disappointing slowdown in the number of jobs created in the three months to August to 94,000 from 181,000 in the previous three months could be "a natural slowdown as the jobs market tightens and unemployment remains low", according to City Index analyst Kathleen Brooks.

Ms Brooks believes that today's job data isn't a dial mover for the Bank of England on interest rates.

She explained:

"However, the prospect of raising interest rates when real wages are in negative territory will make this potential hike a tricky one for the BOE to justify.

"In fact, we believe that Carney’s very loose commitment to a rate hike in the coming months during Tuesday’s testimony to the Treasury Select Committee is reference to the difficult conditions facing the BOE: hike rates because inflation is high and unemployment is low, however, if you hike rates now you could put extra pressure on the consumer and a sharp break on the economy as we move into the end of the year."

Job figures key takeaways

Wage growth picks up to 2.2pc in the three months to August (2.1pc excluding bonuses). While the increase was ahead of economists' expectations, the figures still lag far behind inflation.

Unemployment remained steady at 4.3pc, its lowest level since 1975.

There were 94,000 more people in work between June to August, a sharp slowdown from the 181,000 jobs added in the previous three months.

Muted reaction on the currency markets to the release. Sterling remains stuck in flat territory against the dollar and at a 0.1pc loss for the session against the euro.

Wage growth picks up to 2.2pc

Wage growth in the three months to August picked up to 2.2pc, ahead of economists' forecasts, while unemployment remained steady at 4.3pc, a 42-year low. More to follow...

Job figures preview

Those key job figures will drop at the bottom of the hour so let's have a quick look at what we're expecting to happen.

Average weekly earnings growth in the three months to August is expected to remain steady at 2.1pc (or nudge down to 2pc when excluding bonuses).

Unemployment is forecast to stay at 4.3pc, a 42-year low.

That might not sound like the most electrifying econ data line-up but, set against the backdrop of inflation rising to 3pc yesterday, that sluggish wage growth is quite concerning for Bank of England policymakers.

It's unlikely that this morning's batch of data will improve sterling's mood, according to Spreadex analyst Connor Campbell.

He explained:

"The Bank of England has proven reticent to raise rates with wage growth so stagnant, fearing what a further squeeze on household income would do to the UK’s consumer spending-reliant economy. Such earnings index figures as we are expecting to get this morning, then, are a blow to sterling’s rate hike hopes."

Sterling treading water following BoE appearances in front of MPs

Once sterling's impact fades, over 150 years of data shows that what ultimately matters for wage growth, is growth in productivity. pic.twitter.com/xtx3BnCadS

— Rupert Seggins (@Rupert_Seggins) October 18, 2017

Yesterday's rise in inflation to 3pc should have supported the pound on growing expectations of an interest rate hike next month but the currency sank as Bank of England governor failed to provide any more clear indications on interest rates in his appearance in front of the Treasury Select Committee and the central bank's newest policymakers, Silvana Tenreyro and Sir Dave Ramsden, came down on the dovish side of the spectrum in their grillings.

Sterling has failed to pick itself up again from yesterday's 0.8pc retreat and is treading water against the dollar and euro this morning.

CMC Markets analyst Michael Hewson explained that the dovishness of the two new members has "shifted the maths" at the central bank, meaning that even if rates do go up next month it will not receive unanimous support on the MPC.

He added:

"A lack of unanimity wouldn’t be too surprising given the number of voices already arguing against such a move, however a lot of these voices are the same voices who were arguing that the bank should cut rates just over a year ago, an occasion where it can be argued that the bank erred in its hastiness to alter policy, and which has undoubtedly contributed to the current mess the bank finds itself in, with respect to high inflation."

Agenda: Pound awaits key wage growth data; FTSE 100 snaps losing streak

Sterling has stabilised on the currency markets ahead of key UK job figures, which are expected to show the gap between wage growth and inflation continuing to widen.

Unemployment is forecast to remain at a 42-year low but economists believe that wage growth will retreat to 2pc (including bonuses it is forecast to remain steady at 2.1pc), tightening the squeeze on UK households.

After weakening yesterday on the testimonies of Bank of England policymakers Mark Carney, Silvana Tenreyro and Sir Dave Ramsden in front of the Treasury Select Committee, the pound is stuck in flat territory against the dollar at $1.3175.

A sense of caution gripped markets as #China's Xi delivers key speech at twice-a-decade congress. Dollar rally stalls on Nafta developments. pic.twitter.com/Db9boqnZd8

— Holger Zschaepitz (@Schuldensuehner) October 18, 2017

The FTSE 100 has rebounded this morning, a broad-based climb taking it 0.2pc higher. Yesterday's laggard Merlin Entertainments has clawed back 1.8pc while consumer goods giant Reckitt Benckiser has dipped 1.6pc after cutting its sales forecast following June's cyber attack.

Interim results: U And I Group

Full-year results: Softcat

Trading statement: Rathbone Brothers, Reckitt Benckiser, Hochschild Mining

AGM: BATM Advanced Communications, India Capital Growth Fund

Economics: Unemployment Rate (UK), Claimant Count Change (UK), Average Earnings Index 3m/y (UK), Building Permits (US), Housing Starts (US), Beige Book (US), Construction Output (EU)

Yahoo Finance

Yahoo Finance