Pound craters after amendment to take no-deal Brexit off the table is defeated

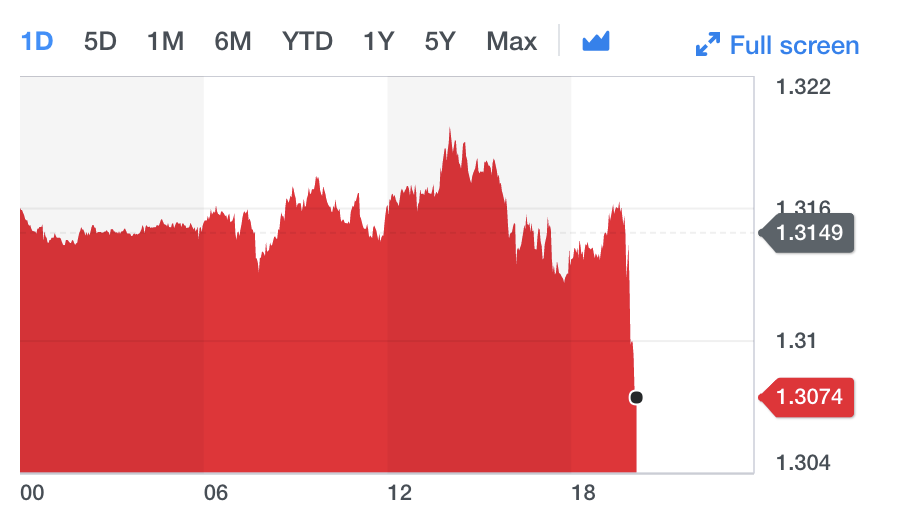

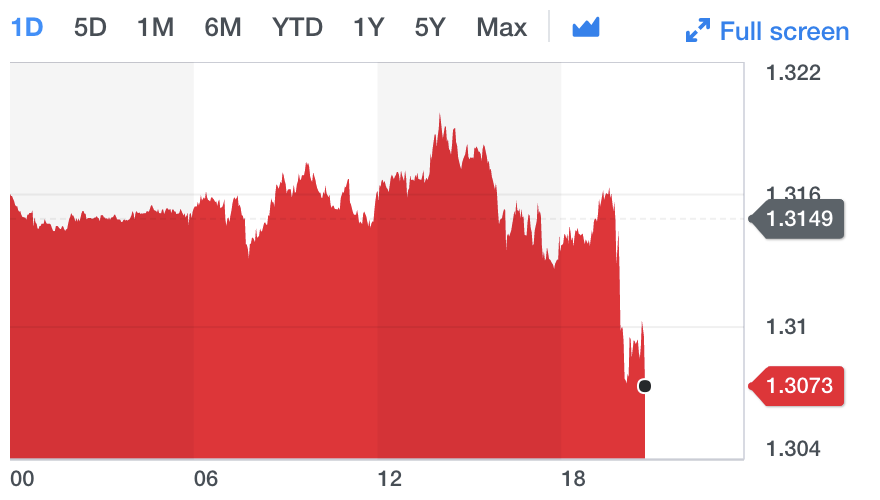

Sterling plunged against the US dollar (GBPUSD=X) after a certain major amendment to prime minister Theresa May’s Brexit deal was voted down. The pound against the dollar immediately fell by over 0.5%.

Members of Parliament rejected Labour MP Yvette Cooper’s amendment, which was aimed at enabling the House of Commons to vote on blocking a no-deal Brexit, also known as a hard Brexit. Here is the summary from the House of Commons. Some 321 MPs voted against the amendment versus 298 — a majority of 23.

These were the Conservative MPs that voted against it:

And these are the Tories who defied @theresa_may to vote for @YvetteCooperMP pic.twitter.com/JRKrJmJzxR

— Robert Peston (@Peston) January 29, 2019

This was one of the seven amendments to the Brexit bill being voted on in parliament.

The pound then sunk even further by nearly 0.7% as a number of other amendments were voted on — particularly MPs backing a call for the Brexit deal to be passed if backstop removed. The Brady amendment was supported by a majority of 16.

This is a steep drop when you consider how the pound against the dollar has been flattened since Britain voted to leave the EU. It has not remotely recovered since pre-referendum levels and has gained a slight uptick over the last week or so because there were hopes Brexit would be delayed.

The EU immediately put out a statement saying that the Irish backstop was not up for renegotiation.

Breaking – immediate EU reaction to commons #Brexit vote – this from @eucopresident spokesman – @SkyNews pic.twitter.com/b2srvEjDMd

— Mark Stone (@Stone_SkyNews) January 29, 2019

A no-deal Brexit is if Britain crashes out of the European Union without a deal. That means that all the rules that govern trade, immigration, standards, and many more, between the bloc and Britain cease to apply. It is the worst case scenario for the UK economy.

Recently at the World Economic Forum in Davos, Switzerland, International Monetary Fund chief Christine Lagarde re-emphasised that a no-deal Brexit will be a threat to global economic stability.

Bank of England governor Mark Carney also echoed her thoughts and re-warned that Britain’s ports and infrastructure is not good enough to withstand and that it will be unpredictable what that will mean for interest rates. He also previously said that the UK could be headed for an economic shock in 2019 that could be more severe than the global financial crisis. In November last year, he said Britain’s in a worst-case Brexit scenario, the UK economy could shrink by about 8% within a year. That fall would be the worst the country has seen since the 1920s.

Even the UK’s own chancellor Philip Hammond said “there will be very significant disruption in the short term and a very significant hit to our economy in the medium to long term” in a no-deal Brexit.

Yahoo Finance

Yahoo Finance