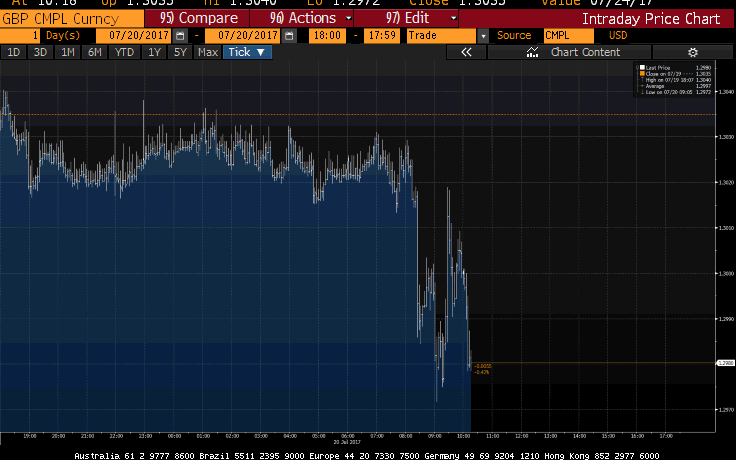

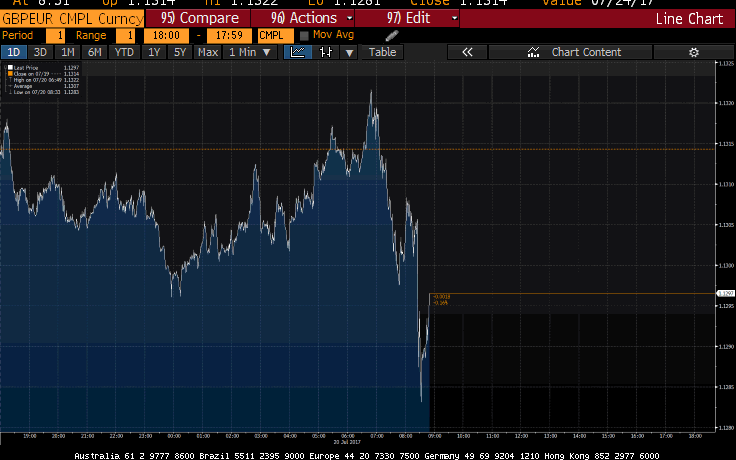

Pound dives to eight-month low against the euro as dovish Draghi fails to convince markets

Pound dives against the euro despite dovish Draghi appearance

FTSE 100 extends gains with retail sales data coming in stronger than expected

Sports Direct suffers 59pc fall in underlying pre-tax profit but shares soar

Markets wrap: Dovish Draghi fails to control the markets as euro advances on pound

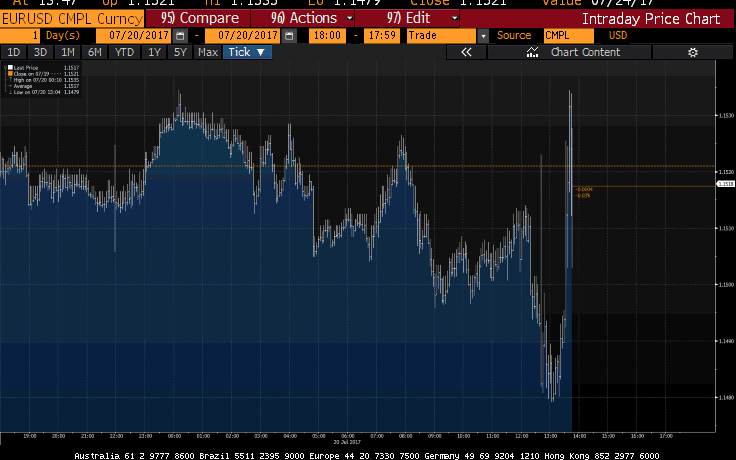

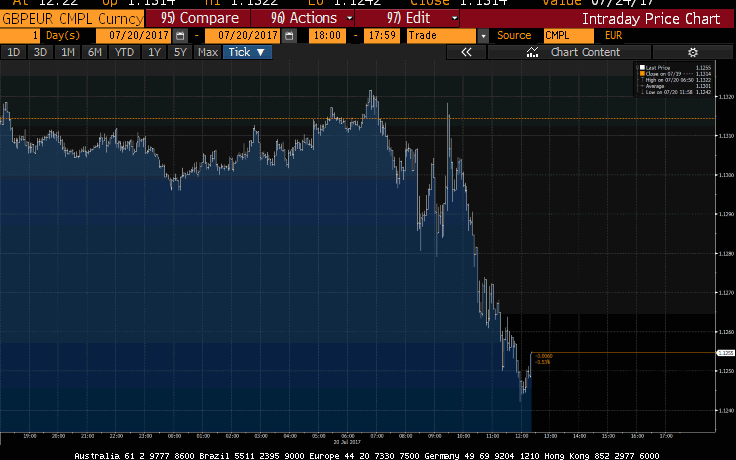

A more dovish tone from ECB president Mario Draghi at the central bank's policy meeting today couldn't stop overexcited traders sending the euro to an eight-month high against the pound and an almost two-year high against the dollar.

The ECB, as expected, held rates at 0pc and, with rumours swirling that the central bank will announce the winding down of its asset purchasing programme in September and has already started examining its options, Mr Draghi's dovish stance fell on deaf ears.

The pound has pared some of its losses against a stronger dollar this afternoon but the FTSE 100's gains have held firm, the blue-chip index closing 56.87 points higher at 7487.87.

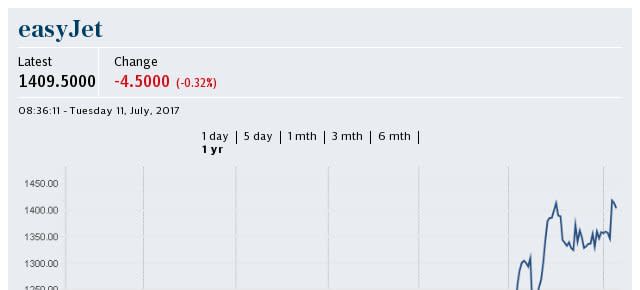

Retailing giants Next and Kingfisher helped the index finish firmly in positive territory after receiving a bounce from stronger-than-expected sales growth on the high street in June. Meanwhile, airliners easyJet and IAG dragged most as analysts rounded on the former's latest update to the market.

IG market analyst Joshua Mahony commented on today's action:

"European markets have seen a clear divergence thanks to the currency market fluctuations, with a Draghi-driven euro rally dragging the DAX lower amid a sharp FTSE ascent thanks to weakness in the pound.

"It seems Mario Draghi lost some of his shine today, with markets largely ignoring the fact that the ECB governor failed to mention tapering, instead driving the euro higher despite his attempt to drive home a dovish tone."

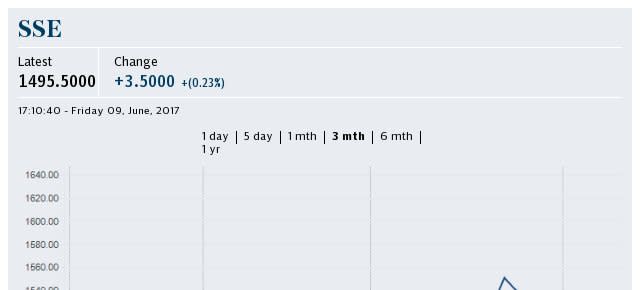

SSE sounds warning of ‘complex challenges’ as customer decline continues

The UK’s second largest energy supplier has warned investors that the industry faces “complex challenges” over the rest of the year as its customer base continues to erode.

SSE, once known as Scottish and Southern Electric, lost 230,000 customers in three months to the end of June as competition within the energy retail market ratchets higher with the influx of new independent players.

SSE also faces a political hit later this year as the regulator prepares to cap bills for the market’s most vulnerable customers.

In addition to a 3pc drop in customer numbers to 7.77m, SSE was hit by lower energy consumption due to milder than expected spring temperatures.

Read Jillian Ambrose's full report here

Small housebuilders snap up double the amount of sites as urban land market heats up

Demand for new homes in regional cities has boosted the price of urban land, with smaller housebuilders snapping up almost double the amount of land in the last year due to increased Government funds and more accessible finance.

Research by Savills found that the price of urban land is up 4pc year-on-year, compared to a rise of just 1pc for greenfield land, as buyer demand focuses on regional cities.

It also found that small housebuilders bought 89pc more land in the last twelve months than the year before, boosted by the Government's Home Building Fund to help smaller firms with little equity. Medium-sized builders also bought 22pc more sites than last year, and are increasingly seeking out larger sites.

Read Isabelle Fraser's full report here

ECB reaction: Draghi is managing market expectations

Mario Draghi was careful to deliver a consistently dovish message, according to Marchel Alexandrovich, chief European economist at Jefferies.

He added:

"Draghi is also making sure that the markets don’t get ahead of themselves and start pricing in QE adjustment before the ECB settles on the right policy path.

"In fact, Draghi seems to allow for the possibility that the decision on how to extend QE will not be announced in September, and the exact details may follow later – 26 October, or even 14 December. "

Pound hits eight-month low against the euro

Euro at $1.16, highest in 2 years. To paraphrase Draghi, the repricing of the exchange rate might be about to receive a bit more attention. pic.twitter.com/L90F7t2r1S

— Jamie McGeever (@ReutersJamie) July 20, 2017

The pound has plummeted to an eight-month low against the euro following ECB president Mario Draghi's speech this afternoon. It is currently trading at €1.1157

Against the dollar, the euro has hit its highest level in almost two years, €1.165.

ECB reaction: 'Euro strength will falter'

Looks like Draghi's broken the bund market pic.twitter.com/ElUXqiyPPM

— Tasos Vossos (@tasosvos) July 20, 2017

FX and Macro strategist at ETF Securities Martin Arnold argues that he expects the euro's strength to falter until "a more urgent need for tighter monetary policy for the Eurozone becomes a more strongly voiced position”.

He added:

"The ECB remains conservative with their communication on the need for tapering, with ECB President Draghi noting that ‘discussions should happen in the fall’ because ‘we are not there yet’ regarding inflation and price stability.

"President Draghi does not want a taper tantrum to push borrowing costs sharply higher. But a weaker Euro would be of assistance, both for lifting inflationary forces and for boosting economic demand."

Reaction to ECB meeting and Mario Draghi: 'Playing it safe'

Here's some snap reaction to the ECB meeting today, starting with Holger Schmieding at Berenberg:

"After financial markets overreacted to Mario Draghi’s Sintra speech, the ECB played it safe today.

"All in all, the changes were rather small. Following Sintra, the ECB this time adjusted its statement less than it had at previous meetings.

"As Draghi explained, the ECB wants to prevent an unwarranted tightening of financial conditions which, according to the ECB, could prevent the slow increase in inflation towards the ECB’s target of just below 2%."

Mr Schmieding said that he expected the asset purchasing reduction to still be announced at the September 7 meeting.

Next up is Craig Inches, head of short rates and cash at Royal London Asset Management:

"It is evident that the doves are in the driving seat for now, and that inflation continues to dog ECB hopes of unwinding monetary policy any time soon.

"Without the convincing and consistent reflationary data which the ECB is looking for, it will be difficult for bond yields to trend higher over the medium term."

And finally, here's Katheryn Brooks at City Index on the slightly illogical movement of the euro despite Mr Draghi's dovishness today:

"Draghi and the ECB may have been dovish at today’s meeting, however that hasn’t stopped the euro from rallying to key resistance levels. Why is the euro rallying when the ECB is dovish?

"The reason is because there is nothing new from today’s meeting, the ECB statement is virtually unchanged from last time and no news means no change in the euro’s trend, which for now is higher."

Brent crude advances past $50 per barrel

Brent crude has risen above the psychological $50-per-barrel barrier for the first time since early June. The oil price has rallied since the US Energy Information Administration revealed a sharper drawdown in crude stocks than expected yesterday.

The two oil giants on the FTSE 100, BP and Shell, have lifted the index in response to the increase, rising 1.17pc and 1.66pc, respectively.

Key takeaways from the ECB meeting and Mario Draghi speech

Mario Draghi was decidedly more dovish today but the markets have largely ignored his cautious tone and are betting that the ECB will soon announce (possibly in September) the tightening of monetary policy.

ECB left its interest rate unchanged at 0pc and will maintain the €60bn-a-month bond purchasing programme.

Mr Draghi emphasised that the central bank does not want to jeopardise a recovery by tightening monetary policy too soon.

He played down reports that officials have started looking at how to wind down the ECB's bond purchasing programme already. Mr Draghi said it has not been discussed.

Mr Draghi was cagey when asked if an announcement regarding its quantitative easing programme will come in September.

Euro soared into positive territory against a dollar that has performed strongly today and is moving back towards the 14-month high it reached against the greenback on Tuesday. The pound is trading against the euro at €1.1217, a 0.86pc fall.

Murdochs face further delay in Fox bid for Sky as MPs push for more scrutiny

Fox faces another delay in its £11.7bn pursuit of full control of Sky, after the Culture Secretary said she would not make a crucial decision on referring the takeover to competition watchdogs before Parliament takes its summer break.

Karen Bradley told MPs she was still minded to refer the bid to the Competition and Markets Authority (CMA) over the extra clout it would give the Murdoch family in the British media.

She declined to trigger an investigation, however, saying she had not yet had time to review all the responses to her initial “minded to” announcement at the end of June.

The further delay is a blow to 21st Century Fox, which in recent days has lobbied for a speedy referral to the CMA. It abandoned hope that plurality concerns raised by Ofcom would be addressed by an offer of undertakings to protect the independence of Sky News.

Read Christopher Williams' full report here

More dovish Draghi fails to calm the markets

Draghi: The reaction of wages to economic developments has changed since the financial crisis but we expect it to return to normal

— ECB (@ecb) July 20, 2017

Draghi not wrong about Sintra, Tallinn and today's message being broadly in line with each other. Markets seem to disagree though.

— Bert Colijn (@BertColijn) July 20, 2017

The press conference has finished and if Mario Draghi was attempting to calm the markets through his more dovish appearance today, it hasn't worked. The euro is now 0.85pc higher against the pound and rebounded into positive territory against a stronger dollar.

He didn't give a particularly convincing answer when directly asked on revealing QE tapering plans in September, only saying that it hasn't been discussed.

Mr Draghi says the ECB hasn't discussed tapering yet

I don't believe that Draghi expected this. #eurusdpic.twitter.com/OI73rZcwXG

— Lee Hutchinson (@tradingbandit) July 20, 2017

#Draghi says tapering scenarios have not been discussed and have not been tasked. @ecb not doing its job? They certainly should be examined

— Paul Mortimer-Lee (@MortimerleePaul) July 20, 2017

I think he probably has Paul to be honest, I wouldn't be worried...

Tapering options not being discussed, according to Mr Draghi

DRAGHI SAYS TAPERING SCENARIOS ARE NOT BEING DISCUSSED

— Nick Kounis (@nickkounis) July 20, 2017

Despite reports that officials have started examining how to begin unwinding the ECB's quantitative easing programme, Mario Draghi has said that discussions are yet to begin.

Reaction to Mario Draghi speech

If Draghi is actly trying to not downplay improvement in the growth outlook while balancing keeping $EUR lower, he's doing a poor job so far

— Justin Low (@kenzyxvw) July 20, 2017

The market literally does not buy a word of this. See you in September to see if he proves anyone wrong.

— Jonathan Ferro (@FerroTV) July 20, 2017

Draghi: The ECB will stay in the market for a long time

— ECB (@ecb) July 20, 2017

Since beginning the Q&A session, the pound has dived against the euro and is now 0.9pc down lower for the day, trading at €1.1216. If this is an attempt at rowing back on his Sintra speech, the markets are not convinced.

Last thing the ECB wants to do is kill off a recovery, says Mr Draghi

Draghi: Implementation of structural reforms needs to be substantially stepped up

— ECB (@ecb) July 20, 2017

When asked about the market reaction to his Sintra speech, Mr Draghi largely avoided the question and said that the last thing the ECB wants to do is taper too soon and jeopardise the recovery.

He added that his comments at Sintra were not that different from those at his appearance at Talin.

Draghi suggests he'll try to pull a yellen: tighten, but it's like watch paint dry. I.e. market, PLEASE, stay calm

— Axel Merk (@AxelMerk) July 20, 2017

Euro spikes against dollar but gains muted on the pound

As Mario Draghi speaks the euro has spiked against the dollar but hasn't moved considerably against the pound.

Draghi speech highlights so far

Mario Draghi: Incoming information confirms a continued strengthening of economic expansion in the euro area

— ECB (@ecb) July 20, 2017

Draghi: Headline inflation is dampened by the weakness in energy prices

— ECB (@ecb) July 20, 2017

Draghi: A very substantial degree of monetary accommodation is still needed for underlying inflation pressures to build up

— ECB (@ecb) July 20, 2017

Mr Draghi emphasises the point a few times that stronger inflation is necessary before any stimulus is removed. Q&A has just started.

Watch ECB president Mario Draghi speak here

�� Mario Draghi gives the ECB's latest update on the state of the euro-area economy https://t.co/FcUn2oywkRhttps://t.co/9neEbPiMxv

— Shailendra Nair (@shailendra_nair) July 20, 2017

Overseas sales slide hits Mothercare shares

A big dip in sales in the Middle East sent Mothercare's shares down 5pc in early trading this morning as overseas performance continued to mar the baby and child retailer’s turnaround in the UK.

International sales were down 8.3pc in constant currency over the first quarter, a deeper fall than analysts had expected, with the firm blaming “continued weakness” in trading in the Gulf. In actual currency they were down 2.2pc.

Mothercare chief executive Mark Newton-Jones, who joined in 2014, is midway through a turnaround programme at the company to shrink its UK estate, refresh its remaining stores and invest in e-retailing.

Read Iain Withers' full report here

Mr Draghi will hint at QE tapering, says Capital Economics

#Dax finally making new highs after the dovish slant to the ECB statement, Draghi up at the bottom of this hour can he sustain the rally?

— City Index (@CityIndex) July 20, 2017

ECB president Mario Draghi will "provide some hints at an imminent decision on quantitative easing tapering", predicts Capital Economics ahead of the conference in around five minutes.

Its European economist Jack Allen added that Mr Draghi will not be as dovish as some believe he will be:

"Given the increases in bond yields and the appreciation of the euro since Mr Draghi’s Sintra speech, some investors might now expect him to present a dovish message at the press conference.

"But to us, this seems unlikely. We don’t think that it is necessary for the Bank to remove the references to a possible QE expansion before it starts to taper."

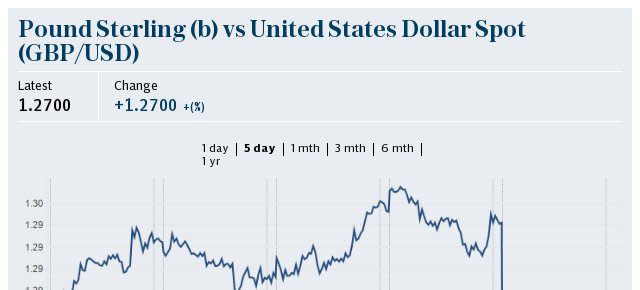

Pound at lowest level against the dollar this week as Brexit talks continue

The pound has fallen to its lowest level against the dollar this week as the EU's chief negotiator warns that talks will only progress once the UK has told the EU whether it is willing to pay a 'divorce bill'.

Sterling has been largely unaffected by the more positive outlook for the retail sector following the ONS release this morning and a rallying dollar has taken full advantage.

ETX Capital senior market analyst Neil Wilson believes that Brexit blues aren't the driving factor for its fall today, however:

"The pound was already heading lower and earlier this morning we saw stops taken that exaggerated the move lower.

"A slightly stronger dollar is the other factor and for all the talk about Brexit, cable [GBP/USD] is still predominantly dollar-driven.

"Deutsche Bank’s stark warning for employees to prepare for a hard Brexit didn’t help the mood, whether or not anyone on those forex desks actually took John Cryan at his word."

ECB president Draghi 'will play for time in today's press conference'

Whoever expects a less dovish Draghi will be disappointed today.Draghi wants to drop € however i am not sure if this drop will last for long

— ZeroLeverage (@zeroleverage) July 20, 2017

ECB president Mario Draghi "will play for time" in the upcoming press conference while still maintaining a confident tone consistent with his speech at Sintra when he first hinted at the removal of stimulus, according to Pantheon Macro chief Eurozone economist Claus Vistesen.

Mr Vistesen commented:

"Mr. Draghi will try to play for time in today’s press conference, and avoid saying anything too controversial.

"A repeat of the point that deflation risks have now dissipated, and a restatement of the comment that “reflationary forces are now in play” are good bets.

"In short, like other central bankers before him, Mr. Draghi is trying to prepare the market for an exit without disrupting markets; usually, that is impossible."

ECB Leaves rates and QE on hold#ECB#EUR#DRAGHIpic.twitter.com/9ZFtGO2wHa

— Sigma Squawk (@SigmaSquawk) July 20, 2017

ECB keeps interest rates at 0pc; Draghi to speak in 45 minutes

ECB retains possibility to increase QE if needed pic.twitter.com/EbAmfbQ8bC

— Richard Barley (@RichardBarley1) July 20, 2017

The European Central Bank leaves interest rates unchanged at 0pc.

No surprise but investors will still be eyeing ECB president Mario Draghi's press conference at 1.30pm for any hawkish shift in tone.

For traders the main event is still to come and thus currency markets have shown no reaction to the news.

QinetiQ's woes continue with shares dropping for a second day after shareholder revolt

QinetiQ’s troubles continued today, after Wednesday’s 9.6pc plunge following a trading update ahead of the annual meeting in which the defence and technology group warned of a slowing of orders and margin pressure.

The FTSE 250 group’s shares were down almost 3pc to 240.4p in early trading as investors digested a pay revolt at yesterday’s AGM, when 36pc of votes went against the remuneration policy and 39pc were against the 2017 incentive plan.

Shares in the company have been steadily heading downwards after hitting a record high of 319.7p in May, but jumped up about 5pc on Tuesday after an upgrade from Investec, which raised QinetiQ from “Hold” to “Buy”, calling the share price weakness “unjustified”. Wednesday saw them more than reverse this gain after the update.

Report by Alan Tovey

French and UK acquisitions push Bunzl to a record year

Distribution company Bunzl has bought French and British businesses to add to its roster, in what is now a record year for acquisitions.

The firm, which supplies food packaging to supermarkets and mops to cleaning companies, has bought French brand Hedis, which operates through a number of subsidiaries across France.

Hedis brands supply cleaning and hygiene-related products to a variety of customers in the public, healthcare, foodservice and cleaning sector.

It has also acquired sister firms Comptoir de Bretagne and Générale Collectivités, which provide light catering equipment and tableware to French businesses.

In total, the three firms’ revenue was €155m (£137m) last year.

Shares have edged up 6p to £22.66.

Lunchtime update: Pound endures torrid day of trading; FTSE 100 outperforms European counterparts

The FTSE 100 has outperformed its European counterparts this morning, buoyed by a weaker pound and a strong session for telecom and energy shares. The mining sector is lagging most on the blue-chip index as commodity prices drop on a stronger dollar.

On the currency markets, the pound has had a torrid day so far, dropping 0.7pc to $1.2943 against the dollar as the greenback rebounds.

It spent about a nanosecond in positive territory against the euro following the stronger-than-expected UK retail sales data but dropped off immediately as analysts started to poke holes in the figures. It is currently trading at €1.1246 against the euro ahead of the outcome of the ECB meeting which is due at 12.45pm.

Mike Van Dulken, head of research at Accendo Markets, told clients:

"European equities have found bullish impetus thanks to a raft of corporate earnings and some welcome currency weakness for both the GBP and EUR, outweighing any nerves about a hawkish ECB update and more QE taper hints. "

Here's the current state of play in Europe:

FTSE 100: +0.70pc

DAX: +0.41pc

CAC 40: +0.24pc

IBEX: -0.21pc

The highest-paid Instagram influencers, including one star who gets £14,000 per post

Sophie Christie has compiled a list of the Instagramers making a fortune from posting pictures. Beauty blogger Huda Kattan makes an incredible £14,000 per sponsored post. Beats me too...

FTSE 100 advances as pound deteriorates throughout the morning

The FTSE 100 has gained momentum as the morning has progressed with equipment rental company Ashtead benefiting from US rival United Rentals' strong second quarter performance and retailers Kingfisher and Next bouncing from the stronger-than-expected retail sales.

Meanwhile on the FTSE 250, Moneysupermarket.com has dived almost 6pc after it reported on its struggling energy division while Sport Direct has rallied 7.3pc despite posting a 59pc fall in underlying pre-tax profit.

The pound has deteriorated throughout the morning and is almost 0.5pc lower against the euro ahead of the ECB meeting. It is trading at $1.2955 against the dollar, a 0.6pc fall.

IG chief market analyst Chris Beauchamp said on sterling's struggle today:

"A surprise bounce in retail sales has done nothing to help sterling, which continues to flounder against the US dollar after breaking back below $1.30 earlier this week.

"Markets do not yet seem convinced that inflation in the UK has peaked, while today’s better high street news is merely an improvement over last month’s dire figure. The picture is not as clear as it was, but the overall landscape of higher prices and weaker wages remains."

Premier Food suffers drop in first-quarter sales

Sales at Premier Foods fell by more than 3pc in the first quarter as the Mr Kipling maker suffered a slowdown in its grocery business.

The company said sales of groceries and desserts, which were hit by a reduction in multi-buy promotions and a warmer June, offset good performance in its “sweet treats” range.

Premier said total group sales were down 3.1pc in the 13 weeks to July, while grocery sales fell 5.6pc. In its “sweet treats” division, Cadbury cakes and a return of Mr Kipling to growth sent sales up 3.8pc.

Read Sam Dean's full report here

Unilever 'cannot relax' after Kraft Heinz takeover bid.

Kraft Heinz may have gone away but Unilever knows it "cannot relax" and investors expect it "to raise their game", says Steve Clayton, fund manager of the Hargreaves Lansdown select funds, on the consumer goods company's results this morning. Unilever said that it has had a "substantial" step-up in first-half profits as it attempts to win over shareholders to its long-term strategy.

Kraft launched a £115bn takeover bid in February which was later withdrawn but SIG analyst Pedro Zuanic puts a 75pc probability on the US company returning with a more aggressive attempt. Whether chief executive Paul Polman has done enough to fend off another bid will remain to be seen.

Mr Clayton added on the Unilever results:

“Volume growth is still hard to come by, in today’s world of lacklustre economic growth, but Unilever’s strength in emerging markets is allowing it to push revenues forward through pricing gains.

"Overall, these numbers look to be ahead of where analysts thought the group would be due to strong margin expansion."

Airliners nosedive after analysts conclude easyJet figures 'not good enough'

British Airways-owner IAG and easyJet have nosedived this morning on the FTSE 100 despite the latter lifting its profit forecast after a "difficult 18 months".

Liberum analyst Gerald Khoo called the results "good news but not good enough" while Panmure Gordon said the profit upgrade is probably already priced in.

EasyJet has shed 77p to £13.40, a 5.5pc fall, this morning with its sector peers also weakened as a result.

Unilever sales rise as it sticks to 'long-term plan' following failed Kraft Heinz takeover

Unilever hailed a “substantial” step-up in first-half profits as it looks to convince investors to stick with its long-term plan following an attempted takeover by Kraft Heinz earlier this year.

The maker of Dove soap and Marmite reported a rise in underlying sales of 3pc in the first six months of the year, while profit before tax rose to €4.6bn (£4bn) from €3.6bn in the same period last year.

Chief executive Paul Polman said the results were further proof of the “validity” of the FTSE 100 giant’s long-term plan for growth.

Mr Polman has overseen an overhaul of the business, including plans to sell its spreads business, since fending off the takeover threat from Kraft Heinz.

Read Sam Dean's full report here

Retail sales rebound 'lacklustre', says Pantheon Macro

much talk of June retail sales strength being temp so less impact on inflation

— Mike van Dulken (@Accendo_Mike) July 20, 2017

Investors seem to be pretty upbeat on retailers following the sales data from the ONS but Pantheon Macro has a more bearish take, calling the figures a "lacklustre result, given the unusually hot weather".

Its chief UK economist Samuel Tombs commented:

"The increase in retail sales in June was relatively modest, given the temporary support to demand from the unusually warm weather.

"Last month was the fifth warmest June since 1910, and food and clothing sales usually surge when the temperature is unusually high in the summer."

Pound falls back below $1.30 against the dollar

It didn't take long for the pound to pare its retail sales bounce, it has slumped to $1.2979 against the dollar, a 0.42pc fall today.

Sterling could have a more positive afternoon, especially against the euro, however.

It is in Mario Draghi's interest to dampen hawkish hopes at the ECB meeting today, according to CMC Markets analyst David Madden.

He added:

"The ECB chief, Mario Draghi, has praised the progress of the eurozone but has stopped short of calling for a reduction in the size of the bond buying scheme.

"Keeping the euro lower is in his interest, so I suspect Mr Draghi will not be overly rosy in his outlook."

Retailers among the top gainers following the strong retail sales data

The retailers on the FTSE 100 are enjoying a boost from the rebound in retail sales in June. Kingfisher and Next have risen to the top of the leaderboard on the blue-chip index, advancing 2.29pc and 1.95pc, respectively.

The pound spiked against the dollar after the data pointed to a slightly more positive outlook for the high street but it is still down for the day by 0.28pc. It is currently trading at exactly $1.30 against the greenback.

Ben Bretell, senior economist at Hargreaves Lansdown, argues that the result will renew optimism in the UK economy:

"Given that falling real wages are continuing to squeeze household budgets, retail sales data is taking on extra significance at present as economists look for signs that consumer spending is coming under pressure.

"This news adds to a renewed sense of optimism on the UK’s economic prospects. Spending seems to be holding up despite falling real wages, and if the sterling-driven spike in inflation is finally receding, we could see a stronger contribution from the UK consumer in the second half of the year. "

ECB rate meeting today is an 'important milestone'

Today's ECB meeting is an 'important milestone' for the central bank, according to CMC Markets analyst Michael Hewson.

ECB president Mario Draghi's bullish appearance at the ECB Conference in Sintra last month was the first hint that monetary policy will soon tighten at the central bank with the euro surging as traders interpreted the speech as more hawkish than usual. Today's press conference (due at 1.30pm) will be the first time Mr Draghi has spoken on monetary policy since.

Mr Hewson added that more hints on the unwinding of the ECB's huge stimulus package could arrive next month:

"While no change in policy is expected today it is against this backdrop that ECB President Mario Draghi will be looking to manage expectations about the timetable for future monetary policy, with markets expecting some form of clarity as soon as the September meeting, by way of the Jackson Hole Central Bank annual symposium in August where we might get further clues."

Retail sales rebound in June stronger than expected

Month-on-month retail sales rose by 0.6pc in June, a slightly better-than-expected result for retailers, according to the Office for National Statistics. The figures will be a relief for the high street after sales tumbled 1.2pc in May. The ONS said that good weather last month had helped the rebound.

ONS senior statistician Kate Davies said:

"A particularly warm June seems to have prompted strong sales in clothing, which has compensated for a decline in food and fuel sales for the month.

"Looking at the quarterly data, the underlying trend as suggested by the three-month on three-month movement is one of growth, following a fall in quarter 1, suggesting a relatively flat first half of 2017."

City will be 'impressed' by Sport Direct's tone this morning

Retail expert Nick Bubb believes the City will be "reasonably impressed first thing today by the tone of the statement" from Mike Ashley and Sports Direct despite it carrying no mention of Game Digital or future share buyback plans. Shares have risen nearly 7pc this morning.

He added:

"The City probably wasn’t expecting such a long statement to have to wade through.

"It is a pity that there will be no analysts presentation to go through the detail, but it is hard to know who would actually conduct that for Sports Direct, as they are in-between FD’s (albeit a new guy called Jon Kempster has stepped up to the plate, joining on 11 Sept) and formal presentations are not the strength of CEO Mike Ashley"

The Twitterati has been highly sympathetic to the company's drop in profits...

the City probably wasn’t expecting such a long statement to have to wade through…It is a pity that there will be no analysts presentation to go through the detail, but it is hard to know who would actually conduct that for Sports Direct, as they are in-between FD’s (albeit a new guy called Jon Kempster has stepped up to the plate, joining on 11 Sept) and formal presentations are not the strength of CEO Mike Ashley

Mike Ashley realising that being a scruffy drunkard who gambles away his profits doesn't come across as very business-like #SportsDirecthttps://t.co/wX40yjNKJw

— Robert Boid (@bobberlet) July 20, 2017

Sports Direct profits plunge 59pc

Sports Direct has reported a 58.7pc slump in underlying profits and announced the appointment of a permanent finance chief for the first time in four years.

The Mike Ashley-run retailer recorded a dive in underlying profits from £275.2m to £113.7m in the year ending April 30. It blamed the fall for not having sufficient currency hedges in place to deal with the sharp drop in the pound last year following the Brexit referendum result.

The sportswear giant said that it had hired Jon Kempster, whose last chief finance role in 2012 was at £300m logistics firm Wincanton.

Sports Direct has been without a permanent chief financial officer since the acting finance boss, Matt Pearson, who replaced the longstanding Bob Mellors, quit last year. Mr Pearson was replaced by a more junior member of the finance team who is not a director.

Despite the poor performance, Sports Direct shares have jumped 7.6pc to 323.5p this morning.

Read Ashley Armstrong's full report here

Stronger retail sales could 'stoke the fires of inflation'

UK retail sales data is due in around half an hour and a small rebound is expected from May's disappointing figures. Month-on-month sales fell by 1.2pc in May and analysts are expecting a 0.4pc rise in the latest release.

"Stronger growth could imply better retailer performances and stoke the fires of inflation," commented Mike Van Dulken, head of research at Accendo Markets.

On the FTSE 100, both Next and M&S have advanced higher ahead of the release.

Draghi 'likely to remain cautious' to contain the hawks

European Central Bank president Mario Draghi will "likely remain cautious" when he speaks following today's policy meeting in order to "contain ECB-hawks' enthasiasm", according to Ipek Ozkardeskaya, London Capital Group market analyst.

She points out that a rapid euro appreciation would hold back inflation from its 2pc target and thus slow down any tightening of monetary policy.

She added:

"The ECB is expected to maintain the status quo at today’s meeting. Yet investors are craving for details regarding the ECB’s plans concerning its Quantitative Easing (QE) program, due to end in September.

"The recent rally in the Eurozone sovereign yields and the euro appreciation has been an interesting opportunity to observe the market’s take on an eventual QE taper."

Overnight round-up: Energy stocks lead S&P 500 to fresh high; BOJ extends time-frame for inflation target

Overnight, Asian markets picked up from where their European and US counterparts left off and rose to their highest level since 2007. Energy stocks led the S&P 500 to a fresh all-time high after weekly crude inventories data showed a larger than expected drawdown.

Ahead of today's European Central Bank meeting, the Bank of Japan held its own overnight and signaled that its huge stimulus plans will remain in place for longer than any other major central bank after it extended the time-frame for achieving its 2pc inflation target.

Inspite of the enormous scale of its monetary easing and QQE The Bank of Japan is failing to generate inflation #Abenomicshttps://t.co/Iep1tsVJSN

— Shaun Richards (@notayesmansecon) July 20, 2017

Agenda: Investors eye ECB monetary policy meeting

Tech stocks broke 2000 record. S&P 500 Tech sector ended at 992.29, closing above prev all-time high in Dot-com era. https://t.co/CFsgjwWISlpic.twitter.com/ye36RUH9nI

— Holger Zschaepitz (@Schuldensuehner) July 19, 2017

Welcome to our live markets coverage.

The ECB monetary policy meeting is the pick of the bunch for investors this morning and, while little change is expected in terms of policy, the markets will be looking for any subtle shift in tone from its president Mario Draghi.

There are reports that internally officials have started examining how it will unwind its bond buying programme. A statement is due at 12.45pm following the meeting with a press conference scheduled at 1.30pm.

Ahead the meeting the pound has edged down against the euro and is trading at just above €1.13. It has also fallen to $1.3016 against the dollar, a 0.15pc dip,

With retail sales data due at 9.30am, the retailers on the FTSE 100 will be worth keeping an eye on. This morning, the blue-chip index has opened brightly with equipment rental company Ashtead leading the pack early on.

On the corporate calendar, Sports Direct has blamed the pound's depreciation for a 59pc fall in underlying pre-tax profits while consumer goods giant Unilever has reported a 3pc rise in underlying sales.

Full-year results: Sports Direct International Interim results: Moneysupermarket.com Group, Nichols, Unilever, Howden Joinery Group

Trading update: Premier Foods, Anglo American, SSE, easyJet

AGM: Ashmore Global Opportunities, Harbourvest Global Private Equity, Royal Mail, Big Yellow Group

Economics: Retail sales (UK), CBI industrial order expectations (UK), unemployment claims (US), producers price index (GER),

Yahoo Finance

Yahoo Finance