UK trade deficit widens despite strong industrial output figures; US stocks follow Europe into the red

Markets wrap: North Korea tension dominates the markets again

Investors have continued to dump riskier assets today as relations between the US and North Korea intensify. US stocks plunged into the red for a third consecutive session with European indices worsening as the day has progressed.

The FTSE 100 has nosedived 1.4pc but a sizeable chunk of the losses can be attributed to a host of blue-chip giants going ex-dividend and a housebuilding sell-off after figures released overnight pointed to a slowing housing market.

European indices had another poor session in response to the geopolitical chest-beating in Asia while gold has advanced just under 1pc as investors flock to safe havens once again.

There were a few winners in London, however, with bottling company Coca-Cola HBC jumping 9.3pc on strong earnings and bakery chain Greggs advancing 5.1pc on the FTSE 250 following a broker upgrade.

A mixed bag of ONS data showing a widening trade deficit but also strong industrial production figures for June has done little to help the pound, which is finishing the afternoon slightly down against the dollar, trading at $1.2984.

Hundreds of Asda jobs at risk as it consults with staff

Hundreds of Asda employees are on the chopping block as the supermarket looks to make changes to 18 underperforming stores.

Britain's third-largest supermarket confirmed that it is consulting with more than three thousand employees at the 18 stores about cutting staff numbers and hours.

However, insiders said that based on similar staffing consultations, it expected redundancies to be in the "low hundreds" rather than thousands.

The supermarket stressed that it had no plans to shut the 18 stores.

Read Sophie Christie's full report here

Losses in Europe intensify as US stocks continue to fall

Losses in Europe have intensified since the opening bell in New York this afternoon and those hoping that US stock markets would provide some calm to proceedings will be disappointed.

This is now the third consecutive session that US equities have plunged in response to the escalating tensions with North Korea. The rogue Asian state said in its latest threat that it could strike the US Pacific island of Guam with four missiles within days.

The FTSE 100 is down around 1.4pc for the session and, although some of the losses can be attributed to a host of big blue-chip firms going ex-dividend today, it seems to have also taken a knock from geopolitical events.

Spreadex analyst Connor Campbell commented on today's play:

"The Dow’s drop had serious implications for the rest of the global markets, as investors voiced their concerns about the nuclear threat posed by two very spoilt children.

"There were similarly alarming slides in the Eurozone. The DAX gradually saw its losses widen to 130 points, sending the German index to a fresh 12 week nadir, while the CAC dropped 0.7% to lurk just above 5100."

UK exports fell in June despite hopes of a boost from sterling's weakness

Exports fell in June despite hopes that the weak pound would boost sales overseas, leaving Britain’s manufacturing output flat on the month.

Analysts had anticipated something of a recovery in June, setting the UK economy up for a stronger second half of the year.

But the figures from the Office for National Statistics disappointed.

The trade deficit widened to £4.6bn in June, defying predictions that it would fall to £2.5bn. That is the biggest monthly deficit of the year so far.

Read Tim Wallace's full report here

Prudential results: Analysts believe the merger is a precursor to a separation

Prudential revealed in its results today that it will merge its UK life and M&G asset management divisions into one business. Shares are largely flat following the announcement but analysts believe that this morning's rejig might just be the start of a larger reorganisation at the company.

RBC Capital Markets analyst Gordon Aitken said:

"We believe that Prudential’s move is a precursor to a separation of the UK business. We believe the market would view this favourably as the rest of Prudential would be able to leave the onerous European solvency regime Solvency II."

Nicholas Hyett, an analyst at Hargreaves Lansdown, commented:

"The combined business would bear a remarkable resemblance to several other UK life businesses, and the success of the DC pension scheme focused PruFund would seem to provide a model for a viable standalone future. There’s no need to get rid of the UK business, but today’s move would make it a lot simpler."

Amec Foster Wheeler defends Wood takeover even as turnaround plan bears fruit

Oil services company Amec Foster Wheeler has defended its £2.2bn takeover by rival Wood Group as a "no-brainer" even as a major turnaround programme begins to bear fruit.

Amec’s final results before the deal completes revealed better-than-expected earnings and a return to profit for the first half of the year, due in large part to the overhaul it started before Wood Group’s approach.

Jon Lewis, Amec’s chief executive, was tasked with rescuing the floundering company when he stepped into the top role last summer, and said the benefits from the transformation programme were beginning to emerge.

But the tie-up with Wood was still the “right thing to do” from a strategic point of view, he insisted.

Shares advanced by 3.3pc following the results.

Read Jillian Ambrose's full report here

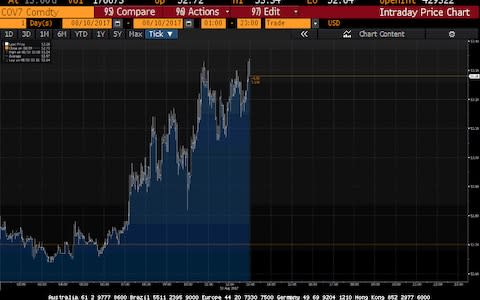

US markets follow Europe into the red; US producer price index weaker than expected in July

US stocks have followed their European peers into the red with the Dow Jones shedding 0.5pc early on and the Nasdaq plunging 0.8pc.

JP Morgan and Goldman Sachs are echoing their British banking counterparts and doing much of the damage early on in New York

There are a few economic releases from across the pond out today but they haven't moved currency markets much. US producer prices fell by 0.1pc in July, a weaker than expected reading, as a 1.4pc decrease in fuel prices weighed on the figures.

The pound has since sneaked into positive territory against the dollar, trading at just over $1.30

US PPI fell below 2.0% in July! pic.twitter.com/MkLMLm2HYf

— jeroen blokland (@jsblokland) August 10, 2017

UK economy suffered slowdown in July, according NIESR

Our monthly estimates of GDP suggest that output grew by 0.2% in the 3 months ending in July - Read here: https://t.co/3xIy0DmAYV#NIESRGDPpic.twitter.com/Q0FbNJI20h

— NIESR (@NIESRorg) August 10, 2017

The National Institute of Economic and Social Research have revealed that the UK economy suffered a slowdown in July with its latest monthly estimates showing that output grew by 0.2pc in the three months ending July.

NIESR said that the main driver of economic growth in the second quarter, the service sector, appears to decelerated last month.

Its head of UK macroeconomic forecasting Amit Kara said on the outlook:

"We see a modest recovery in the second half of this year in response to strengthening global growth and a weaker currency, but on the flip side, consumer spending is likely to be weighed down by weak wage growth and investment spending held back by Brexit-related uncertainty.

"Further out, we see quarterly economic growth strengthen somewhat to 0.4-0.5 per cent as the economy rebalances away from domestic demand and towards net trade. Economic growth however, remains below its long-run average growth rate of 0.6 per cent because of subdued productivity growth."

Prudential to form UK 'super-group' as it merges insurance and fund arms

Prudential is to merge its UK asset management arm M&G with its European insurance unit in a shock move that will reignite speculation the businesses are being packaged up to be spun-off or sold.

The enlarged group, M&G Prudential, will bring together over 9,000 members of staff and £332bn in assets with the goal of saving £145m a year from the tie-up until 2022.

Chief executive Mike Wells refused to comment on whether the deal meant the FTSE 100 group was working towards a sale of the divisions, saying simply that the group's structure gets reviewed many times a year.

He added that it was too early to draw any conclusions on job cuts. "I'm not looking to speculate," he said when asked about the potential number of roles that could go.

Read Lucy Burton's full report here

FTSE 250 update: Investors tuck into Greggs; Worldpay rises after agreeing takeover deal

The FTSE 250 has slumped into the red today along with the FTSE 100 but isn't suffering the same losses seen on its bigger brother.

Bakery chain Greggs is leading the mid-cap index, rising 5.5pc, after broker Berenberg upgraded the stock to "buy", citing its potential to expand its product range and increase its store count.

Engineering firm Amec Foster Wheeler has advanced 3.3pc after swinging back to a profit while at the other end building materials-maker Ibstock has slipped 5.7pc on a slowdown in its US division.

On the FTSE 100, very little has changed since mid-morning.

Blue-chip heavyweights going ex-dividend continue to keep the index firmly in the red while Coca-Cola HBC has risen 7.8pc on strong earnings and Worldpay Group has popped 2.5pc after US company Vantiv agreed to buy the payments company for approximately £8bn.

Glencore dashes hopes of early dividend increase in favour of boosting cash pile

Glencore has dashed hopes of a special dividend in the first half of the year, opting to stockpile cash ahead of more potential acquisitions.

The Switzerland-based miner and commodity trader comfortably hit City expectations in the six months to June 30, generating pre-tax profits of $2.45bn ($1.88bn) - a vast improvement on the $369m loss it made in the same period last year.

Revenues climbed 31pc to $100bn as it rode the wave of higher commodity prices, particularly in coal, copper and zinc. Earnings from its large trading and shipping division - closely watched by analysts - hit $1.37bn.

Shares in the mining giant advanced 2pc following its results.

Read Jon Yeomans' full report here

Brent crude rises to two-and-a-half-month high

Brent crude has rallied to a two-and-a-half-month high today despite OPEC's monthly production report showing another output increase from the oil cartel.

While OPEC upped its 2018 oil demand expectations by 220,000 barrels per day as consumption picks up, compliance to March's agreed production cuts dropped by 10 percentage points, according to Reuters data.

Nonetheless, Brent is now 1pc higher for the session, trading at $53.22 per barrel.

The market has brushed off the ebbing compliance but ETX Capital analyst Neil Wilson has some concerns:

"This report raises fresh doubts about whether OPEC’s production curbs are working. Production increased thanks mainly to higher output from Saudi Arabia, as well as the turning tide in Nigeria and Libya.

"They’re currently exempt from curbs but this situation may need to be reassessed quickly. As ever the question mark is over compliance, which has slipped to 86% - not as good as before but not terrible for the cartel by any means - and we need to see whether this can be shored up, or if it’s a signal that the deal is coming apart. The fact that Saudi Arabia did not submit any July data is of further concern with regards to compliance."

BAE Systems submits bid to lead new warship renewal programme for Australian Navy

British defence giant BAE Systems has officially submitted a bid to build new warships for Australia, which is launching one of the Western world’s largest fleet renewal programmes.

The FTSE 100 company has proposed a partnership with the Canberra government to build nine anti-submarine warships for Australia’s navy under the country’s SEA 5000 Future Frigate programme.

The design submitted for the new contract is based on the Type 26 frigate which BAE started building last month at its Glasgow shipyards, with the first ship expected to enter service with the Royal Navy in the mid-2020s.

Read Alan Tovey's full report here

UK output data: Weak car production pulls down figures

Today's UK output data only confirmed the "sluggish" growth experienced in the second quarter despite the 0.5pc growth in industrial production easily beating expectations, according to Investec analyst Phillip Shaw.

He explained:

"Industrial production was recorded to show a 0.5% increase on the month in June. This was much firmer than the ONS’s initial ‘guesstimate’ of +0.1%, but this leaves the new estimate for Q2 as a whole to be unrevised at -0.4%."

He highlights car production as one of the weak spots in the data, which "probably reflects a combination of a hit to real household incomes from higher inflation and changes to Vehicle Excise Duties".

UK output data mixed. Industrial production beats, construction component misses and manufacturing in-line. #GBPUSD off lows pic.twitter.com/nWIueFSYRg

— Sigma Squawk (@SigmaSquawk) August 10, 2017

Audience numbers surge at Cineworld as movie hits pull in film-goers

Box office hits including Beauty and the Beast, starring Harry Potter actress Emma Watson, and Guardians of the Galaxy Volume 2 helped profits at Cineworld surge by more than half as the company pledged to keep expanding.

The cinema group said the line-up of films so far this year had been more popular with audiences than last year, with admissions up 10pc to 50.7m - well above the 2.7pc growth rate last year.

This meant pre-tax profits jumped 57pc to £48.2m on the back of sales of £420m, up nearly a fifth on the same period in 2016 thanks also to slightly higher ticket prices.

A steep rise in the amount spent on food and drinks meant refreshments made up almost 25pc of revenue at £103m. The company has been developing its offering and now has Starbucks concessions in 25 cinemas.

Read Bradley Gerrard's full report here

Lunchtime update: FTSE 100 dragged firmly into the red by big hitters going ex-dividend

A host of heavyweight stocks going ex-dividend has pushed the FTSE 100 down 1.2pc this morning with geopolitical tensions on the Korean peninsular continuing to weigh on stock markets in Europe.

Blue-chip housebuilders Barratt Developments, Taylor Wimpey and Persimmon have all been dragged down by the RICS' latest survey, which showed that the house price slowdown has spread beyond London, while bottling company Coca-Cola HBC's has risen 7.6pc on strong earnings.

A mixed bag of data on the UK''s industrial and construction output and trade deficit from the ONS today has resulted in the pound nudging up 0.1pc against the dollar. It has had a better morning against the euro, however, rising 0.3pc to €1.1095.

Spreadex analyst Connor Campbell explained the relatively muted reaction to the data on the currency markets:

"Part of the reason was the generally uninspired data coming out of the UK. Though the industrial production reading beat expectations to jump to a 6 month high of 0.5%, any goodwill generated by this move was undone by the UK’s worst trade deficit figure for 9 months, with exports plunging 4.9% in June."

Here's the current state of play in Europe:

FTSE 100: -1.24pc

DAX: -0.72pc

CAC 40: -0.40pc

IBEX: -0.59pc

Abellio wins West Midlands rail franchise from Southern operator Go-Ahead

Rail company Go-Ahead, the operator of the beleaguered Southern network, has lost its bid for the West Midlands rail franchise to a rival offer pledging hundreds of new carriages and free Wi-Fi.

Shares in Go-Ahead fell 2pc to £17.70 on the back of the news its joint venture Govia, which it runs with French group Keolis, failed to keep the rail franchise it has held for a decade.

The Department for Transport (DfT) has handed the contract to a consortium consisting of Dutch transport company Abellio, East Japan Railway Company and Mitsui & Co. This bid, which was the only rival to Govia’s, will also see councils in the West Midlands have greater control over trains that run in the region.

Go-Ahead said it was “disappointed” its bid was unsuccessful given it had “delivered significant improvements across the entire network”.

Read Bradley Gerrard's full report here

Ex-dividend-affected stocks distorting the FTSE 100

The ex-dividend-affected stocks are distorting the FTSE 100 today with the reality actually a bit duller than it seems.

The index has fallen 82 points to around 7415 with the heaviest losses being attributed to blue-chip big hitters going ex-dividend.

Bottling company Coca-Cola HBC is one of the stocks fighting the index's plunge, jumping 8.1pc after beating analyst expectations in its latest earnings thanks to growth in its emerging markets division.

ETX Capital analyst Neil Wilson commented on today's markets:

"The FTSE 100 is lower but not by much if you strip out the ex-dividend factors, which have conspired to clip 41 points off the index.

"Housebuilders are dragging with the RICS survey showing the slowdown in house price growth has spread beyond London. That survey is acting as a weight on Taylor Wimpey, Barratt Developments and Persimmon."

Revealed: The most (and least) affordable places to live in the world

The United States, Jamaica and Saudi Arabia are among the most affordable places to live in the world, based on average house prices versus average income in the respective countries.

Australian home and office removals firm Assured Removalists combined data on average annual salary, income tax and house prices to produce a ratio that shows the measure of housing affordability around the world. The higher the ratio is, the less affordable the houses are. Click above to read Sophie Christie's full report.

UK trade deficit reaction: Tentative encouraging signs in the data

The pound has pared its morning losses against the dollar since the ONS's mixed bag of data was released but sterling now remains stuck in flat territory just below $1.30. It's faring better against the euro, however, advancing 0.3pc.

There are "some tentatively encouraging signs" regarding the UK's trade deficit, according to Paul Hollingsworth, UK economist at Capital Economics, despite the ONS revealing today that it widened by £0.1bn in the second quarter of 2017.

He argued that the significant widening in the goods and services deficit from £2.5bn in May to £4.6bn in June can be largely ignored given that this figure is "very volatile and prone to significant revisions".

Mr Hollingsworth added this on the outlook following today's figures:

"Looking ahead, surveys suggest that the manufacturing sector should gain some momentum in Q3, while export growth should pick up further. As a result, we remain optimistic that growth should hold up fairly well in the second half of the year, rather than slow."

UK trade deficit widens: #GBP impact on X barely visible but import prices higher. Correlation UK #trade to #GBP v weak so why the surprise?

— Rebecca Harding (@RebeccaAHarding) August 10, 2017

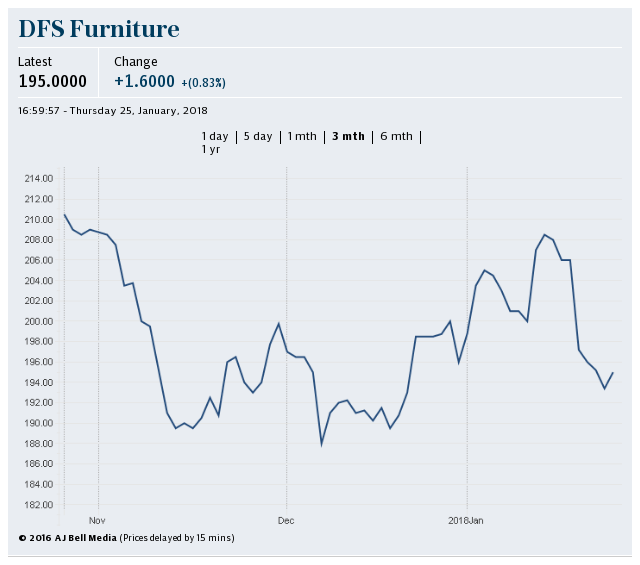

DFS shares tumble after profits fall due to 'uncertain' trading

Sofa giant DFS has said uncertainty around the general election caused a 4pc drop in sales in the second half of its financial year.

DFS warned earlier this summer that it had been hit by “significant” declines in the number of people coming into its stores, causing shares to plunge by more than 20pc.

It has now said the drop-off in footfall means profits for the year to July 29 will be at the lower end of the guided range it issued alongside the June warning. The latest update sent its shares down more than 7pc in early trade, though they later clawed back some ground to change hands around 5pc down at 218p.

“Revenue in the second half has been weaker than we expected owing to significant declines in store footfall and customer orders across April, May and June,” the company said.

“We believe this to be an industry-wide issue, resulting from the uncertain economic environment and unexpected general election, exacerbated by warm weather in May and June.”

Read Sam Dean's full report here

Heavyweights going ex-dividend pulls down FTSE 100

FTSE 100 heavyweights Anglo American, BT, Rio Tinto and Lloyds going ex-dividend has pulled down the index this morning.

The UK's blue-chip index has retreated 1.1pc today with stock markets in Europe also plunging further into the red as the morning progresses.

Risk aversion is still weighing on European equities, according to IG analyst Josh Mahony.

He added:

"The potential for a conflict between North Korea and the US seems to be an ongoing threat to risk appetite which will likely flare up every once in a while.

"For now, tensions are high, yet in all likeliness we will see this intensity simmer down somewhat, with both sides standing to lose more than they would gain from military action."

Trade deficit rises slightly to £8.9bn in June

UK goods & services trade deficit widened by £2bn in June to £4.6bn, the largest shortfall in nine months pic.twitter.com/3e0pydt0uN

— D1STP (@D1STP2017) August 10, 2017

The UK's trade deficit widened by £0.1bn to £8.9bn in the second quarter of the year due to increases in imports of goods and services, according to the ONS' figures released this morning.

However, it said that despite the weaker pound and higher trade prices, there were similar rises in import and export volumes of goods.

Construction output falls by 1.3pc in second quarter

ONS Construction output in Q2 fell by 1.3% compared with Q1, a downward revision from 1st est. of GDP.#constructionhttps://t.co/6h4t9xkTZ0pic.twitter.com/bmNevnxt7J

— Noble Francis (@NobleFrancis) August 10, 2017

Quarterly construction output fell by 1.3pc in the second quarter of 2017 with the sector contracting for a third consecutive month in June.

Output dropped by 0.1pc on a month-by-month basis in June with the ONS saying that a 1.1pc fall in the repair and maintenance sector was largely offset by a record 5.1pc increase in private housing.

Industrial production in June beats analyst expectations

Mixed bag of UK data with wider trade deficit offset by stronger than expected industrial production

— RANsquawk (@RANsquawk) August 10, 2017

The 0.5pc rise in month-on-month industrial output growth was the most impressive figure from the mixed bag of data just released by the ONS, easily beating expectations of a 0.1pc increase.

The ONS said that the rise in industrial production was mainly due to a 4.1pc rise in mining and quarrying as a result of increased oil and gas production.

Transport equipment manufacturing's 3.6pc fall partially offset a 4pc increase in the other manufacturing and repairs category, the ONS said. Overall monthly manufacturing growth came in flat for June.

UK output data mixed. Industrial production beats, construction component misses and manufacturing in-line. #GBPUSD off lows pic.twitter.com/nWIueFSYRg

— Sigma Squawk (@SigmaSquawk) August 10, 2017

Key takeaways from ONS industrial output and trade data

The UK's trade deficit widened by £0.1bn to £8.9bn in the second quarter of 2017 with import increases closely matched by rising exports

Total UK industrial production rose by 0.5pc month-on-month in June, ahead of expectations of a 0.1pc increase

Manufacturing came in flat for June

Construction output fell by 1.3pc in the second quarter, with a 0.1pc month-on-month fall in June

The pound has nudged up since the figures dropped but is still in negative territory for the session

Co-op Bank’s losses narrow to £135m in first half of year

Struggling Co-op Bank has reported an improvement in the first half of the year, with losses narrowing to £135m from £177m last year.

The ailing lender put itself up for sale earlier this year only to fall back on a £700m cash injection from its hedge fund owners.

In the six months to June 30, The Co-op Bank’s net interest margin, a key measure of performance, fell to 1.32pc from 1.42pc a year ago.

Its common equity tier one ratio - an important yardstick of the bank's stability - fell to 9.8pc from 11pc in December, which it said was a result of the first-half loss.

Read Jon Yeomans' full report here

ONS output figures expected to be flat or a slight improvement

The industrial, manufacturing and construction output data due soon could be a bit of a damp squib with the readings expected to come in flat or nudging up slightly.

Marc Ostwald, an analyst at ADMISI, said this on the expected flat month-on-month growth in manufacturing:

"This is somewhat at odds with yesterday's BoE Agents reports that noted "Manufacturing output growth had strengthened again. Activity in export supply chains had increased, and there was some pickup in import substitution. Demand from the oil and gas sector had also edged up", and indeed with the sector PMI and CBI surveys."

Industrial output growth meanwhile is expected to come in at 0.1pc.

Michael Hewson at CMC Markets notes that the ONS figures and PMI surveys are painting very different pictures of the UK economy:

"For all of this year these independent surveys have been much more optimistic and quite frankly better when it comes to reporting the improvement in order books in terms of surging export markets, as well as rising employment levels in the sector.

"The ONS numbers on the other hand have been uniformly negative with only one positive month so far this year, in April which rather invites the question as whether the ONS numbers are even fit for purpose, as well as which numbers represent the more accurate picture of the UK economy."

European markets edge down but heavy losses caused by North Korea tensions subside

Stock markets in Europe have edged down into the red this morning but the losses aren't close to what we were seeing yesterday.

The North Korea issue is rumbling on but it appears that investors' focus is starting to shift with the Nikkei 225 finishing in flat territory overnight despite Japan's proximity to the Korean peninsular.

Michael Hewson, CMC Markets analyst, points out that the flaring up of tensions between the two countries is nothing new for investors and markets have calmed themselves relatively quickly.

He added:

"Yesterday’s flare up felt a little different initially probably more so because of the inexperience of President Trump in the area of foreign policy, particularly given his tendency to conduct policy by way of tweet and press conference.

"While markets in Asia and Europe finished sharply lower yesterday, US markets managed to reverse most of their losses, as Secretary of State Rex Tillerson went on a damage limitation exercise, stopping off in Guam on the way, as Japanese and South Korean officials tried to play down the spat."

Deutsche's Jim Reid notes that not even the threat of nuclear war can really wake up the markets. pic.twitter.com/HXwwOJ7jNo

— Katie Martin (@katie_martin_fx) August 10, 2017

Agenda: Investor angst over North Korea wanes; pound dips ahead of key output data

Welcome to our live markets coverage.

Tensions between North Korea and the US kept Asian and American markets on the back foot overnight but investor angst is beginning to wane with the Nikkei 225 and S&P 500 finishing in flat territory.

The FTSE 100 has fallen sharply this morning, retreating 0.7pc, with miners, oil stocks and telecoms giant BT weighing heaviest on the index so far.

Asia stocks fall as N. Korea angst continues to provide an excuse or opportunity for further profit taking. Won drops while Gold almost unch pic.twitter.com/kYtHRqjv9q

— Holger Zschaepitz (@Schuldensuehner) August 10, 2017

Glencore provides the major corporate release of the morning with the global miner holding off from a big shareholder payout in favouring of stepping up its acquisitions activity.

The focus for the currency markets this morning is UK industrial, construction and manufacturing data, which is due at 9.30am from the ONS. Dovish US Federal Reserve policymaker William Dudley could also stoke the forex markets this afternoon at his scheduled appearance.

This morning ahead of the key ONS data, the pound has edged down 0.2pc against the dollar, trading at $1.2980.

Interim results: Co-op Bank, Glencore, Tritax Big Box Reit, Prudential, PageGroup, Amec Foster Wheeler, Evraz, Cineworld Group, The Vitec Group, Derwent London, Hill & Smith Holdings, Coca-Cola

AGM: Investec, Blue Planet Investment Trust

Economics: RICS house price balance (UK), Industrial production m/m (UK), Construction output m/m (UK), Manufacturing production m/m (UK), Goods trade balance (UK), PPI m/m (US), Unemployment claims (US), Core PPI m/m (US), JOLTS job openings (US), Final CPI (GER)

Yahoo Finance

Yahoo Finance